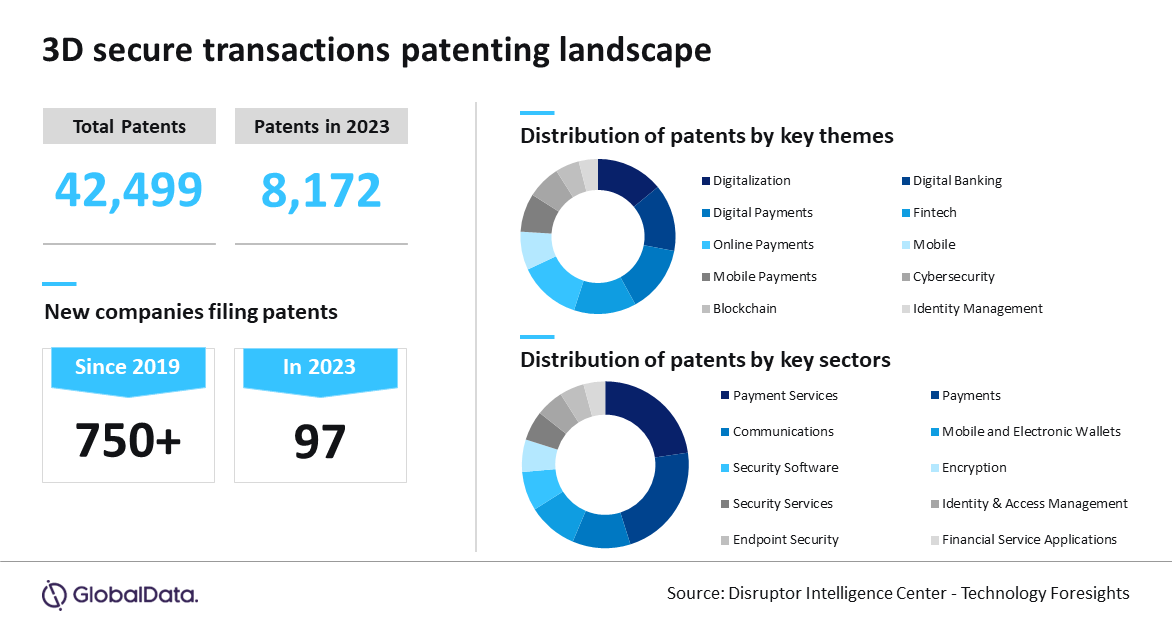

As digital payments continue to rise worldwide, the banking industry is prioritising advanced security technologies to combat the rising online threats. Central to this shift is 3D secure transaction technology. Against this backdrop, the patent filings for 3D secure transactions have risen significantly from 4,603 in 2022 to 8,172 in 2023, demonstrating the industry’s commitment to balancing customer service with enhanced digital security, reveals GlobalData, publishers of RBI.

3D secure technology, a robust authentication framework that prevents fraud while ensuring a seamless user experience, authenticates online payments through three domains: the issuer (card-issuing bank), the acquirer (merchant’s bank), and the interoperability domain (secure communication infrastructure).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData releases Tech Frontiers: The Banking Edition

GlobalData’s latest FutureTech Series Report, “Tech Frontiers: The Banking Edition,” reveals that the notable growth in patent filings for 3D secure transactions underscores the sector’s commitment to embedding advanced authentication measures across digital channels, driven by the rising frequency of online fraud and heightened customer expectations for seamless security.

Rahul Kumar Singh, Senior Analyst of Disruptive Tech at GlobalData, said: “The rapid growth and increased patent activity in 3D secure transaction innovations reflect the banking sector’s evolution towards proactive fraud prevention and enhanced customer trust. By integrating advanced, multi-layered security measures, banks are not only responding to the emerging threats but also refining authentication to balance protection with seamless user experiences. This strategic approach transforms security from a regulatory requirement to a competitive advantage, strengthening customer relationships and expanding digital services amid the rising cybersecurity risks and customer expectations for frictionless transactions.”

GlobalData’s report offers an in-depth examination of critical banking innovations through its proprietary Technology Foresights framework, focusing on their impact, challenges, and applications across various banking operations. This analysis shows how transformative technologies like 3D secure transactions are reconfiguring digital security to meet the demands of an increasingly complex threat landscape.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNotable patents by key companies in 3D secure transaction technology

Visa has developed mobile tokenisation hubs and NFC-enabled virtual wallets designed to enhance the security and convenience of contactless payments, demonstrating its commitment to secure digital transactions.

Mastercard utilises blockchain-based credential management systems to reinforce mobile payment integrity, providing a more transparent and secure environment for digital transactions.

Capital One has pioneered gesture-activated and voice-protected cards, enhancing user control and security during transactions without sacrificing convenience.

Singh concluded: “Despite the progress, integrating advanced security measures like 3D secure transactions within the legacy systems and ensuring data privacy remains a challenge. Overcoming these hurdles will require strong collaboration among banks, regulators, and technology providers. By investing in adaptable security solutions and forming strategic partnerships, the banking sector can deliver a more secure, seamless digital experience that meets evolving customer needs and defends against emerging threats.”