After a bruising and divisive election campaign, Donald Trump has triumphed. RBI sounds out banking industry experts on the implications for the financial services sector.

Daniele Antonucci, chief investment officer, Quintet Private Bank

While the US presidential election outcome isn’t confirmed yet, Donald Trump is in the lead at the time of writing. With three swing states – Pennsylvania, North Carolina and Georgia – already called for Trump by the US media, he’s also slightly in the lead in the remaining four key states of Michigan, Wisconsin, Nevada and Arizona. A candidate needs 270 electoral votes to win the Presidency. At the time of writing, Trump stands at 267, Kamala Harris at 224.

In addition to the Presidency, American voters cast their ballots on the full House of Representatives and one-third of the Senate. Preliminary results suggest a close contest in the House, but the Republicans are currently leading and are on track to secure a majority. As expected, Senate control looks poised to shift from Democrats to Republicans. If this ‘Red sweep’ were to happen, it would enable Trump to implement more of his programme – including fiscal measures such as tax cuts and tariff increases on emerging markets (and potentially Europe).

In the coming weeks, we could see some volatility. However, it’s also possible that clarity on the US elections reduces uncertainty for some time. It’s worth noting that between 1936-2023, the S&P 500 delivered an average performance of 15-16% in periods when the US had a split Congress, compared to 12% when there was a united Government. Perhaps this is because of the volatility created by a unified government being able to deliver more significant policy changes.

Obviously, we’d need to see the final results. Based on US laws, the next important date is 11 December, when all vote reporting, counting (and recounting) stops. Six days later, all 538 members of the Electoral College will meet, with at least 270 votes needed to elect the next US President. The result of the election is then sent to the new US Congress, which will convene for the first time on 3 January 2025 and officially validate the Electoral College on 6 January. Finally, on 20 January, the 47th US Presidential inauguration starts.

A continuation of the ‘Trump-Trade’

As we write, financial markets continue to react to the news. Asian stocks are softening, while the S&P 500 futures (financial instruments that could anticipate the equity market reaction once the US opens) gained and are now close to their all-time high. We have a slight tactical equity overweight, which we combine with a preference for short-dated government bonds and high-quality corporate bonds, while we’re typically underweight risky bonds.

We think a Trump lead could signal gains in oil & gas, financial and telecom stocks, as deregulation would benefit these sectors. It might also – at least at first – be positive for US equities more generally, given a sizeable fiscal boost and, therefore, faster US economic growth, which could support the industrials and materials sectors. The impact on technology firms is likely to be more nuanced, with some uncertainty on possible antitrust actions but also tax cuts potentially boosting capital expenditure, possibly a net positive.

Tariff increases would negatively impact emerging markets, which is one of the reasons why, tactically, we currently don’t have active positions in those regions. If applied to NATO allies, tariffs may impact Europe too, and if they were to result in higher US inflation, the US consumer sector might be negatively affected.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

As higher US fiscal deficits look likely, 10-year US Treasury yields jumped by 14 basis points to 4.41%. We’ve so far stayed underweight US Treasuries on concerns that a large fiscal stimulus might result in a significant supply of government bonds (a wider budget deficit leading to higher government debt), lowering their price.

We also hold gold, commodities and high-quality government bonds in our long term, strategic asset allocation, as we think they can cushion a variety of geopolitical and economic risks, and a hypothetical rise in uncertainty. We also hold ‘insurance’ instruments for the US and Europe (where client knowledge and experience, and regulations and investment guidelines, permit), which can appreciate when equity markets decline. Conversely, if we were to detect lower uncertainty ahead, or a more positive path for, say, US equities, we might consider selling those instruments.

In terms of currencies, recent dynamics have been mixed. This morning, the US dollar strengthened further against the euro to 1.076, the lowest since July. We’ve already seen a stronger dollar recently, in part because the European Central Bank has reduced interest rates more than the US Federal Reserve (Fed). Conversely, the pound sterling hasn’t weakened that much relative to the dollar, only depreciating slightly in recent weeks. This is because the Bank of England (BoE) has so far refrained from cutting rates as swiftly as other central banks. This Thursday, we expect both the Fed and the BoE to lower their key policy rates by a quarter-percent.

Steven Blitz, Managing Director, Global Macro, Chief US Economist, GlobalData TSLombard

By winning the electoral college and probably the popular vote, he can claim a mandate on the economy and he will use it. This is a one-term presidency, so he will act fast and, having learned from his first term, his Administration will be more efficient at getting policy enacted.

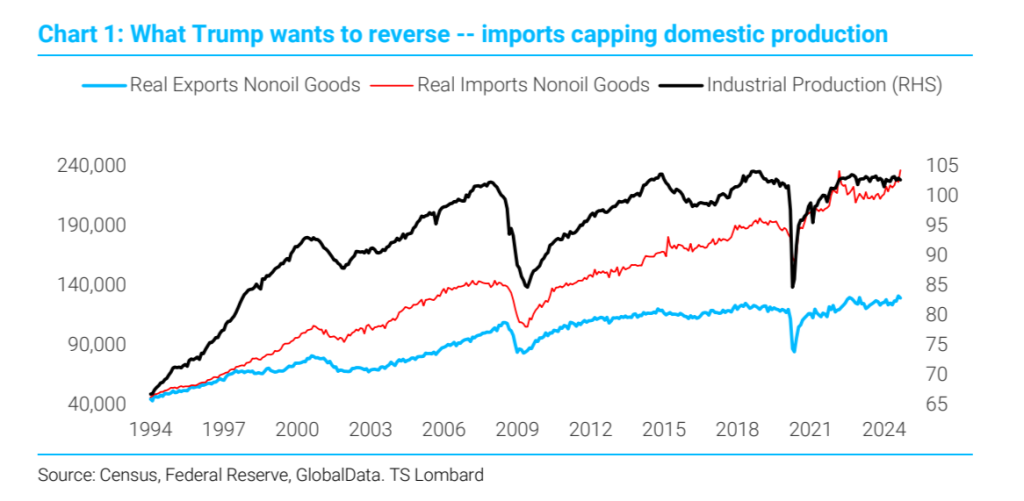

The direction of his economic policies will be built on the truism of the American voter that got himself elected despite his negatives – the economy overwhelms everything else and cuts across all ethnicities. Give Trump credit for knowing how to reach people who see themselves as working class first rather than as an ethnic group and turn it into votes – especially among young men, who turned out in force in this election. The unemployment rate for men aged 20 to 24 was 9.1% in October compared to 7.8% a year ago. For women in the same age group, 6.3% unemployed compared to 6.2% October 2023.

With that, he beat Harris’ advantage with women by a surprising turn out of young working-class men feeling economically disadvantaged. It is an ironic turn that Trump wins with the Democrat’s old coalitions by selling an economic promise that turns upside down the thrust of policy that was the bedrock of “Reaganism” — globalisation and hard money.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor Harris, it was always going to be an uphill battle, vice presidents generally fail especially when the president served has low marks. The enthusiasm of her base over abortion gave her a lift. Her failure to direct answer economic policy questions was her undoing. As for abortion, the nation has become ticket splitters. In Florida, the abortion rights amendment won 57% of the vote, though it lost because it fell short of the 60% threshold, and Trump won the state by a bigger margin than in 2020.

In sum, economic disaffection returns Trump to the WH and he will not wait long to act.

John Buran, CEO, Flushing Financial

We congratulate President-elect Trump on his second term. We look forward to improvements in the economic environment for both businesses and consumers under the new administration. We remain dedicated to delivering exceptional value to our clients and communities alike as we work toward a successful future together.

Helen Child, Founder and CEO, Open Banking Excellence

Donald Trump’s victory along with the evolving Open Banking landscape, presents both challenges and opportunities for UK tech firms with international ambition.

The Consumer Financial Protection Bureau’s (CFPB) Personal Financial Data Rights Rule, brought in under Section 1033 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, enshrines consumers with the right of access to their digital financial data and the ability to share it securely with third parties. In The Transatlantic Index USA, Open Banking Excellence (OBE) analysed the impact and market opportunity of this groundbreaking rule.

The US Open Banking market, projected to reach $35.79bn by 2031, opens up huge opportunities for emerging UK companies to export their expertise into the US However, the changing US political landscape has ushered in a new era of uncertainty for those seeking to establish a US foothold until the nature of the new Trump administration’s approach becomes clearer.

Andrea Cicione, Head of Research, GlobalData, TSLombard

Donald Trump has reclaimed the US Presidency and US bonds have sold off as the expected loosening of fiscal policy, looming tariffs and the crackdown on immigration could complicate the Fed’s mission to bring rates to “neutral” swiftly. We estimate that a 60% tariff on China and 10% tariff on RoW would increase US CPI inflation by 1.3 ppts; and even if this is just a one-off change in the price level, it would still make matters difficult for the Fed. December 2025 3-month SOFR futures are now priced at an implied rate of around 3.85%, which is still lower than the ~4% we have pencilled in. Bond term premia have increased across a range of estimates recently and there could still be some way to go. Markets will likely latch onto the “looser fiscal policy = higher term premium” story in the coming weeks especially as a red sweep comes to fruition. And even if our views are more nuanced, there could still be some upside as the Trump policy set leans more towards uncertainty and negative supply shocks, which is a serious threat to the expansion of the term premium. We remain short US long bonds (TLT) vs long MSCI ACWI especially as the Fed is set to continue cutting into a strong economy tomorrow.

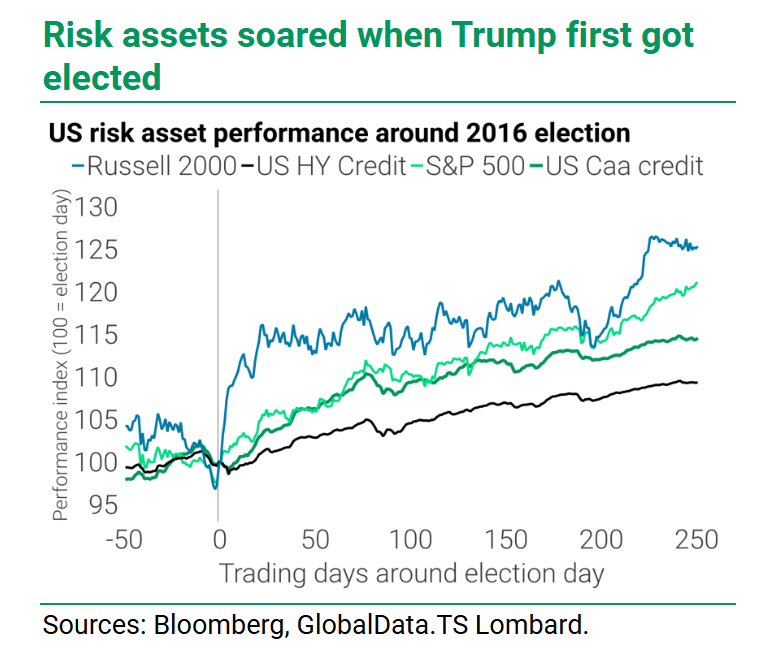

Stocks love the combination of Trump & no landing

Equities are up significantly, trading on the idea that Trump will deliver sweeping tax cuts, and financials and small caps are leading the pack. The S&P 500 has gained around 20% in the 12 months following the 2016 election of Trump; and for now, it looks like an embrace of the Trump trade even if a looming global trade war could be a headwind for equities next year. We maintain our bullish bias on US stocks, Financials and CCC credit, especially as the odds of a no-landing scenario have increased again following a very encouraging ISM services report yesterday.

We are still looking for more USD strength

Our US rates view still implies more upside for USD. Growing protectionism and shrinking cross-border trade could disproportionately dampen economic momentum outside the US, as America still enjoys stronger layers of protection than RoW, including the relatively closed nature of the US economy and the importance of US capital markets. Europe – notably Germany – already faces a vicious cocktail of cyclical and structural headwinds; and a second Trump Presidency only adds to those woes. EURUSD will likely have to fall further from here. However, green shoots are clearly emerging from the Eurozone economy, with a recovery in real incomes taking shape, recently better PMIs, generally stronger economic surprises, accelerating GDP growth and a sustained pickup in credit growth. And if the momentum can be maintained, the euro would likely be shielded against a significant fall vs USD.

Scott Dawson, CEO of DECTA

A second Trump term means a change of leadership at major regulation and enforcement bodies like the Federal Trade Commission (FTC), with an emphasis on getting rid of regulations. It’s likely that we’ll see the granting of new banking charters, and, with a general lack of effective regulation, it’s a certainty that low-quality players are going to enter the market. This could mean increased competition, or it could mean a race to the bottom.”

It was a remarkable close and divisive campaign, but hopefully the country can unite and move forward. With the UK and US both having a change of government in 2024, it will be interesting to see if and how our countries align over the coming years, particularly given the very different strategies towards key issues such as tax, trade and regulation.”

“A lot has been made of the cryptocurrency opportunity as Trump takes office again. I don’t see it having a significant change in the long term. Much like we say a jump in crypto in 2021, only to see it plummet again, we will see an initial boost again, but that landscape hasn’t developed intrinsically enough to change payments infrastructure.”

The way forward for fintech has been obvious all along. Companies need to assert control over their payment systems by working with resilient providers that can adjust to changing fees, regulations and technologies. The changes this decision will bring aren’t going to be restricted to the US – other countries will either follow suit or be indirectly affected by changing US regulations. Companies in Europe should keep up with what is happening across the Atlantic, because the US market is so huge it will have repercussions around the world.

Nigel Green, CEO, deVere Group

Trump’s promise to stop offshore wind projects on ‘day one’ of his presidency has raised concerns among renewable energy companies, especially those heavily invested in the offshore wind market.

The market’s reaction is understandable, yet it overlooks the broader, global trend toward clean energy that continues to gain momentum, regardless of political cycles.

Despite the potential for a temporary slowdown in some US-based projects, the long-term outlook for the renewable energy sector remains incredibly positive.

This presents a significant opportunity for investors to buy into the sector at a discount while the market remains focused on short-term uncertainties.

While a Trump victory could shift some US policies, the momentum behind renewable energy is undeniable, with countries across Europe, Asia, and the Middle East accelerating their green energy investments.

Governments around the world are investing heavily in renewable energy solutions to meet climate goals, reduce carbon emissions, and diversify energy sources. The shift towards clean energy has become a fundamental aspect of economic planning and national security, with no signs of slowing down.

The renewable energy sector’s growth is driven by long-term global trends, not by political administrations.

The market’s short-term reaction to potential US policy changes is understandable, but for investors with a long-term horizon, this dip represents an opportunity. The world is moving towards green energy, and no political leader can stop this seismic shift. Investors who recognize this will benefit from the ongoing global commitment to renewable energy.

Smart investors know that market fluctuations present opportunities. We believe that those who accept the inevitability of the green energy transition and act now could be well-positioned to reap the benefits as the sector grows.

As such, this market dip will be viewed as an opportunity for investors to enter the green energy space at a favorable price point, setting themselves up for long-term gains.

Chris Metcalfe, Chief Investment Officer, IBOSS, part of Kingswood Group

In the short term, the market reaction to Trump’s return to the presidency will likely be positive but volatile. However, further down the line, I believe the inflation outlook could deteriorate significantly if he follows through on his promised tax cuts and economic policies. While a Harris victory would have posed its own inflationary risks, those would have stemmed from factors such as increased government spending and regulatory changes.

We’ve already seen some initial reactions in the currency markets following the news of a Trump presidency. While sterling is falling against the US dollar, the pound is appreciating against both the yen and the euro, suggesting that investors are positioning themselves based on expectations of potential trade disruptions.

Additionally, Trump says he has a preference for a weaker dollar, which would have profound implications for global trade and investment flows. Still, unlike economic policy, markets largely dictate currency moves and will be out of his control. Overall, the environment will likely become more contentious, and the gloves may come off in the ongoing trade wars.

Furthermore, the European Union faces a considerable challenge in managing trade tariffs effectively. A Trump presidency may embolden populist parties across Europe, potentially leading to a rise in protectionist policies. This would intensify trade wars and create further uncertainty in the global economic landscape.

One key aspect we must consider is China’s response to a Trump presidency, which remains uncertain. China has various options available to it, and their strategy will be critical in shaping global market dynamics. I think it would be a mistake to expect the market reactions of the next couple of weeks to continue to play out for the rest of his presidency. As a Trump America becomes more isolationist and further dismantles the globalisation narrative, new relationships will be forged between countries and economic blocks, and it is too early to say how that will look.

Nazmeera Moola, Chief Sustainability Officer, Ninety One

The Republican victory is likely to see the US retreat from all global climate initiatives – much like we saw in the first Trump presidency. This is likely to slow momentum to combat climate change unless other parts of the world step up and fill the gap. We do think that countries like China and India will continue to focus on energy transition related investments – as these investments have been driven by their positive financial benefits and impact on growth to date.

While a red sweep is net negative for climate considerations, we do not expect a blanket repeal of all elements of the Inflation Reduction Act. Large portions of the IRA are increasingly being defended by republicans – whose districts benefit from the investment. However, if elements like the green hydrogen credits are retained, we are likely to see amendments in the manner in which they are implemented that would result in more questionable climate outcomes. The republican victory opens the door for tax credits for EVs to be rescinded.

However, the proposed tariffs will provide some insulation from US EV producers from cheaper Chinese competitors. Other considerations include the impact of the prospective tariff hikes on the cost of new renewable projects in the US and the likely expansion of oil and gas exploration on federal lands as environmental regulation is rolled back.

Daniel Murray, deputy CIO and global head of research, EFG Asset Management

US equities have been in buoyant mood over the past few weeks, including on election day. This is consistent with markets pricing a Trump win.

Futures are up strongly, led by small caps. At the time of writing the Russell 200 e-mini future is up over 5% while the broader S&P 500 mini future is up over 2%.

Bond yields have moved decisively higher in reaction to larger expected budget deficits under a Trump administration. The yield curve is now positively sloped from two years out, signalling greater confidence in economic expansion over the next 12 months. Market anticipation of Trump’s victory helps explain the muted market reaction to Friday’s weak nonfarm payroll numbers.

At the same time, the US dollar has rallied in sympathy with higher bond yields. Bitcoin has also rallied as part of the general risk-on trade.

Chinese equities sold off overnight in expectation of more tariffs on US imports from China. While Trump has talked about applying tariffs of 60% on Chinese produced goods, the reality is that they will likely be of the order of 20% to 30%. Expect China to announce more stimulus later this week of up to CNY2trn to try to offset the negative tariff impact, reinvigorate local government finances and diminish the headwind from the ongoing property sector debt overhang.

In the excitement of the election, Trump’s legal challenges have been little talked about over recent weeks. However, he faces sentencing on 26th November for his conviction in New York on 34 felony charges related to falsifying business records. It is possible that the US Supreme Court – which is loaded with appointees from Trump’s previous Presidency – will intervene.

Gold has been inexplicably strong this year but has sold off a bit overnight and this morning. A part of the recent strength in the gold price could have been associated with election uncertainty and the widely held belief that the result would be close and contested. In practice, the definitive election result has eliminated a major source of uncertainty, helping to explain the gold price sell off.

Justin Onuekwusi, CIO, St. James’s Place

Looking at Trump’s campaign promises, as well as his actions during his last presidency in 2017, we expect his presidency to bring reduced regulations across the board. Additionally, it’s expected he will focus on immigration and a greater use of tariffs in international trade. How this will play out and be received by markets remains uncertain.

The 2024 election has been a divisive one. With so much noise, it is bound to have an impact. We remain focused on delivering long-term investment outcomes and maintain conviction in our current positioning. We think making bold calls on the future based on a single event can lead to poor decisions.

There is potential for higher short-term volatility in bond markets in the aftermath of the election. We think this is particularly likely around US Treasuries as sentiment adjusts to the result.

Possible higher inflation may also cause yields for long-term bonds to rise higher than short-term bonds . This is sometimes seen as a signal for the start of a strong economic period but can also indicate a time of higher interest rates.

As the US remains the benchmark for global fixed income, the broader global bond market may feel the ripple effects of this. We will continue to monitor these markets carefully and will adjust positioning should there be a material change in the outlook and opportunity set.

Given Trump’s focus on international negotiations, sectors tied to international trade – particularly tech and consumer goods – may experience more volatility. On the other hand, his emphasis on deregulation and corporate tax cuts could give short-term boosts to industries like traditional energy, financials, and defence.

US smaller companies could be more affected by any post-election volatility but we believe this to be a short-term concern. In our view, the valuation case for global small companies is currently strong and expect over the medium-term US small caps will do well. We will continue to watch this space with interest as Trump’s campaign promises materialise.

Elections, particularly ones as contentious as this, have a way of stirring up short-term market volatility. However, history has shown it is unwise to make significant adjustments based on political events. Market volatility is often based on speculation and not any change to fundamentals.

While elections may create temporary volatility, we believe remaining disciplined and building a diversified portfolio is the most effective means of delivering long-term value. It is important to remember the main risk from market events is the poor decisions we can make when they occur, rather than the ramifications of the events themselves.

With Donald Trump looking increasingly set for a triumphant return to the White House, the dollar has gained ground against a basket of currencies. Investors are bracing for tariffs and a clamp down on immigration, policies considered to be inflationary which are likely to mean interest rates may be more elevated in the years to come. Trump’s more renegade approach to trade is likely to push the US further away from global institutions and the rules-based order built up over many decades. But at the same time, expectations are high that a Trump presidency will mean fewer regulations on big tech and big finance. Although Kamala Harris could still pull off a win, her chances of victory have narrowed.

Susannah Street, head of money and markets, Hargreaves Lansdown

US futures point to a positive surge on Wall Street, with Tesla among the early gainers. Elon Musk is a staunch supporter of President Trump and traders are assessing that a second Trump administration see a lighter touch in terms of regulation. However, although a rally in tech may be on the way, trade tariffs could end up having negative consequences for the sector by potentially exacerbating trade tensions with China and disrupting international supply chains for key components. Bitcoin has also rocketed to a record high as crypto fans expect a more supportive regulatory environment.

On the bond markets, Treasury yields have been climbing sharply, as traders assess the implications of a fresh Trump presidency for inflation and US government borrowing. Not only is a raft of tariffs expected to be imposed next year if Trump wins, which will push up the price of imported goods for American shoppers, his vow to kick out immigrants with waves of deportations could also have economic ramifications, potentially pushing up wage bills for companies. His pledges of tax cuts are also considered to be inflationary and are also causing wariness about the huge US deficit swelling further. Republicans have already clinched the Senate but it’s still unclear which party will gain the upper ground in the House of Representatives which will also have significant implications for future budget agreements. If the House turns blue and the Democrats gain a majority it may limit the Republicans ability to bring in sweeping tax cuts.

There is a chance of course, that Trump won’t enact his most strident trade policies which headlined on the presidential election campaign. He vowed to increase tariffs by another 10% on most foreign products and impose much higher duties on goods from China. Even if such heavy tariffs are not swifty imposed, the threat of them is likely to make Chinese-US relations a lot more uncertain in the coming years and could hamper China’s economic recovery even further. However, his isolationist approach might make containing China over the medium and longer term more challenging, given that Trump isn’t likely to want to build alliances in the same way as we saw under Biden and this splintering effect may enable China to form new partnerships in a fractured world.

There are risks that inflationary pressures in the US, prompted by higher tariffs will be exported. As the dollar rises, countries which import commodities priced in USD may also see prices increases, which will either need to be absorbed by companies or passed onto customers. If other countries started to feel onerous effects of higher tariffs on their economies, there may be more demand for the dollar as it is considered to be a safe haven. This could be counter-productive to efforts to increase exports from the US as the stronger dollar is likely to make products of US exporters less competitive globally. When it comes to Europe, an increase in tariffs imposed on exports is likely to cause some pain, but given the dollar is also strengthening and is likely to be beefed up even further, due to inflationary pressures, the currency changes may help British and European firms maintain their competitiveness

Oil prices have dipped back amid expectations that under Trump more crude will flow from US wells. Given his America First mantra another Trump Presidency is likely to place emphasis on energy independence and his policies are likely to favour fossil fuels, promoting deregulation in the oil, gas, and coal industries. Brent Crude has edged down below $75 a barrel as traders also digest data showing that US crude stocks rose by 3.1 million barrels last week, more than expected. There is also a close eye being trained on the Fed’s commentary on Thursday after its decision on interest rates, which could also help build up a picture of expected demand in the world’s largest economy.