The UK 7-day current account switching service launched back in September 2023. So, the latest quarterly numbers give us 10 years of data to crunch.

Specifically, the service has has now facilitated 10.2 million switches, averaging a fraction over 1 million per year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Before anyone gets too carried away, back in 2012 there were 1.2 million switches. That figure has not been exceeded since the launch of 7-day switching, until now.

Since the service launched, annual switches peaked in 2014 at 1.16 million. The annual total dipped then in each of the next four years, to 1,033,939 in 2015 and to 1,010,423 in 2016. By 2017 (931,956) the figure was back below the one million total and fell again to 929,070 in 2018. By 2021, the annual number had fallen even further to 782,223.

2023: a record year for current account switching

Between October and December 2023, 433,701 switches took place, the highest quarterly figure on record. For calendar year 2023, switches total 1,457,165, a record year.

Monthly switching volumes peaked in November with 162,637 switches. October and December saw 141,924 and 129,140 total switches respectively. Within these figures, small business and charity accounts saw a relatively strong quarter. 5,616 such accounts were switched during the period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor 2023 as a whole, a mere 23,495 SME and charity accounts switched, equivalent to just 1.6% of all switches. And that annual figure of just over 23,000 is actually well below the annual average of 33,000 SMEs to use the Current Account Switch Service in the past decade. As UK challenger bank Allica Bank noted earlier this month, that works out at the equivalent of just 0.5% of UK SMEs.

The elevated personal switching figures may indicate that consumers are reevaluating their existing accounts amid ongoing economic uncertainty. Account holders may be exploring banks and building societies that provide more tailored services. The more likely explanation is that switching rises during periods when banks offer attractive switching incentives.

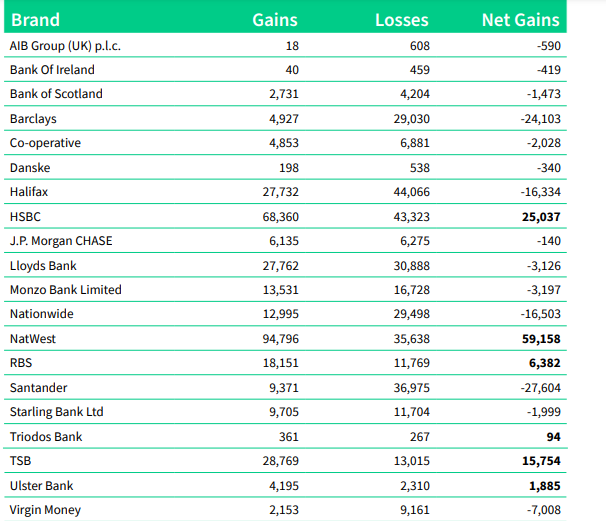

End user switching data, highlighting brand-by-brand net gains and losses, is published three months in arrears. So, the latest quarterly numbers show net gains and losses by brand for the period between July and September 2023.

Q3 2023 switching winners and losers

NatWest, HSBC, TSB and RBS had the highest net switching gains in the third quarter of 2023.These brands have all been running account switching promotions. Santander and Barclays report the biggest net losses among switchers in the third quarter.

During Q4 2023, 77% of people were aware of the service with 87% satisfied with their switch. 99% of switches were completed within seven working days.

As has been the case consistently, online or mobile banking (44%) was the top reason people preferred their new account. Following this, interest earned (34%) was the second most important reason. Customer service (33%) and location of branches (22%) come in at third and fourth respectively.