Bank branch numbers in the UK have continued to fall within the last few years. The rise of digital technology has been a huge driver of this, with most of us now able to access all the banking services we need from the comfort of our own homes. Evie Rusman reports

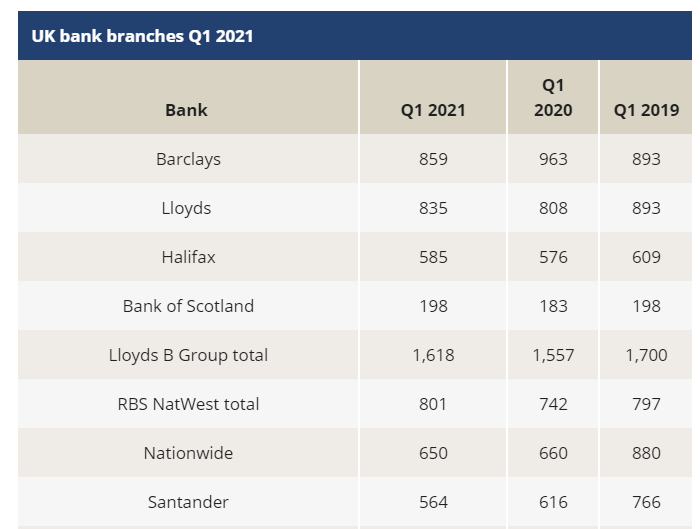

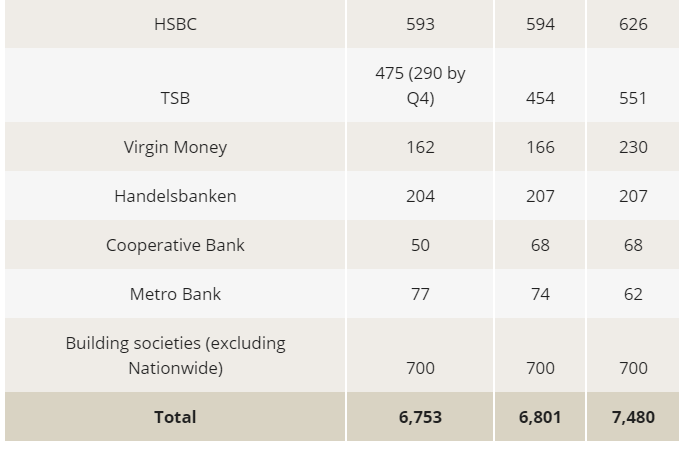

Research conducted by RBI shows that there has been a gradual decrease in the number of bank branches in the UK since 2019. In Q1 2021, there were 6,753 branches, 727 less than in Q1 2019 (7,480). Why is this?

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

A rise in digital banking services as well as a shift in consumer attitudes are the most likely culprits.

Over the last decade or so, the number of people using digital banking services in the UK has risen significantly. A survey by Statista shows that in 2007 only 30% of individuals used online banking services. Fast forward to 2020, and this figure has more than doubled to 76%.

In addition, stats from Finder reveal that digital-only banking users rose by 16% in 2020, with over a quarter of Brits now having an account (27%).

As a result, the need for physical bank branches has dwindled as most of us now choose to bank from home.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBanks downsizing

What does this mean for the future of branches? And which banks are downsizing?

The RBI figures show that one of the biggest drops came from Barclays, who now has 859 branches in comparison to 963 in Q1 2020, a fall of 104.

Santander has also cut 52 branches since 2020, leaving the bank with a total of 564 branches. Following Santander’s annual results, which saw its profits plunge by 44%, the bank is expected to slash more jobs and close more branches during 2021.

A potential move would follow the likes of HSBC, who announced plans to cull its branch network by 82 this year. Meanwhile, Barclays and Lloyds will close a combined total of 138.

TSB

Another bank set to undergo a massive overhaul is TSB – despite increasing its number of branches since 2019, the bank is changing its strategy all together with plans to close near 200 branches in 2021. This will leave the bank with 290 branches by the end of Q4, a decrease of 185 since the start of the year.

TSB says that a move to digital banking has fuelled its extensive closure programme. And prior to Covid-19, TSB said that more than 90% of the transactions it processed were already through digital or automated channels – the pandemic has only cemented this.

A TSB spokesperson tells RBI: “The decision to close a branch is never taken lightly, but our customers are banking differently – with a marked shift to digital banking.

“TSB is committed to a national branch network but needs to ensure that we have the right balance between branches on the High Street and our digital platforms. Customers have a post office or ATM within a mile of each branch that’s closing, maintaining local access to cash.”

As part TSB’s new strategy, it is investing in re-developing its remaining branches and providing new facilities such as video banking and self-service machines.

Are branches still relevant?

With so many closures, it is difficult to see how the physical bank branch can survive. However, one bank that believes in them and has remained consistent when it comes to branch numbers is Handelsbanken – since 2019, the bank has only closed three branches, giving it a total of 204.

Speaking to RBI, Chris Teasdale, Chief Branch Officer at Handelsbanken, argues that bank branches are extremely important in adding to the customer experience. He says that branches offer banks the chance to build personal relationships with customers and help them with their financial needs.

“For us, our branches are not just physical spaces; they house teams of highly skilled banking professionals who are committed to building long-term, personal relationships with our customers,” he says.

“Supported by specialist functions across our Bank, and through the close relationships that they form with their customers, our branches are empowered to offer personal and tailored customer service and make decisions based on their customers’ needs and requirements. Our branches are, and will always be, the home for the long-term relationships we form with our customers.”

Teasdale also says that Handelsbanken is now at a stage where it has established a good geographical footprint across the UK.

“As such, we are looking closely at our branch network to ensure we continue to be represented in the right areas to serve our customers in the best possible way,” he adds.

“This might mean that we will open some new branches and merge or close others. However, this is nothing new. Calibrating our branch network in this way to suit our business strategy and customer demand is something we continuously do at Handelsbanken.”

Access to services

Earlier this year, the UK’s financial regulator the FCA criticised banks for branch closures due to worries surrounding access to cash, particularly for older demographics.

In January 2021, the regulator urged banks to reconsider closing branches during the Covid-19 lockdown.

“We are concerned that these activities could have significant consequences for customers,” the FCA says. “It may be harder than usual to reach all customers under the current restrictions and engage with them on closure proposals effectively (for example, small businesses that are temporarily closed).

“Some customers may need to access in-branch services to help them prepare for closures but may be unable to do so. Customers may also need additional help to access online banking and making payments. We want firms to review their plans against our existing guidance and ensure that they continue to comply with our Principles.”

The FCA also says banks should consider pausing branch closures to reduce the potential harmful impact on vulnerable customers.

Despite this, it is hard to say how branch closures will impact customers, but as most of us now bank online, will it really be that terrible?