Siegel+Gale has conducted its second Global Brand Simplicity Index study, and the simplicity score for retail banking has gone up by 11% in comparison to 2010. Philip Davies, president, EMEA, at Siegel+Gale talks to Meghna Mukerjee about why focusing on simplicity is important for retail banks

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

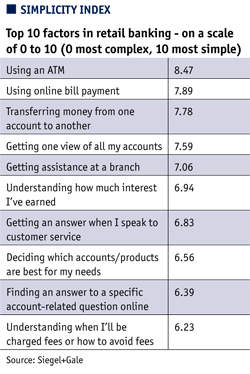

Understanding fees, their charges and how to avoid them, is the most complex for consumers, a Global Brand Simplicity Index study conducted by strategic branding consultancy firm Siegel+Gale has revealed.

The findings of the Global Brand Simplicity Index study, which is in its second year, have revealed that understanding fees is the most complex process whereas using an ATM is the simplest.

The 2011 study was an industry-by industry research on the state of simplicity and how the implementation of simplicity could make an impact to the industry.

The simplicity score for retail banking has gone up by 11% in 2011 in comparison to 2010 on the Simplicity Index.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to Siegel+Gale, the first Simplicity Index study “confirmed just how much simplicity pays”.

Philip Davies, president, EMEA, at Siegel+Gale, says the study is useful as a means to measure and assess how simplicity can “effectively and efficiently”

make organisations connect with consumers and remove complexity.

“It is measuring a very specific and significant element rather than an overall brand evaluation. In doing that it is really focusing on specifics. So it could actually very well be called an experience index as well, because it is assessing how actually a service is received and how it is experienced at all touch points,” says Davies.

Davies adds the Simplicity Index is “not simply about how it is communicating but about how it actually performs and connects with audiences” and the key audiences are asked about how they feel about a particular organisation from a holistic point of view.

“It is about getting the same experience wherever you are. You have something which is utterly reliable, can be trusted, and can be relied upon to deliver exactly what you are expected to deliver,” says Davies.

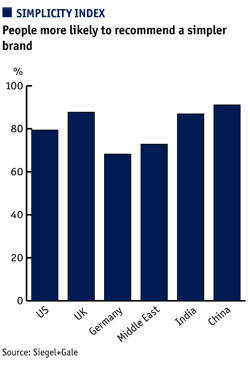

The research was conducted across the US, UK, Germany, China, India and the Middle East, and according to Siegel+Gale, several recurring themes presented themselves in the aggregate and also, occasionally, in particularly personal responses.

One of the main points of difference in the 2011 Simplicity Index, compared to the one in 2010, is that it quantifies the impact of technology – the internet in particular – and further identifies and analyses the attributes of simplicity, and conversely, complexity.

“From last year’s survey to this year, I think some of the comparisons are around the influence of technology in finance and also in terms of some of the effective use of the technology and some ineffective ones as well.

“If you were to look at how it makes a difference to an organisation like first direct or also NatWest, you would make a cross comparison between those two. In that respect [on the Simplicity Index] first direct did pretty well and NatWest did not do so well.

“You look at how first direct connects with you – it is a very good brand. You just give them your post code and they will find out who you are and you don’t even have to go through some process of trying to spell your name to them. They will actually find out exactly who you are and identify you.

“But if you look at NatWest, it has actually tried to embrace all the things that it has been told it should be doing, for instance around social media and using technology,” says Davies.

However, Davies adds, the question is not just about using technology, but about using it “really well”.

“NatWest has been a really good example of not using technology particularly well because there are many different social media platforms it is connected on and it feels like you have many different options of talking to NatWest with different voices at the same time,” explains Davies.

In the retail banking sector, among the simplifying factors cited by respondents, were an easy-to-use website with round-the-clock access, convenient branch locations and short wait times on telephone help lines.

Results from the 2011 Simplicity Index reveals that investments in simplicity have benefited financial institutions – such as JP Morgan Chase making cheque deposits possible via smartphones in the US, that was picked best in class by the respondents.

Citibank received the lowest US ranking in retail banking and was singled out as confusing in its brand architecture as well as its products and services.

Davies says the Simplicity Index was based on certain key factors.

“It is about the experience. So you think about how the process is going to simpler but think about the experience. Think human as well, so what is the most intuitive way that we can actually connect with people?

“Another absolutely key thing is thinking about innovation. When it comes to things like social media, do it in a way that actually works in harmony with current social media as well,” says Davies.

But the most importantly factor is consistency.

“Once you have started doing something you should continue doing it well and continue doing it the same way,” adds Davies.

In the UK in particular, according to the Simplicity Index, all in all 87.7% of people are more likely to recommend a simpler brand.

Out of 25 categories, the retail banking returns were low in 2011, however, coming in at the18th position and below the global average.

first direct scored highly and was awarded points for its personal touch, and simple communication was a primary reason respondents chose first direct. “First Direct always answers the phone with a real person… and never sends you to automated phone systems that we all hate,” one respondent answered.

On the other hand, Santander did not do well on the Simplicity Index based on poor communication and customer service.

Among the financials institutions, The Cooperative Bank in the UK was not included in the study.

“The Coop was looked at as a general brand overall and it was not isolated as a financial product. It is something we are considering for next year’s survey and we will also be using the Smile brand,” says Davies.

The UK retail banking market in general does lag behind other industries, according to Davies, and there is “less good innovation in financial services”.

“There is slower uptake of technology as well and it is not always used in great or the most intuitive ways,” adds Davies.

Certain lenders that Siegel+Gale plans to include in the next Simplicity Index study are Metro Bank and Virgin Money.

“We are fascinated by Metro Bank even though it has very few branches. It is utterly customer focused and is trying to reinvent a few unobserved rules within banking. I think it is taking away some of the assumed practices that banks tend to follow. It could be the brand that creates its space rather than a brand that makes its space.

“We will also probably look at what the experience of Virgin Money will be like – about how it is going to do in the financial space having been a brand that is symbolised by doing something fun. To see how it is going to position itself in the retail space and sell financial products will be interesting,” says Davies.

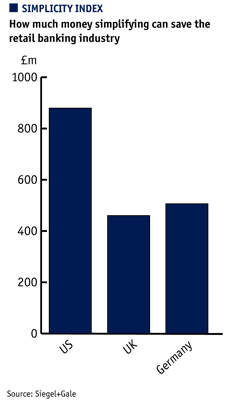

A study such as the Simplicity Index is of interest and importance to banks, says Davies, as there is a “massive prize to be won for the big retail banks to find a way to de-clutter and help consumers prioritise their financial arrangements”.

“I think the work that has been done by first direct is obviously how one should work in terms of a brand, but in terms of a large financial services product, I would say Barclays is starting to look like the brand that communicates very powerfully and also produces simple, straight forward packages of products and explanations,” says Davies.

In Germany, ING Diba – though smaller in comparison to its competitors – emerged as the leader in simplicity by a large margin.

Commerzbank on the other hand found itself at the bottom of the simplicity rankings in Germany, with respondents complaining of its “stubborn” and “inflexible” customer service.

Though strictly governed and regulated, the retail banking sector in the Middle East ranked 11th out of 25 industries overall.

The Islamic banks surveyed were all perceived to deliver simpler service than their international counterparts, with Emirates Islamic Bank and Al Rhajhi Bank securing the top positions within the list.

Among non-Islamic retail banks surveyed, Emirates NBD was the top performer and was the most simple brand overall.

Overall, the region’s Citibank delivered better than other international names, but still ranked behind home-grown offerings, based on customer inability to easily search the bank’s website or find basic information in printed materials.

HSBC was by far the least simple, plagued by issues around customer privacy including leaked client emails in the UAE.

In India, the retail banking sector faired well ranking at the 8th place out of the 25 industries domestically, and the respondents projected retention of trust despite the global financial crisis.

Retail banking also reflected a robust rise in India. Domestic banks performed significantly better on the simplicity scale than their global counterparts as Bank of India led the way with clear and direct communications as a focal point.

In China, however, foreign banks HSBC and Citi ranked higher in simplicity rates than many local Chinese banks, maintaining a stronger reputation than their domestic counterparts, even though China’s largest bank, ICBC, scored higher than many of its competitors.

Davies says the aim of Siegel+Gale’s surveys has always been based around simplicity – removing clutter and obstacles between an organisation and its desired audience.

“We are able to conduct a survey like this because we are a global player in branding and our history dates back to 40 years. What we want to make sure is what in a journey is going to improve the experience for any consumer,” says Davies.