Banks and insurers should both be investing in human-artificial intelligence (AI) interaction and in AI applications for decision-making, according to a new report.

GlobalData’s AI in Financial Services report notes that AI is already being increasingly used in client-facing and back-office settings within the financial services industry, with the sector having experienced “significant digitalisation in recent years.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

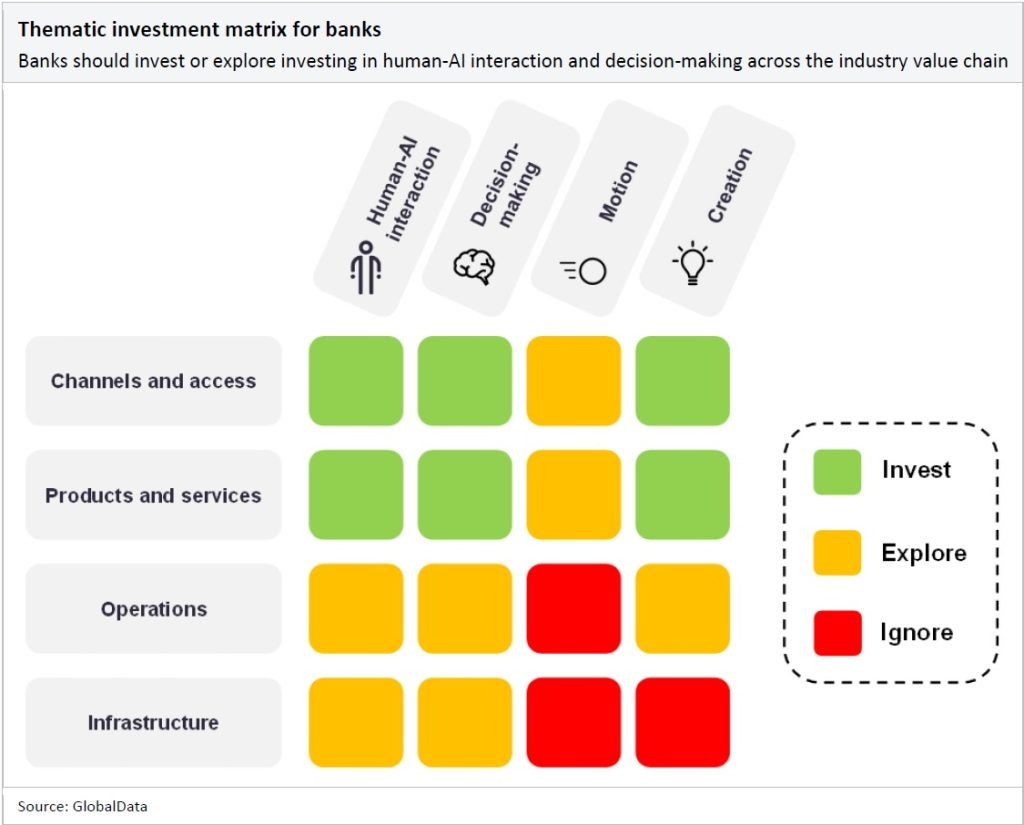

Based on a matrix of advanced AI capability categories (human-AI interaction, decision-making, motion, creation, and sentience) and the value-chain layers for banking (from infrastructure up through operations; products and services; and channels and access) and insurance (from customer service up through claims management; underwriting and risk profiling; marketing and distribution; and product development), the report recommends where banks and insurers should focus their time and resources.

AI investment for banks

GlobalData’s analysis finds that banks should invest in human-AI interaction, decision-making and creation across the channels and access and the products and services layers of the banking value chain. Specifically, within the realm of human-AI interaction, it points to conversational platforms as a necessary area of investment, with the continued shift to digital banking requiring a mix of both customer service staff and virtual assistants to provide comprehensive support.

Also on the customer side of things, the report flags computer vision as an area for investment due to its role in biometric identification and security.

In the decision-making segment, it suggests banks should invest in market trend forecasting and price prediction capabilities, and it also advises continued investment in generative AI across the channels and access and the products and services layers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOf this, the report explains: “Generative AI can play a critical role in portfolio management by providing market analysis, risk assessment, portfolio optimisation, scenario analysis and investor communication. It can assist in analysing market trends, evaluating risks, optimising portfolio allocation, simulating scenarios, communicating with investors, addressing behavioural biases and using historical data for predictive modelling.”

AI investment for insurers

While the report recommends investment more across AI capability categories for banks, it advises that for insurers investment should be more focussed across the value chain. Indeed, there are recommendations for investment across four of the five value chain levels for insurers.

“AI is becoming an increasingly important tool in underwriting and risk profiling,” the report states. “Virtual assistants and forecasting capabilities, which fall under the human-AI interaction and decision-making segments, respectively, are especially important when evaluating risk and supporting policy underwriting. These AI tools can also create more personalised insurance products.”

Notably, as for banks, the report also recommends investment in generative AI for insurers, advising that it has the potential to streamline services. It provides the example of tech company Sedgwick’s Sidekick tool, which it describes as “a generative AI-powered application that uses OpenAI’s GPT-4 technology to enhance workflow for insurance claims professionals. The application can streamline claims document processing, reducing human errors and saving time on manual tasks.”

Across financial services, the report indicates that AI can help tackle the challenges of personalisation through customer data analysis, cybersecurity through monitoring and channel shift through the provision of digital touchpoints.