2018 was an incredibly busy and crowded year for the banking sector. Open Banking started a quiet revolution across the industry with incumbents and challengers facing off to offer the best services through their mobile banking apps. Briony Richter looks at what apps topped the charts.

With Open Banking spreading across the EU, mobile banking became more important than ever with customers increasingly shifting to digital and judging their experiences from those channels. As more branches close around the world and mobile banking is on the rise, consumers are, more often than not, interacting with their bank through online or mobile channels.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It is easy to see why people prefer mobile banking; it gives them easy access to a range of products, it’s quick and convenient with 24/7 access. Furthermore, it is also secure – another element that Open Banking has been trying to promote. It allows banks to open up to other third parties that effectively give consumers greater choice.

However, finding the best mobile banking app is not an easy task. Nowadays, each and every bank offers a wide array of functions and features in their apps such as the ability to check balance, view statements, send and receive payments and categorise spending.

With all banks offering very similar features, it comes down to the functionality and overall quality of the app. So which ones are grabbing consumers’ attention?

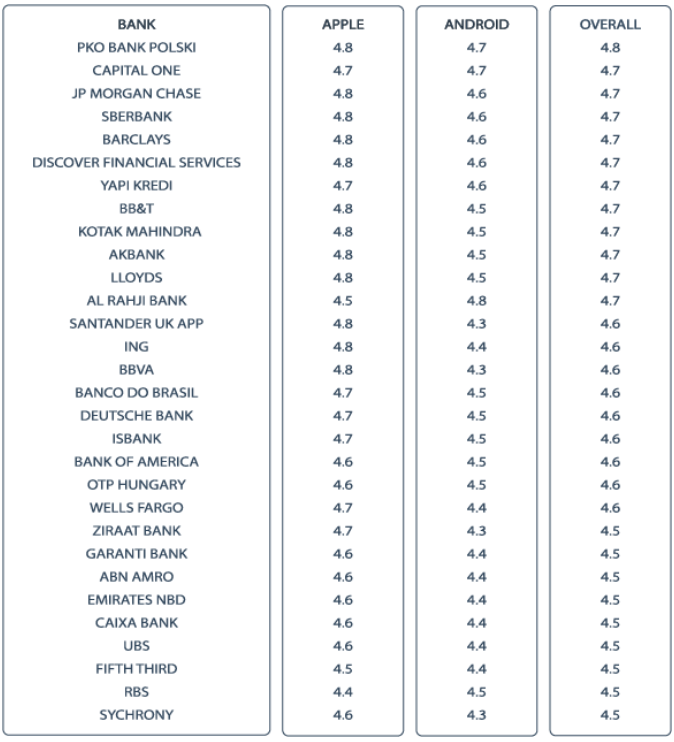

RBI created a table that aggregates user rankings from the Apple and Android app stores to find an overall rating of mobile banking apps. Out of the top 100 traditional banks, 61 scored a rating of 4.0 or above out of 5.0. Furthermore, none of the traditional banks dropped below an overall rating of 2.0 out 5.0.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

PKO takes top spot

PKO Bank Polski has won top spot in the RBI ranking. Its mobile banking app is at the centre of its banking experience for customers.

User reviews on both the Apple and Google Play store comment positively about the app design and how easy it is to navigate and manage their money.

The platform shows a customer everything they need on one screen. Although we are stepping into a digital age, the mobile app has a feature that tells a customer where their nearest branch or ATM is to withdraw cash, supporting the best of both worlds.

Speaking to RBI about the mobile banking app, Michał Macierzyński, director of the Digital Services Department at PKO Bank Polski, said:

“The leading motive for the development strategy of PKO Bank Polski is the digital transformation of interbank processes, as well as customer services. It is a key, which allows us to maintain the position of a leader in our sector, at the same time changing the biggest bank in Poland and in the region into an agile organization, focused on needs and stepping ahead of the expectations of our clients.

“Therefore, the most important piece of information on how to improve and develop the IKO application are the voices of our clients, monitored on a regular basis at mobile app stores, in the social media and on the Internet. Every day, we work to increase the number of people actively using the bank’s mobile access channels and to make the experience of users of our mobile application and web services the best it can be.”

PKO Bank Polski has continued to launch services and products in recent years that aim to enhance the user experience and encourage more of their customers to bank digitally.

Coming just in behind PKO Bank Polski is Capital One, JP Morgan and Sberbank. Those three banking apps are three out of 11 banks ranked that scored 4.7 out of 5.

One particular reviewer on the apple store noted that the Capital One app is visually good but has experienced several bugs when trying to view their PIN on the app. However the user also notes that having the option to create a payment plan within the app is extremely useful.

With Sberbank, users highlight their enthusiasm for having Visa support with Apple Pay and the seamless onboarding process.

All the apps that scored 4.7 offer a variety of unique and convenient services. However, developing a completely transparent and faultless app is an incredibly difficult task and it all comes down to balancing several characteristics perfectly.

Convenience can’t outweigh security

Although customers want fast and frictionless mobile banking, it’s critical that banks ensure that these characteristics correlate with security.

Quick and easy is important but if customers experience fraud or data misuse, they will instantly be put off using that bank again in the future.

Therefore, mobile banking apps must create a harmonious balance between providing customised, quick features and a high-level of security.

Barclays mobile app takes great pride in its security efforts. The app scored 4.7 and was the only UK bank to reach the top 5. It has fully embraced the benefits that Open Banking offers and allows users to securely view transactions and balances from other current accounts.

Furthermore, in the last year, the bank also launched several innovative features such as its ‘switch off’ function.

The feature allows customers to block certain types of spending such as online gambling. It was a strategic move to support consumers that may be struggling with addiction to become more in control of their finances. The feature will cut off an individuals’ spending in betting shops and gambling websites.

Reviews on both app stores praise it’s fantastic user experience and simple platform that makes it easy to manage several accounts at the same time.

Ruchir Rodrigues, head of Digital & Open Banking at Barclays said: “Over 6 million of our customers use our mobile banking app to manage their day-to-day finances. As we see our app becoming a vital part of our customers’ financial lives, we want to make their experience as easy, personalised and secure as possible. We are thrilled to hear the positive feedback and excited to share even more features on our app to make the customer journey even better.”

Banks are now raising the bar when it comes to their mobile banking app. It’s a fiercely competitive market, one which has high consumer demand and to win, those demands have to be met.