Social media presence is a necessity for any institution in any sector, but in an industry as tightly regulated as financial services, just how ‘social’ can you become? Some businesses have, however, done just that. Patrick Brusnahan ranks financial businesses from across the globe, and talks to experts on strategy

Social media is fast-paced and fast-moving. For an institution to make any dent in the space, it needs to move quickly.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

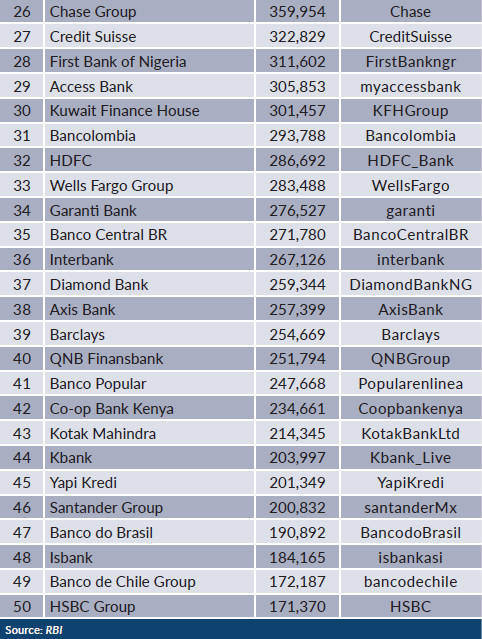

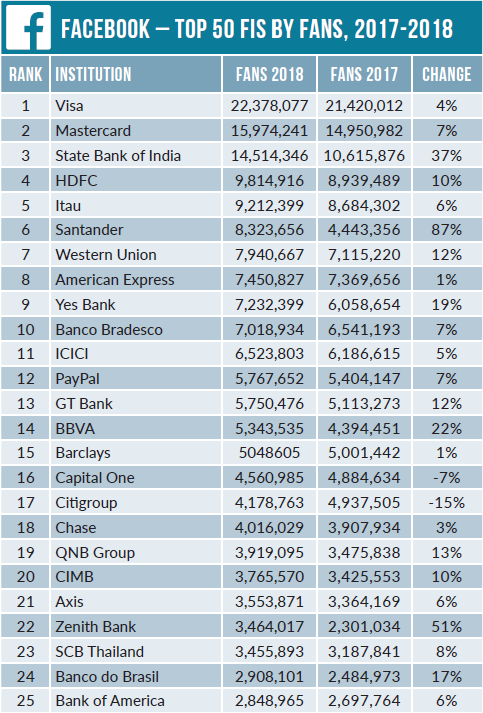

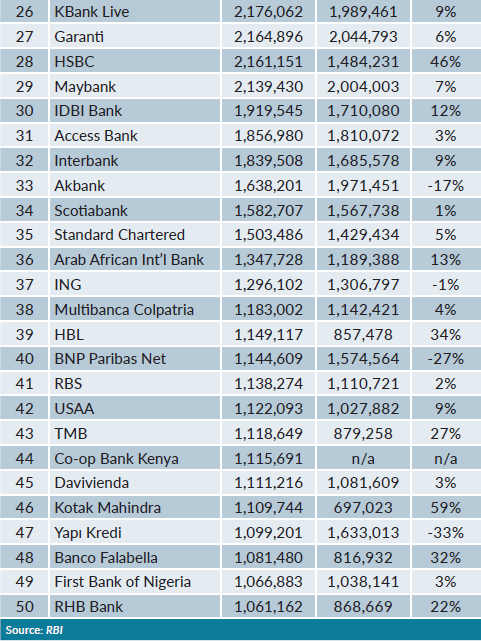

This does not, however, necessarily comply with the reams of red tape commonly associated with banks. As a result, the top two institutions in RBI’s Top 100 financial institutions (FIs) on Facebook are, once again, not banks. Visa and Mastercard claim the top two places – positions they have held since 2014.

Visa had 22,378,077 likes across its two pages, a 4.5% increase from the previous year, and Mastercard had close to 16 million, with a slightly larger year-on-year increase of 6.9%

Adrian Farina, senior vice-president of marketing at Visa Europe, tells RBI: “Visa uses social media in a variety of ways and it has became integral to many of our team’s operations, be it marketing, corporate communications, customer services or recruitment.

“We see digital and social media as great tool to help us achieve our corporate vision of being the best way to pay and be paid, for everyone, everywhere.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKirsty Redfearn, head of consumer and digital marketing, UK and Ireland, at Mastercard, has a similar opinion. Speaking to RBI, she says: “Social media forms part of our integrated marketing mix. We would use social media as one of the many channels that form our marketing campaigns across the year. I think we find it quite a useful channel to have a dialogue with cardholders and consumers in the space of their everyday life.

“It’s a mutual channel where we are able to talk to them about their passions, their interests, and hopefully take them on a journey of understanding on how Mastercard can help them enable that.”

Farina adds: “Social media has become part of our DNA over the past five years and, from a marketing perspective, ever more important as part of our media mix.

“Social is extremely versatile and provides us with the means to position our brand with our clients, engage consumers around the benefits of Visa products, highlight elements of our corporate narrative, such as our focus on innovation and security, and operate promotions and competitions.”

Banks on social media

State Bank of India (SBI) placed third in RBI’s Facebook rankings, with over 14.5 million likes on the platform – a staggering 36% more likes than the previous year.

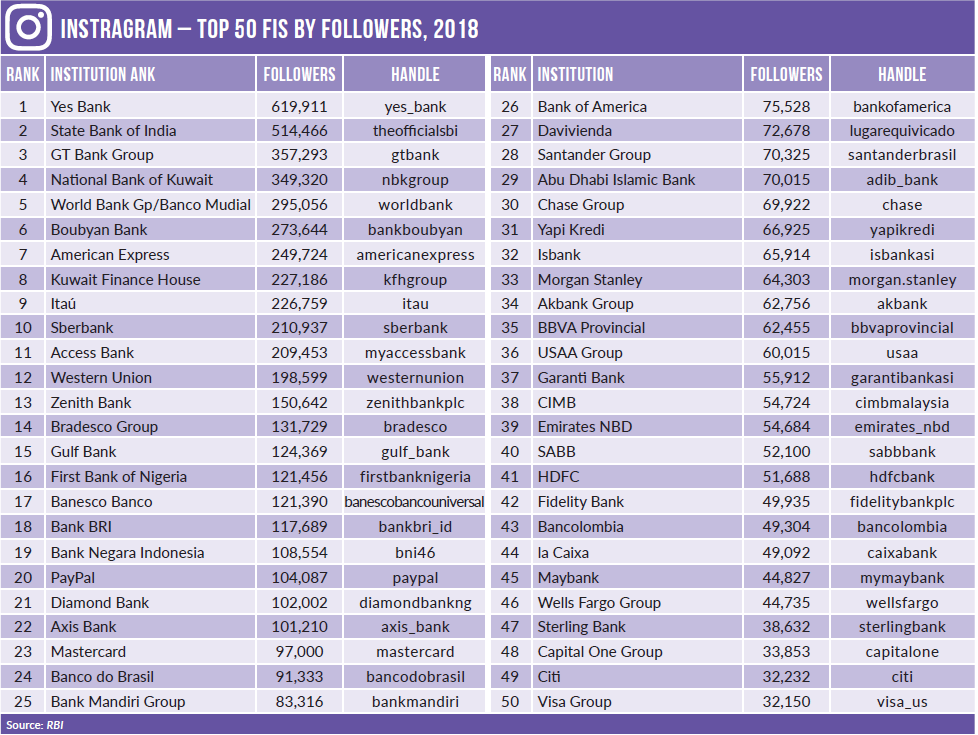

Following SBI to complete the top five was also India-based HDFC Bank, and Brazil-headquartered Itaú. In addition, SBI topped RBI’s Twitter rankings with 3.4 million followers. It also did well on Instagram, with 514,466 followers there.

The highest-placed UK bank was Barclays. In 2018, it had over 5 million likes on Facebook, as well as 254,669 followers on Twitter.

So, why is Barclays top in the UK? Speaking to RBI, Mark Brayton, director of marketing and customer engagement at Barclays, believes there are a number of roles that social media plays for Barclays, customer service being a main one.

He explains: “Customers’ expectations of customer support from brands have changed. We feel it’s really important to offer that choice, and social media is a core part of that customer service mix for any banking customer these days.

“We have huge amounts of messages coming in each week, approximately 6,000 across all of our channels, and the team responds to 3,500 tweets every week. There is a demand, and this is a hugely important space for us to be able to serve our customers in the channel of their choice.”

India-based Yes Bank, with 7,232,399 Facebook likes, also sees the benefit of social media for customer service.

A spokesperson for the bank said: “Social media is treated as an important customer service channel. We are able to respond to almost all queries or complaints within 30 minutes.”

Social media campaigns

While customer service is crucial in social media, it is not its sole function for banks. Producing social media campaigns to garner interaction and attention is the name of the game here.

Brayton says: “My team are more focused around social media as a customer engagement and communication channel – how we represent ourselves as a brand through those channels, how we communicate, what we talk about, how we share news, how we become relevant for our customers and our clients and our core audiences.”

Campaigns have to be adapted depending on the channel. Just because something worked on Facebook does not necessarily mean it will work on Twitter, and vice versa.

“It is hugely important that we take different approaches to different channels,” Brayton adds.

“On Twitter, for example, short bursts of information and primarily using it as a customer-engagement communication channel are the things that tends to work best.

“On Facebook, as I’m sure you well know, the use of video content in short, sharp bursts in people’s news feeds can really start to communicate in a snappy yet engaging format, which has become synonymous with our social channel.

“The style of communication really needs to suit the platform. That’s where we’ve had a lot of our success over the years, and really engaged on social media.”

He continues: “What we make sure we do is constantly track essential statistics and analytics. We then get to understand what audiences are looking for and the subject matter they might want to share.

“Then we make sure that as a brand within the social media space, we create that balance between communicating about what we feel passionate about as an organisation and reflecting the context that we know what audiences will want in that particular channel.”

One of the different approaches Barclays has taken is having “editorial-style” meetings. After collating SEO data, the team gets together and discusses the information it sends out. In particular, it decides what Barclays “feels it should have a point of view on”. It then creates something quickly – usually within the next three days.

“That was quite a leap forward for us,” Brayton says. “That was a huge development, and gave us speedy access to content production and development, but crucially, made us confident that our content on social media was relevant.”

Yes Bank utilises a cautious approach, while still delivering a story with its content. Its spokesperson says: “Social media provides a great platform to connect with users around the world and engage with a story-telling approach. Crisis and influencer management are key areas to be focused on with social media to avoid damage to our brand image.”

Robert Glaesener, CEO of social analytics business Talkwalker, believes there are differences between how mainstream and challenger banks approach social media with their campaigns. He explains: “Mainstream banks have a tendency to focus more on sponsorship activity and their social and workplace initiatives.

“Barclays also has a much more segmented approach to social media, using multiple Twitter and Facebook accounts to target different sectors of its audience.

“Challenger banks are far more focused on their own products and services when it comes to social. It is about telling ‘their’ story. While they struggle to match engagement levels for mainstream banks on Facebook, on Twitter they perform well, with Revolut and Monzo outperforming mainstream rivals like Santander and Co-op when looking at performances of the main company Twitter account.”

Compliance

Banks are not known for just saying anything they want. There are processes and compliance teams to go through, so how does a business like Barclays remain relevant in a fast-moving medium and work with that?

Brayton explains: “Compliance is absolutely paramount for all communications we make. We evolved our compliance partners to be part of our editorial board sessions to make sure that we are, and continue to be, 100% compliant.

“It’s a new rhythm and dynamic for the organisation, that was previously used to creating the same kind of process but over a longer period. We needed to ramp up our operations over the last few years to make sure we’re speedy and more forthright than we’ve ever been before.”

Glaesener believes compliance could be holding incumbent banks back on their social media activity, particularly in terms of the tone adopted. He says: “Established banks could experiment with a slightly lighter tone on social media. It will always be difficult for mainstream banks to use emojis and slang in the same way as a challenger.

“Given the demographics of social media users and the need to attract young customers, carefully managed experimentation may help them find a tone of voice that is a bit more personal and less corporate without forfeiting credibility.”

Engagement is the primary metric to determine whether social media interaction is working, but while certainly looking at it, Barclays is also careful not to place too much credence into it.

Brayton concludes: “Engagement is a key metric for us, but there isn’t one kind of benchmark we look for.

“We have different Facebook pages and different Twitter handles for the different audiences that we have across our customer and client base. We’ll get different levels of engagement across environments. Our Barclays Agricultural Twitter handle gets very high levels of engagement because it is more specific and focused in the types of communication.

“While it is an important metric to check, we tend not to engage ourselves in definitive benchmarks in those. We just learn through previous activities through that platform.”