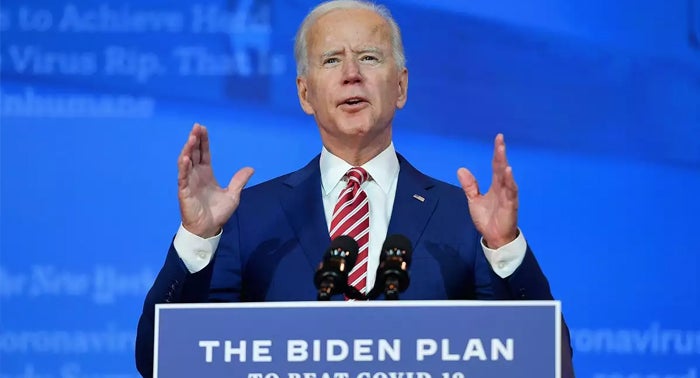

President Biden’s focus on helping minorities and people with low and moderate incomes will lead to more robust consumer protection and fair lending regulations, industry observers predict.

Under the Biden Administration, financial regulators are expected to emphasise racial equity as they focus on consumer protection and expanding access to financial services.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

That would mark a departure from the last time Democrats controlled the White House and Congress at the start of the Obama administration.

Early efforts then centred on fighting the crisis, followed by a push to ensure that it would never happen again with the Dodd-Frank Act of 2010, the most sweeping financial legislation in a generation.

“Obama looked at how to make the financial system stable,” said Karen Petrou, head of Federal Financial Analytics, a regulatory advisory firm. “Biden is looking at, ‘How do we make the banking system just?’ That’s very different.”

Coming down on the high-cost short term loans industry

In practice, that will translate into tougher rules on payday lenders—who charge high rates of interest on short-term loans—and stronger enforcement of fair-lending requirements, an administration official said.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBiden’s team will also push to establish a government-backed consumer credit firm as an alternative to the companies that create credit reports, the official said.

Mr. Biden’s choices for top regulatory posts highlight his push to protect consumers from what some Democrats view as predatory behaviour by financial firms.

Rohit Chopra, currently on the Federal Trade Commission, is the nominee to head the Consumer Financial Protection Bureau.

Michael Barr, a former Treasury Department official who helped craft Dodd-Frank and create the CFPB, is said to be the top candidate to lead the Office of the Comptroller of the Currency, which oversees national banks such as JPMorgan Chase & Co. and Bank of America Corp.

Putting hard-nosed monitors at the helm

At the FTC, Mr. Chopra has repeatedly advocated bolder enforcement actions. In 2019, he and another Democratic commissioner objected to a settlement in which Facebook Inc. agreed to pay $5bn following a probe into the tech giant’s privacy missteps, contending it wasn’t tough enough.

Mr. Chopra is seen as likely to step up enforcement actions at the CFPB, with a focus on higher monetary penalties and a crackdown on repeat offenders.

Actions fell sharply early in the Trump administration before rising again last year.

He may also revisit a provision, repealed under the Trump administration, requiring so-called payday lenders to verify borrowers’ incomes to ensure they can afford to repay high-interest, short-term loans.

He also is expected to boost the power of the bureau arm focused on fair lending.

Facing Republican concerns

Republicans in Congress and bankers, who have criticised the CFPB as an instrument of government overreach, are wary of the prospect of yet another swing of the regulatory pendulum.

“The banking industry needs regulations written for years, not election cycles,” said Richard Hunt, president and chief executive officer of the Consumer Bankers Association.

“The more regulators from both parties can put politics aside, draft regulations with input from all parties and explain their positions, the more Americans can benefit from a well-regulated banking industry.”

Consumer advocates are looking to the Biden administration to ease lending standards that tightened during the pandemic, which they say has disproportionately harmed minorities who tend to have lower credit scores and less cash for down payments.

Dismantling Trump-era rules

The Biden administration’s focus on racial equity also means banks likely will be required to lend and invest more in low- and moderate-income communities under revamped rules for the Community Reinvestment Act.

The OCC and other regulators can block mergers and new branches if banks fail to meet these requirements.

Banks are unlikely to see further easing of rules.

During the Trump administration, banks saw some requirements of Dodd-Frank scaled back through legislation that increased a key regulatory threshold at which larger firms are subject to tougher rules.

On the other hand, Treasury Secretary Janet Yellen could move to undo Trump administration changes that made it more difficult to subject nonbank financial firms, such as Wall Street money managers, to heightened supervision.