Canadian neobank Neo Financial is challenging Canada’s big five banks by reimagining the customer experience of banking, CEO Andrew Chau tells Robin Arnfield

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Neo current account with 1.3% interest

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“The savings account is effectively an everyday banking account, as it can be used for bill payments, direct payroll deposit, Interac e-Transfer P2P payments and transferring funds between bank accounts,” says Chau.

The only current account features that the Neo account does not provide are branch and ATM access. Unlike other Canadian neobanks such as Koho PC Money and Mogo, Neo does not offer prepaid debit cards linked to its savings accounts.

“Since most Canadians use credit cards for spending, we decided to just issue a credit card,” says Chau. “Offering a debit card with ATM access wasn’t a priority for us.”

Neo credit cardholders can pay off their balance from their Neo account or from an account at another bank.

Mastercard branded credit cards

Neo offers two Mastercard-branded credit cards paying high rates of cashback at partner merchants.

Neo’s own-branded card is available in three versions: the Standard, which is free, the Plus, costing C$2.99 ($2.40) a month, and the Ultra, costing C$8.99 a month. In addition, Neo issues Canadian retailer Hudson’s Bay Company’s Mastercard-branded credit card, replacing HBC’s previous issuer, Capital One.

“We launched the HBC credit card in March 2021,” said Chau. “As well as HBC rewards points, cardholders gain access to our rewards programme, and we’ve had very positive feedback about this. Cardholders also like the fact that now you can load your HBC card into Apple Pay and Google Pay, which you couldn’t with the Capital One/HBC card.”

When managed by Capital One, there were nearly 2 million HBC credit cardholders. However, Capital One didn’t transfer its HBC card book to Neo. So, once their existing HBC/Capital One card stopped working in May 2021, cardholders had to apply for a new card from Neo.

“When people visit HBC stores, they are offered our HBC card at the checkout,” says Chau. Customers can also apply for the card using the Neo app, which helps with Neo customer acquisition, or on the HBC website.

Neo sees itself as a technology front end, focused on customer experience, and offering services from different financial service providers. “We’ve taken a digital-first approach and built our technology platform from scratch. This differentiates us from other new entrants which piece together off-the-shelf technology and label it as digital or online banking.”

Neo’s target customer base is anyone who uses their smartphone for banking. Currently, Neo only provides a digital banking app, as its website is informational only, but it is adding transactional capabilities to its website. “This means people who prefer to bank using their PC will be able to use us,” adds Chau.

“During the pandemic when digital banking really accelerated, we’ve seen very strong tailwinds in demand for our savings account and credit cards.” New customers can open a Neo savings account in three minutes on their smartphone by scanning and uploading ID documents.

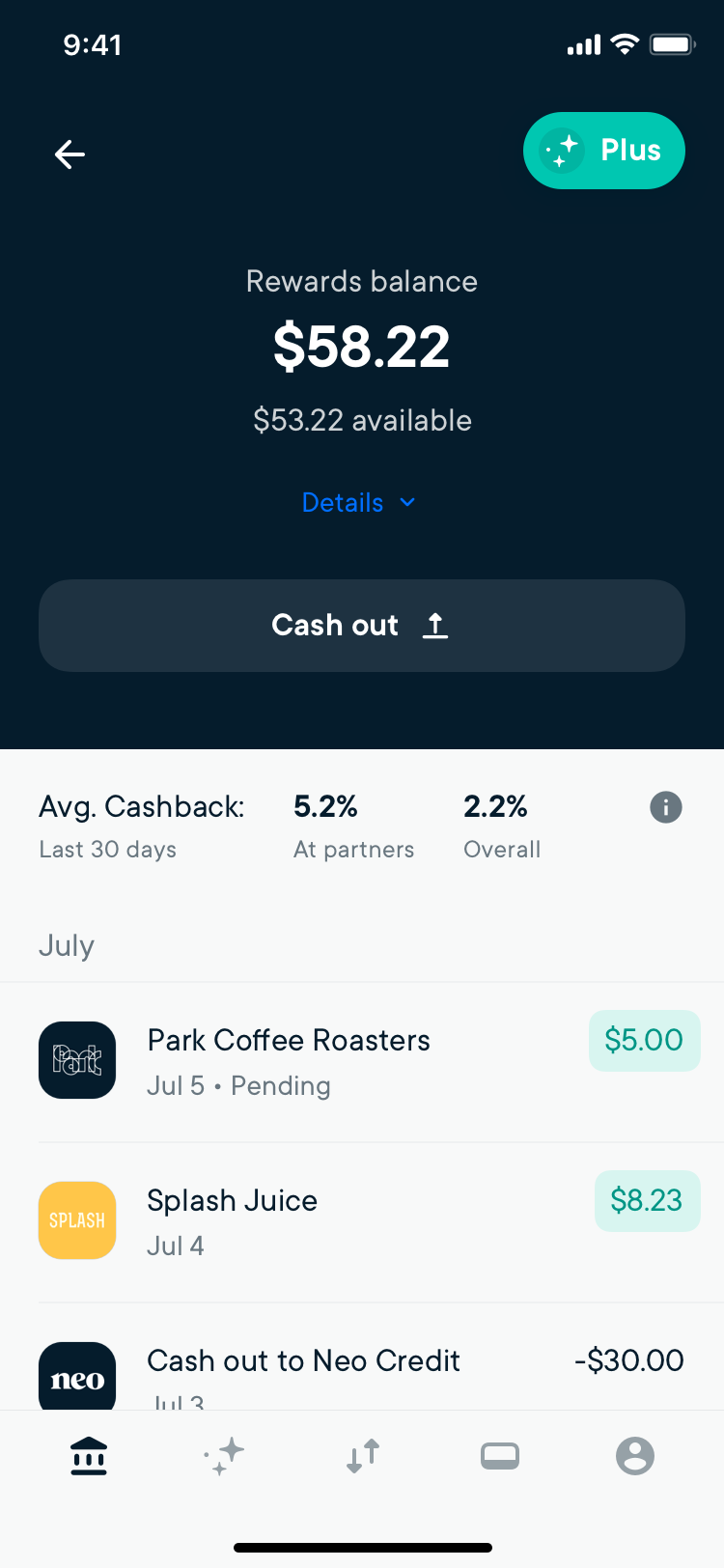

Rather than pay a fixed cashback reward on all purchases, Neo pays 4-6% cashback on purchases at its retail partners and up to 1% elsewhere, with the level of cashback depending on whether cardholders have a Standard, Plus or Ultra card.

“We’ve established a network of thousands of local and national retailers, restaurants and cafés as well as brands such as Netflix and Amazon, where our Neo and HBC cardholders earn high rates of cashback. Unlike traditional credit cards that make you wait until the end of the year to redeem your cashback, Neo cardholders can redeem their cashback instantly at the point of purchase.”

Future product plans

In December 2020, Neo raised C$25m in Series A funding and C$25m in debt facility financing. The fund-raising round was led by Valar Ventures, a New York-based venture capital firm, whose backers include PayPal co-founder Peter Thiel. Shopify CEO Tobi Lutke also invested in Neo’s Series A round. ATB Financial provided the debt facility.

Chau says that Neo has a great partnership with Concentra and has no plans to apply for a Canadian banking licence.

Concentra’s core business is providing wholesale banking services for Canadian credit unions. In addition to providing its banking-as-a-service platform to Neo, Concentra also has its own direct-to-customer banking business offering consumers mortgages and deposit products.

“We’re the 13th-largest bank in Canada, which makes us a relatively small bank,” says Concentra president and CEO Don Coulter. “So, we need to provide value in different ways. We’re focused on providing banking in a better way for Canadian consumers and businesses. The way we achieve our purpose is through partnerships with fintechs that are creating better experiences for their customers.”

“The founders of Neo had a great track record in founding SkipTheDishes, which is a very successful venture,” says Coulter.

“They wanted to get into banking and had the attributes and skills to create a great experience for customers, but they weren’t bankers. They needed a partner with access to banking infrastructure and payment rails. So, we partnered with Neo, as it was aligned to our purpose of creating a better banking experience and more choice for Canadians. We’re looking at building a road map of things we can do together with Neo.”

Concentra is also working with Intellect Design, a global digital banking software vendor to build its own digital bank.