It has been a year since Open Banking launched and was supposed to take the banking world by storm; however, the movement has been fairly quiet since its much-advertised introduction, and banks have not been impressed. Was PSD2’s bark worse than its bite? Patrick Brusnahan writes

Open Banking and PSD2 were hyped up to be a revolution for banks, but some have argued that it has arrived not with a bang but a whimper.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

UK fintech influencer Liz Lumley tells RBI: “Not much has happened to the industry in terms of Open Banking, but that doesn’t mean it is a failure. Remember, the major incumbent banks were forced to do this by a regulatory mandate – one that was established as a ‘framework-based regulation’ (which means it can be interpreted) rather than a standards-based one. Give it time: you wouldn’t expect to go from chubby, couch potato to super-fit overnight. It takes time and effort.”

She adds: “The public has no idea what Open Banking is. It was never explained to them in a meaningful way. Education should have come from the big banks, but it wasn’t a priority for them.”

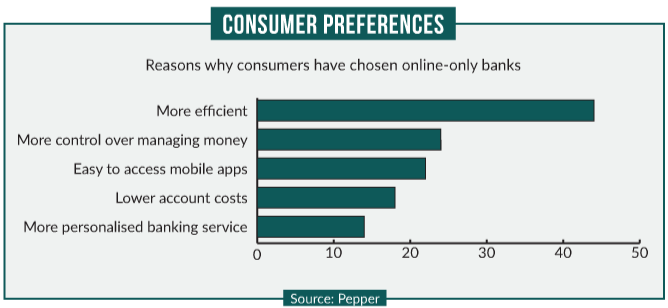

With the new system, banks had to open their payments infrastructure and customer data assets to third parties. The goal was to make the incumbents more customer-focused, but it has not had its desired effect; in fact, everyone except banks seems to have gained an advantage. According to a report from Pepper, the digital sub-brand of Israel-based Bank Leumi, banks are not happy. According to the Change In Banking report, 58% of decision-makers at banks stated that Open Banking had had a negative impact on their organisations. However, 56% of banks still believe it represents an opportunity.

The consensus is that Open Banking favours fintechs and Google, Amazon, Facebook and Apple (GAFA) rather than the incumbents, while 64% of UK retail banks, such as Barclays, TSB, Virgin Money and RBS, believe it has given GAFA the advantage. Also, 24% of respondents believe it has given fintechs the distinct advantage.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFurthermore, two-thirds of decision-makers think tech giants will offer full banking services within the next five years. However, relatively few consumers – a mere 29% – believe GAFA will overtake banks.

Asked why retail banks are slipping behind innovative fintechs, 65% claim it was because there is a reluctance to adopt external technology. On the other hand, 54% believe collaboration with fintechs is essential to innovate faster. An additional benefit of collaboration, at least according to 48% of decision-makers, is to cut through the red tape that Open Banking brings with it.

Speaking to RBI, Pepper CEO Michal Kissos Hertzog says: “Despite the concern, Open Banking won’t cultivate a winnertakes- all scenario. Regulations like PSD2 and initiatives such as Open Banking are set to change the face of banking. Banks with agile and lean systems that allow them to update their offering and continue to meet consumers’ demand for more valuable, convenient and easy banking experiences will thrive. Banks that fail to seize the opportunity may well disappear.

“The public may not fully appreciate Open Banking, but they are certainly starting to feel the benefits. The industry’s views on Open Banking are mixed, but it has to be seen positively. I believe that banks need to collaborate more openly with other players. We share the same goals; why don’t we share innovation and technology? Open Banking architecture promotes collaboration between banks and fintechs, and that is a significant opportunity.”

Will the future change?

Open Banking is not what people hoped – at least not yet. So what will the future of banking look like? Lumley says: “I see a consolidation in the industry going forward. You will see an increase in M&A activity and more failed startups. We will also see a huge push into payments and personal financial services from GAFA. It is not that big a leap to imagine a world where we’re saying: ‘Alexa, what’s my credit card balance?’ or ‘Alexa, remortgage my home.’”

Hertzog concludes: “A bright, promising banking future is possible, but only if retail banks put customers at the heart of every decision. They must forget about product development and cost cutting, and think differently. All too often, banks are too ‘proud’ to adopt technology that is not their own. They must recognise the importance of collaboration to meet growing customers’ digital demands. Only then can they truly embrace digital and provide a more consumercentric banking experience.”