The £60m re-branding programme for Virgin Money is one of the most significant branding exercises in recent UK banking history. As Douglas Blakey reports, the re-brand incorporates a new generation of Virgin Money stores designed to bring to life the core Virgin brand DNA

The Virgin Money re-branding exercise is big-not just in terms of its scale, budget and ambition.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

A major bank re-brand is not a novelty but the Virgin re-brand has a lot riding on it.

The UK has witnessed many a bank re-brand over the years. For example, the Midland Bank brand was dropped by HSBC in 1999, some seven years after being acquired by HSBC. That exercise encompassed about 2,000 branches at the time.

And gave agency Lowe and Partners a much-coveted multi-million advertising budget at the time to promote the new brand.

Fast forward a few years and Santander re-branded its three UK acquisitions: Abbey National, Bradford & Bingley and Alliance & Leicester.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnd then of course came the much publicised failure of Northern Rock.

One of the first victims of the financial crisis, Northern Rock was such a shambles that it had to be nationalised in 2008.

It was 2011 before the government sold off Northern Rock in a deal worth about £750m to Virgin. 2012 kicked off with the new owners of Northern Rock adopting the Virgin Money brand in an urgently needed re-brand.

That covered some 75 branches, serving around 4 million customers.

Richard Branson’s Virgin Group was the largest shareholder in Virgin Money with a near 39% stake. Virgin’s foray into UK financial services turned out to be profitable but short-lived

In June 2018, CYBG, owner of Clydesdale Bank and Yorkshire Bank snapped up Virgin Money for £1.7bn.

Clydesdale Bank, Yorkshire Bank brands axed

But while CYBG purchased Virgin Money it is the latter-named brand that is to survive.

So the Clydesdale and Yorkshire brands dating back to 1838 and 1859 respectively are to be demped.

Moreover, CYBG is paying Virgin Group an initial £12m a year to use the Virgin Money brand.

At the time of acquisition, Virgin Money operated 73 outlets. Clydesdale Bank operated a Scotland-based branch network of 71 while the Yorkshire Bank branch network included 99 outlets.

All a far cry from back in 2002 when Clydesdale and Yorkshire operated a combined network of 490 branches.

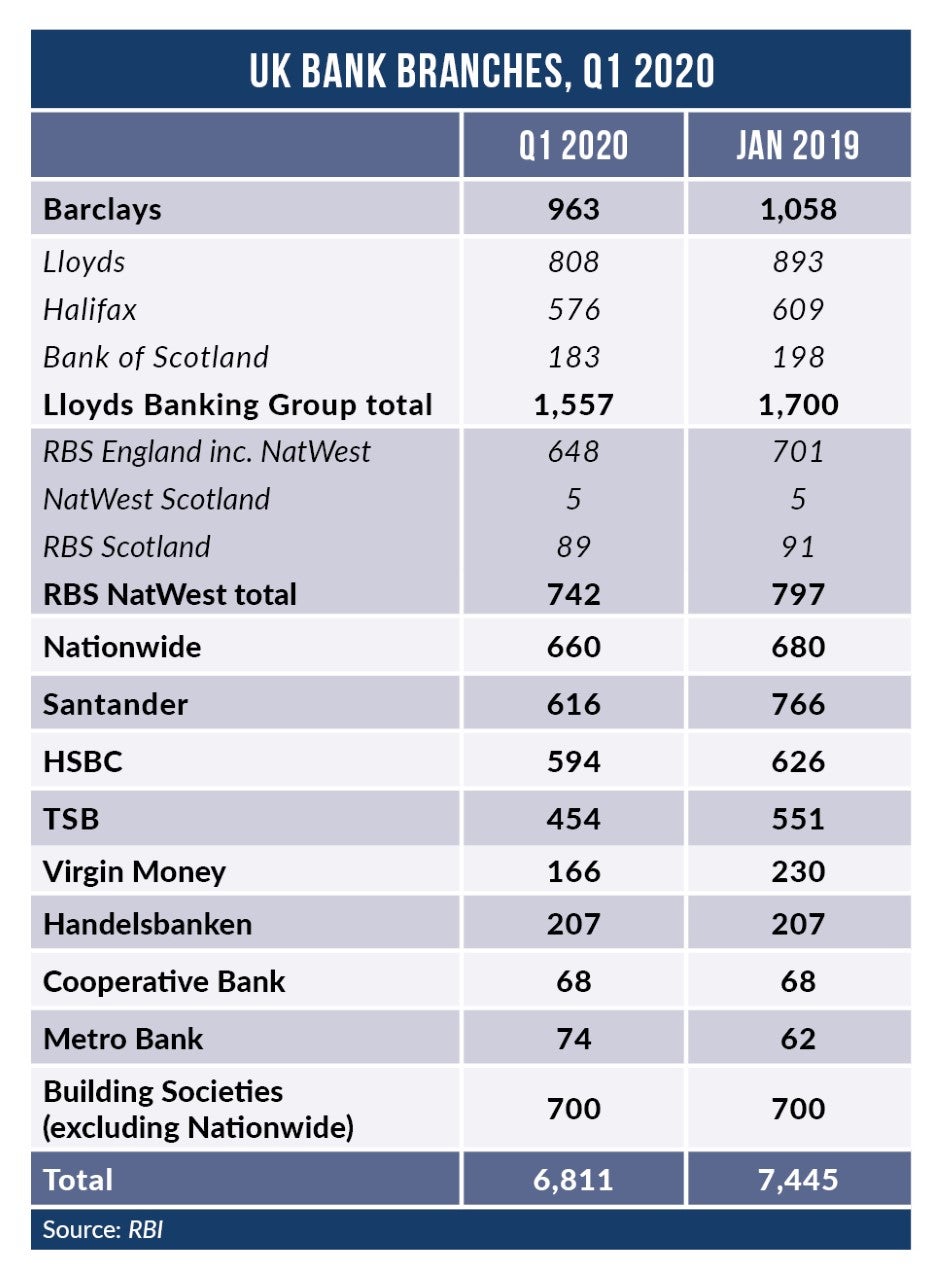

Since the 2019 deal, the combined branch network for the three brands has shrunk from 243 to 218.

Moreover, by the second half of 2020 that number will drop to 166 branches once the re-brand is complete.

While the physical channel is shrinking in the face of the radical change in customer behaviour, the bank is investing heavily in the branch network.

Virgin Money launches network of Dynamic Experiences designed by I-AM

Following the merger, leading international design agency I-AM was appointed to design the first-generation of new Virgin Money UK stores to hit the UK high street.

I-AM has developed a customer centric, store format strategy. This includes a family of concepts specifically tailored to serve the needs of local communities, the first of which are being trialled at the High Street Kensington, London, Birmingham and Manchester stores.

Virgin Money stores: brief & approach:

The overall objective for the project was to build on the Clydesdale digital sub-brand’s B-Works concept. This project amplifies that experience and seeks to bring to life the core Virgin brand DNA attitude, values and personality.

Jon Blakeney, I-AM Group Managing Director tells RBI: “This required an agile format strategy, focused on delivering ‘Brighter Money’ experiences in store.”

To really understand what customers want from the physical spaces, I-AM visited 26 branches across 11 cities. In particular, the I-AM team devoted over 120 hours to observation and conversations, conducting 50 in-depth interviews across staff, customers and stakeholders.

“Through our research we reviewed the positive features of the existing estate along with issues that were common across the majority of branches. This provides a platform to position the new stores within the hearts and minds of the customers.

Truly memorable experience

Blakeney says that the new stores create a truly memorable experience that re-imagines the role of physical stores.

“People are at the heart of the experience, and we have created a series of feature modules built to engage and serve customers throughout the space.

“The new stores, open to customers and non-customers, provide facilities for entrepreneurs to co-work and create in the social media studio, fuelled by bottomless cups of free coffee.

“The stores are a platform for social engagement, host destinations for a diverse range of networking events, seminars, panel discussions, even morning yoga and evening gigs – all tailored to the needs of the local market.”

Virgin Money stores: key to the customer proposition

The stores are a pivotal component of the Virgin Money customer proposition, to support the 6.6 million personal, small business and mortgage customers. Virgin Money intend to use the stores as a launch vehicle to introduce customers to new products and services within their own and Virgin group companies.

Blakeney adds: “We have created the first in a national network of ground-breaking spaces, that genuinely enrich the banking experience from a consumer perspective. Virgin Money have a platform to engage customers on a different level, to reach out into their communities with open arms and to shift the dialogue of banking from money to wellbeing for the mind, body and soul.

“The new Virgin Money stores will turn banking on its head. We are proud of the success of B Works, and we are delighted to help take Virgin Money to the next level.”