Ever more numerous, neobanks have imposed their digital model in France. Mohamed Dabo reports on a booming sector

The story of neobanks in France is a familiar one. The new players busted onto the banking scene and quickly outmanoeuvred banking giants thought to be sheltered from any major challenge.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The online banking market emerged in France in the 2000s. Acting and working mainly online and through mobile applications, these newcomers have become big players in a remarkably short period of time.

The arrival of international players in the French ecosystem has boosted competition and neobanks have now become true challengers.

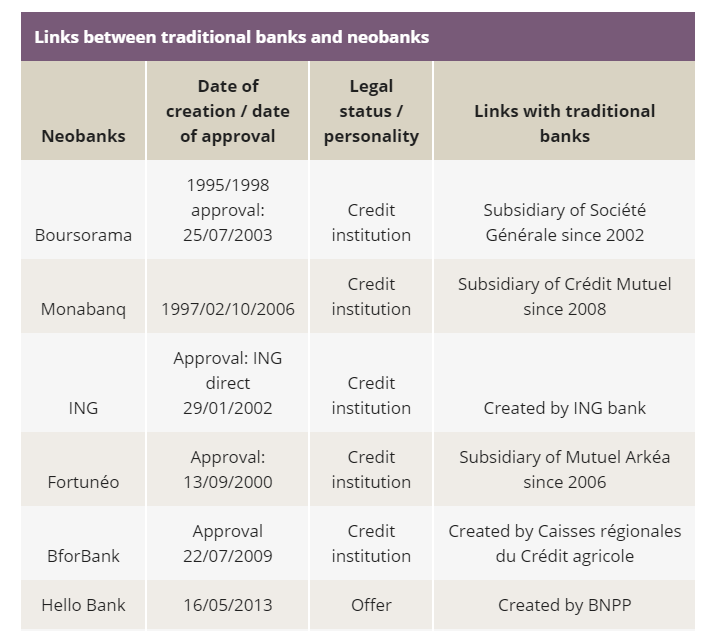

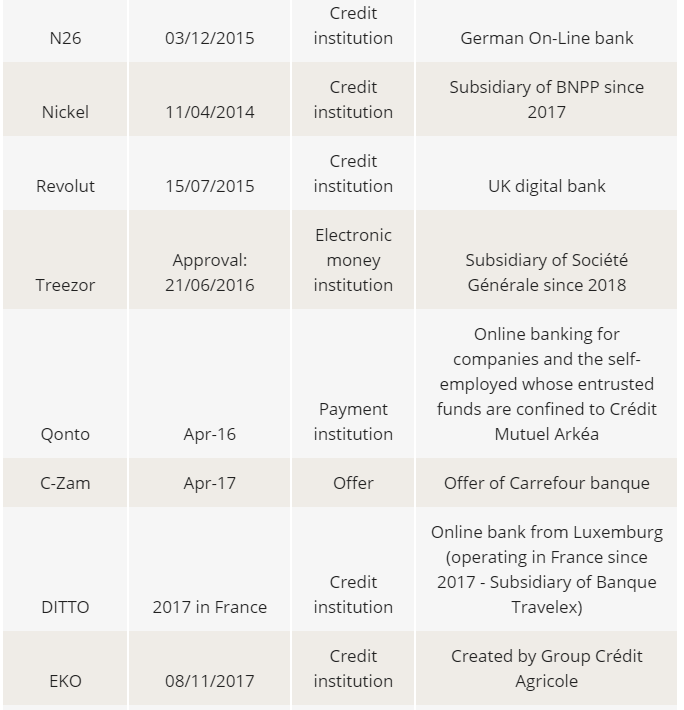

The sector has undergone a rapid expansion, particularly since 2006, driven by major players such as Boursorama Banque, Monabanq, Fortuneo and ING Direct, which are in fact subsidiaries backed by major traditional banks.

Because online banks don’t have as many structural costs to cover as traditional banks, they make significant savings. Thanks to this, they are able to offer their clients much lower rates and charges.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe number of French online banks continues to multiply. And more and more French people are turning towards these new players, whether they are part of a trusted traditional bank or a standalone bank.

Partnership with traditional banks is redefining banking

There are now two main types of companies that provided services digitally: companies that applied for their own banking licence and companies that partnered with a traditional bank to provide those financial services.

The major players

Boursorama Banque is one of the oldest online banks on French the market.

It is often described as the cheapest bank, which has earned it undeniable success: more than 2 million customers since its creation, making it the undisputed leader of the online banking market.

The banking niche is therefore focused on very competitive prices associated with a wide range of products, like what can be offered in a physical bank.

Boursorama’s Welcome offer is another good option, as it is free to open, and has no income or minimum deposit requirements.

Boursorama was founded in 1995 and is a subsidiary of Société Générale.

Monabanq was founded in 2006. It is a subsidiary of the Cofidis Participations Group and owned by Crédit Mutuel.

Monabanq grants its clients a current account for €2/month, with no income requirements, and a Visa Classic card.

Operated by the ING Group.

ING is one of the best-known online banks and ranks second in the online banking market in terms of number of customers.

ING in France is part of the ING group, the second largest savings bank in the world, leader in banking / insurance and asset management.

Operated by Crédit Mutuel Arkéa.

In 2006, Fortuneo was bought by Crédit Mutuel Arkéa. Then in 2009, it became an online bank offering banking services as well as insurance. The bank targets high net-worth clients wishing to manage their savings themselves.

Fortuneo has more than 600,000 clients in 2021 in France, Luxembourg, Belgium and Switzerland.

Operated by Crédit Agricole.

BforBank is an online bank launched in October 2009 by the Crédit Agricole Regional Banks. BforBank offers day-to-day banking, savings, investment, and credit services (consumer and real estate).

Hello bank! is a digital direct bank owned by BNP Paribas that started operations in 2013. The bank operates in France, Belgium, Germany (using the name Consorsbank), Italy, the Czech Republic and Austria.

BNP Paribas has claimed that it is “the first 100% digital mobile bank in Europe”.

The bank is supported through different BNP Paribas retail banking subsidiaries where they exist. BNP Paribas, BNL and BNP Paribas Fortis branches can be used to deposit checks or to withdraw money in these countries.

N26 is a neobank offering Personal accounts, Business accounts including a debit card, with all transactions being managed from an iPhone or Android application.

N26 currently accepts to open mobile bank accounts for residents of Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, United States,

Formerly known as Compte-Nickel, Nickel offers you a Mastercard payment card, a bank card and a French RIB. It is accessible even for people with prohibited banking but doesn’t provide cheque books and nor does it allow overdrafts.

The Nickel bank card enables you to make payments online and in stores, as well as withdraw cash from ATMs for €1/transaction, or for €0.50/transaction in any of Nickel’s partner tobacconists. This card can be used abroad, contrary to standard bank cards which often come with systematic authorisation.

Keep in mind that keeping your account open will cost €20 per month.

Orange Bank was created following a partnership between the operator Orange and the Groupama group, in 2017. It puts focus on innovation, banking expertise and digital expertise. All its loan and banking services are accessible via a smartphone, on the bank mobile app.

Orange Bank has a lot of perks to offer its clients and future clients. All its offers are straightforward, simple, and customisable and you can make transaction via your phone and through SMS.

Its bank card is free and customisable, and you will be exempted from account opening fees if you make payments via bank card or phone more than 3 times per month.

Probably one of the best-known online banking service, Revolut appeared on the market in 2015. It comes with an app through which you can transfer money internationally, free of charge. It also allows you to make payments abroad without extra charges.

Revolut is very innovation-focused, offering innovative services and allowing for the use of crypto-currency. You can thus sell and purchase Bitcoins and other currencies over the app.

Revolut also offers loan solutions, with very attractive rates and the convenience of being unlocked in the space of minutes!

Treezor is an independent provider of outsourcing and white label solutions for electronic payments. Founded in Paris, Treezor owns a European License and is one of the approved suppliers for MasterCard Prepaid.