Online and mobile banking have made a huge impact across the global banking sector and in the UK. If a retail bank does not have a mobile banking solution, it can consider a great deal of interaction – if not customers – lost. But what has been the specific impact on the UK? Patrick Brusnahan writes

Every prominent retail bank in the UK has some form of mobile banking feature, the prominence of which depends largely on the bank.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Mobile banking in the UK

For example, challengers such as Monzo and Starling have nothing but mobile banking. Even Metro Bank, which prides itself on its branch network and “stores”, has a well-regarded mobile app which, at the time of writing, rates 4.8 on both Google Play and the Apple App Store.

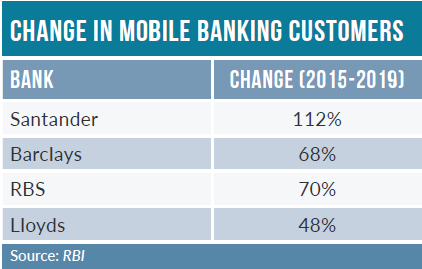

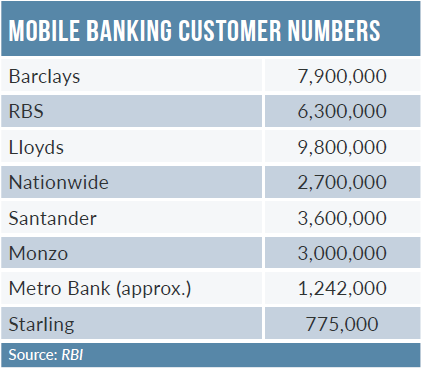

Furthermore, the number of mobile banking users shifts dramatically from bank to bank. According to RBI, Lloyds Banking group has the most with 9.8 million mobile banking users – perhaps understandably, given the three brands under its umbrella. Next come Barclays with 7.9 million, RBS with 6.3 million, and then Santander with 3.6 million.

In a notable development, Monzo recently hit over three million users – and, therefore, mobile banking users – taking it above the UK’s largest building society, Nationwide, which holds just 2.7 million mobile banking users. Of course, in terms of overall customer numbers, the building society ranks above the digital start-up with 15.9 million members and 3.4 million “committed” members, customers with two products or more.

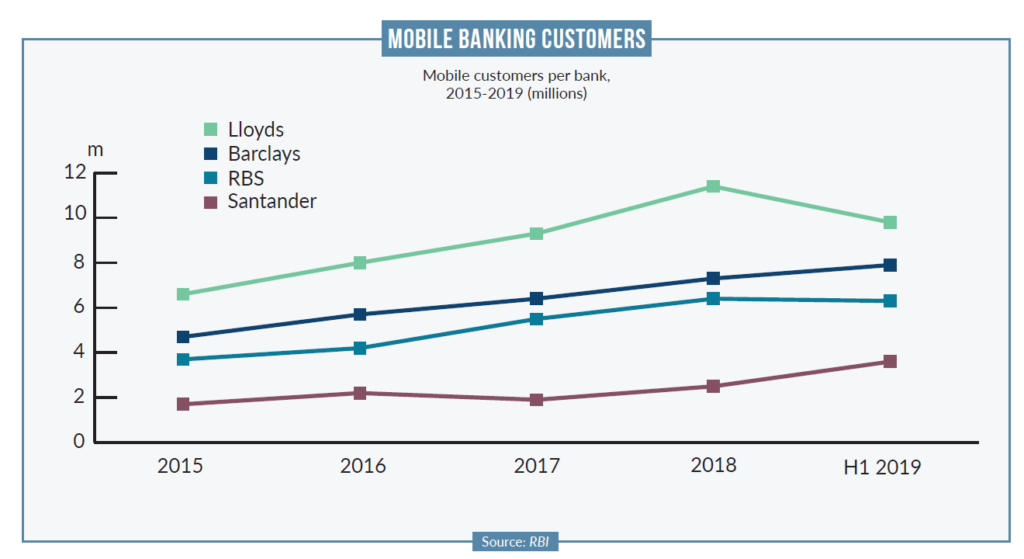

The highest level of growth in mobile banking customers since 2015 comes from Santander, which increased its count by 112% over the four years. It was followed by RBS (70%), Barclays (68%) and Lloyds Banking Group (48%).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Open Banking

A big motivator to improve the mobile banking experience for consumers is Open Banking. With the ecosystem becoming increasingly interconnected, bringing convenience to the mobile channel was a clear no-brainer.

HSBC was the first of the big four banks in the UK to release an Open Banking app. In June 2018, it released Connected Money, which allows HSBC customers to view all their financial accounts in the same place. Users can access current accounts, savings accounts, mortgages, loans and cards held from 21 banks – including Barclays, Lloyds and Santander – all in one app.

In addition, a spending analysis tool, Balance after Bills, shows customers how much money they will have left once the bills have been paid, as well as in-app messaging for further insight into their finances.

In September 2018, Barclays joined the Open Banking fray, enabling the 85% of its customers who also use other banks to link their data. Current accounts from Lloyds, Halifax, Bank of Scotland, RBS, NatWest, Nationwide and Santander can now be viewed within the app.

It utilises the industry-approved Open Banking API for security, and customers do not have to give out usernames or passwords for their other accounts.

Lloyds Banking Group launched its Open Banking solution in June 2019; however, it also continued to make additions to the app. The banking giant introduced new features to the mobile banking apps of its sister brands. These include the ability to share confirmation of payments with acquaintances using automatic payment receipts. In addition, the service will send instant alerts to contacts through WhatsApp, SMS or email after a payment is made.

The updated versions also allow customers track all transactions within the app. The feature supports transaction searches by description or amount, simplifying the process of expenditure review.

The new features are currently available on the Android versions of the Lloyds Bank, Halifax and Bank of Scotland apps, and are scheduled to roll out on the iOS platform later in the year.

Furthermore, NatWest, part of RBS Group, rolled out a bank aggregator app in March of the same year. The Accounts with Other Banks function, made possible through Open Banking, requires only a few minutes to set up. Once completed, UK NatWest customers can view current accounts from 15 different UK banks.

The feature offers account information, balances and transactions from other accounts, providing a complete financial overview on a single screen, and enabling customers to track expenditure and savings. It also eliminates the need to visit different banking apps to check balances.

Selfies

When people think of smartphones, thoughts of selfies are never too far away. With the emergence of platforms such as Instagram and Snapchat, banks have began to look at ways to utilise the selfie trend.

Digital startups such as Monzo and Starling embraced the selfie from their beginnings; however, while it was rumoured for many high street banks for years, Metro Bank was the one to fire the starting pistol in February 2018, rolling out selfie technology to open current accounts online. The launch integrated the digital and physical with debit cards available to collect in store. Just like Metro Bank’s in-store account-opening process, customers can use their account right away, with account details provided immediately at the end of a successful application. Customers have the option of receiving a new Mastercard debit card by first class post, normally arriving within two working days, or calling into their nearest store and having the card printed on the spot.

According to Metro Bank, the entire account-opening process, with verification and authentication taking place in real time, means accounts can be opened in less than 10 minutes, including registration for internet banking.

NatWest also joined the selfie revolution in June 2019, allowing customers to open an account using a photograph for verification. And by simplifying the ID verification process, NatWest also enabled customers to save time on the authentication process.

The lender’s hope was that the added convenience and speed of ‘selfie banking’ will improve the overall customer experience, while also removing the need to remember long passwords and account details.

Just one month later, challenger TSB announced that it also had plans to embrace the selfie. However, rather than younger customers, the service is aimed at people aged above 55 years, enabling them to open an account remotely without visiting a branch. The bank utilises ID verification technology from Jumio in the app to enable the account-opening process.

The launch of new service is primarily driven by TSB-conducted research which found that people above 55 tend to avoid mobile banking. According to the survey, 57% of over-55s never use mobile banking, despite possessing a smartphone, with around 58% of respondents stating ‘fear of fraud’ as the main reason.

However, around 73% of people in that age group opined that they would benefit from remote banking. The most common reasons cited by the elderly people for remote banking are ‘speed’, ‘convenience’ and ‘24/7 access’.

Mobile banking is revolutionising the sector, and incumbents and challengers alike need to figure out what is most important to the solution.

Consumers are different, and some may use their phones for everything from loan applications to payments, while others may only use it to check their balance.

What is certain from the numbers is that more Brits are using mobile banking, no matter the bank. It is only a matter of time before it becomes a key differentiator.