Stuart Gray, Director – Financial Planning Centre of Expertise, at Royal Bank of Canada tells RBI editor Douglas Blakey that an increasing number of Canadians want to focus on their financial future.

Canadians are increasingly concerned about inflation-but at the same time more and more Canadians are shifting their financial priorities to longer-term saving and investing.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

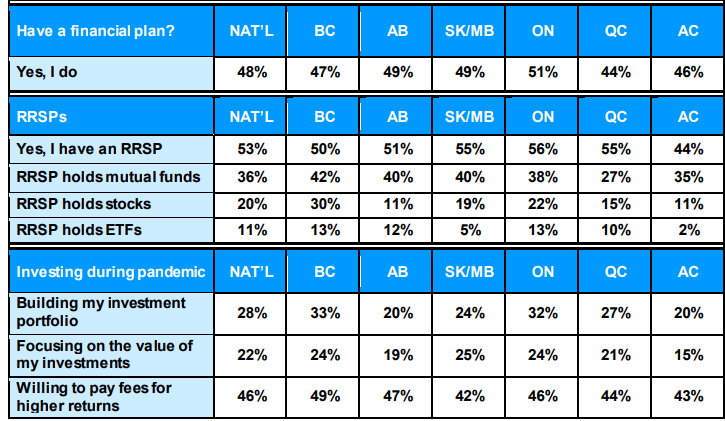

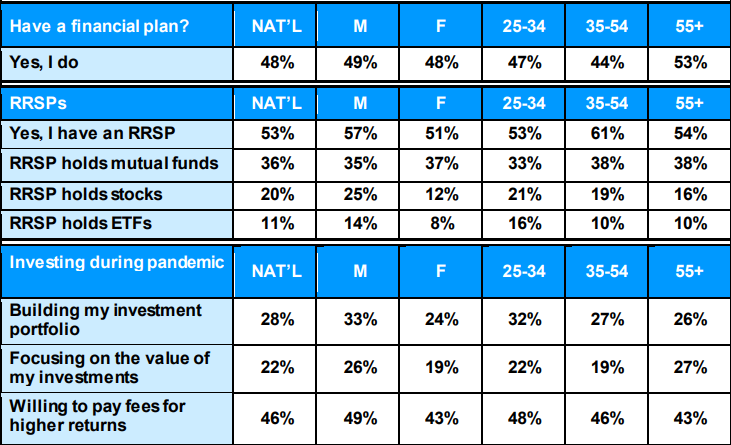

“RRSPs are making a big comeback,” Stuart Gray tells RBI. After seven years of trending downward – and last year’s historic low of 46% – RRSPs have rebounded and now over half (53%) of Canadians have RRSPs in place to save and invest for their retirement. Also, within those RRSPs, more Canadians are holding mutual funds (36% vs. 30% last year), stocks (20% vs. 14%) and ETFs (11% vs. 7%).

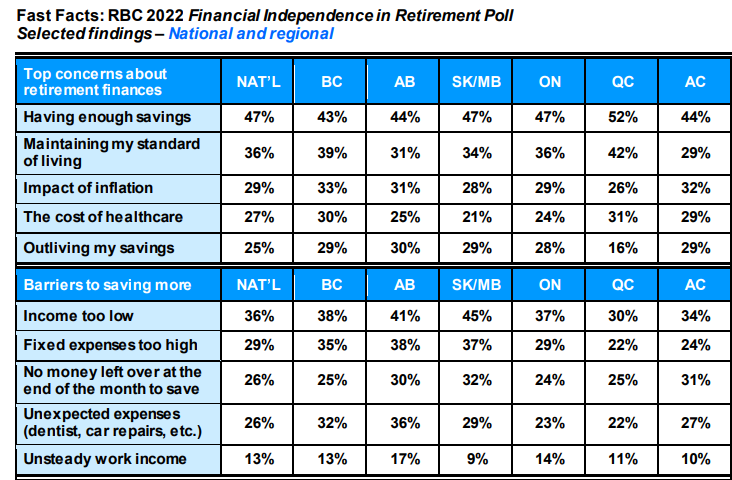

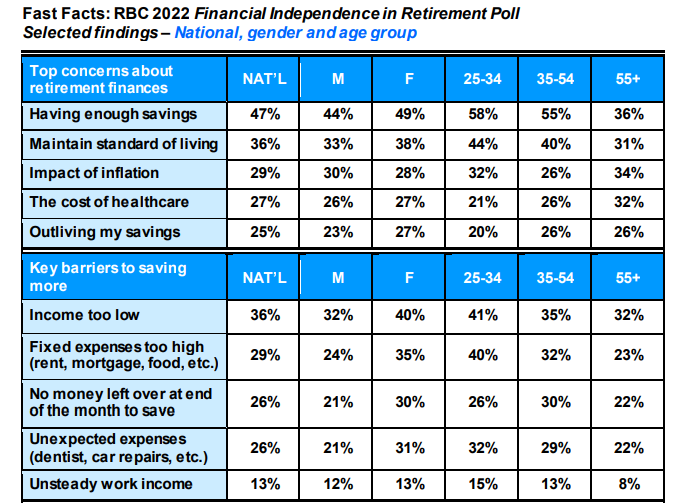

Inflation is adding uncertainty for Canadians trying to look past the pandemic and refocus on their financial future. For example, inflation has now moved into the top three concerns Canadians have about retirement for the first time in more than a decade, according to RBC’s annual Financial Independence in Retirement Poll.

Inflation is also limiting the ability for Canadians to increase their savings with 29% identifying the cost of fixed expenses as a key savings barrier. This rises to 40% for Canadians ages 25-34.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere is a key difference across all age groups, however, despite the uncertainties posed by the pandemic and rising inflation. Today, almost half (48%) of Canadians have a financial plan and the majority (86%) of those say they are feeling positive about their financial future because of that plan.

“The unexpected has changed lives over the past two years, but if you have a plan, it’s easier to adapt to those changes,” says Gray. “A plan helps you keep on top of your finances, so you know what adjustments you can make for changing circumstances while saving for today and investing for the future.

Adds Gray: RRSPs are making a big comeback and that highlights that Canadians want to refocus on their financial future.

“After years of trending downward – and last year’s historic low of 46% – RRSPs have rebounded and now over half (53%) of Canadians have RRSPs in place to save and invest for their retirement. Also, within those RRSPs, more Canadians are holding mutual funds (36% vs. 30% last year), stocks (20% vs. 14%) and ETFs (11% vs. 7%).”

Another future-focused indication in the poll findings is that the percentage of Canadians who are building their investment portfolios has risen to 28% from 25% last year (and 10 points higher than a decade ago). Of particular note, younger investors aged 25 to 34 are also expressing the most interest in building these portfolios (32%).

Since the onset of the pandemic, these younger investors are also focusing more attention on the value of their investments (22%) and almost half (48%) indicate they are willing to pay fees if this offers the opportunity to gain higher returns on those investments.

RBC’s Digitally enabled, relationship bank drive pays dividends

“When assessing value, investment performance after fees is what really matters. It’s encouraging to see that younger Canadians understand how crucial this is in achieving your retirement savings goals and building a strong financial future,” adds Gray. “Whenever you want advice, our financial advisors are here to help – in person or through our MyAdvisor digital advice platform.”

RBC’s MyAdvisor digital advice platform enables clients to receive insights and counsel in real time. Since its launch in 2017, more than 2.8 million clients have activated their personalised savings plans.

MyAdvisor offers a hybrid approach, so customers do not have to choose between digital or human – they get both. Along with 24/7 digital access to their plan, cash flow, net worth and goals, clients receive insights, real-time visuals and forecasts to help stay on top of their money and reach investment goals. MyAdvisor also connects users to the expertise of an RBC adviser in their community, via live video, phone or in-person within a branch. Through interactive scenario planning, users can see the potential future impact of today’s money decisions on tomorrow’s outcome.

Meantime, RBC’s AI-based solutions including the award-winning NOMI deliver personalised services tailored to individual banking needs. NOMI Find & Save, for instance, has helped RBC customers save an average of more than C$420 per month in fiscal 2021. Since the launch of NOMI, close to 2 billion insights have been viewed by clients through RBC’s mobile app.

Other innovation hits include RBC InvestEase, an online investment management service launched in November 2018 by the RBC. Customers can open an account by answering a set of questions about their risk tolerance and financial goals. In order to start investing, individuals need to maintain a minimum deposit of C$100. The annual management fee for this service is 0.5%. As of December 2020, with a combined total of 150 ETFs, RBC InvestEase managed over C$100bn in AUM. In fiscal 2021, RBC InvestEase saw a 145% increase in funded accounts with a responsible Investing portfolio y-o-y. AUM growth continues to accelerate with a 131% increase y-o-y driven by strong growth in new deposits and new funded accounts.

RBC Fiscal 2021: strong cross sell growth

In fiscal 2021, RBC’s Canadian Personal & Commercial Banking businesses grew volumes and gained market share in lending, deposits and investments. As a result of this client activity, in Canada, RBC maintained or extended its #1 and #2 share in key categories of its Personal & Commercial Banking businesses.

RBC also achieved progress in deepening client relationships, both within Canadian Banking, where nearly 19% of clients have all four of transaction accounts, credit cards, investments, and borrowing products with RBC, and between segments.

Global Data research: Canada individuals segmented by asset band (000s) 2015-2025