Bank of America has highlighted its commitment to the physical channel with a major branch investment programme. While the bank has closed more than one-in-three of its branches since 2009, it remains committed to investing in its existing branches and opening new centres where it is unrepresented,

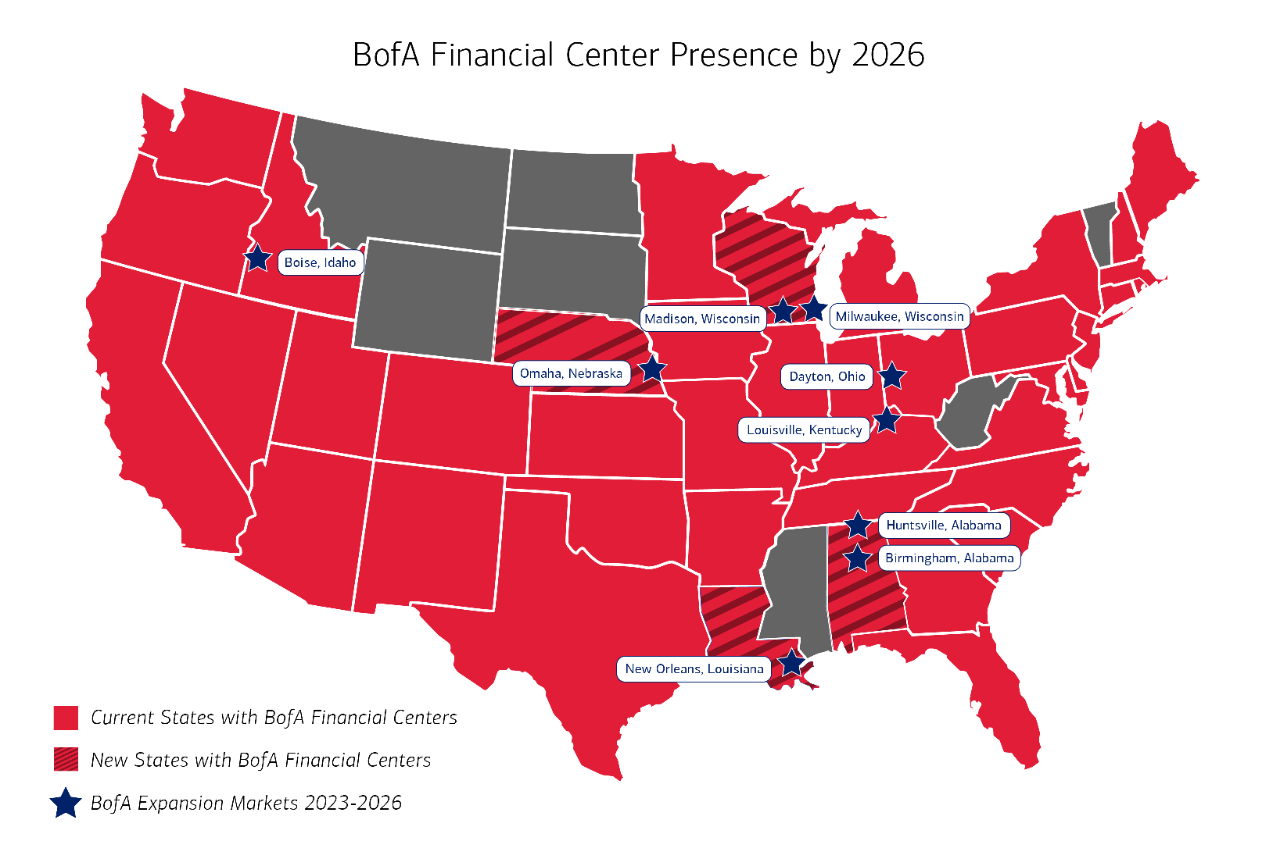

The bank will optimise its retail banking presence in well-established markets. In addition, this year it will begin a multiyear retail banking expansion across nine markets and four new states, including Nebraska, Wisconsin, Alabama and Louisiana.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Through this four-year expansion programme, Bank of America will operate financial centres in more than 200 markets across 39 states.

“As part of our high tech and high touch approach, we continue to invest in digital capabilities, and to modernise our financial centres to reach more clients and meet their evolving needs,” said Bank of America CEO Brian Moynihan.

“By expanding our capabilities in these markets, we are able to better serve clients, and help drive local community growth and development.”

Branch modernisation

By the end of 2023, the bank will complete a three-year project to renovate and modernise its financial centres. Through this effort, more than 2,500 existing centres will have been renovated. The focus is on creating offices and meeting spaces for clients to talk with financial specialists, make state of the art technology easier to access at the front of the centres and ensure clients have a consistent, modern experience inside every centre.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn addition, Bank of America is expanding its community banking centres to 700 from 600. The community centres aim to increase financial resiliency and economic mobility by connecting the community with jobs and access to core banking products, services, technology and capital, to help local communities thrive. More than 2,600 bank employees are certified to serve clients who do not speak English. For example, nearly 90% are certified in Spanish, with the remaining associates certified in at least one of 12 other languages.

Bank of America currently operates approximately 3,900 branches across the US. Nearly 30% of these branches are in LMI communities, and 44% are majority-minority communities. The branch network has declined annually since peaking at 6,238 branches in 2009 with branch closures outnumbering new centre openings.

Through its current branch network, 240 million people across more than 200 markets, or more than 76% of the US population, have access to the bank’s services. Through ongoing investments in its financial center network, since 2012 an additional 16 million people now have access to the bank’s services where previously they did not.

Bank of America branch openings: 58 new centres opened in 2022

As part of a nationwide partnership with ArtLifting, all financial centres in the new markets will feature works by artists who are living with disabilities or impacted by housing insecurity. As of 2023, the programme has expanded to feature 27 artists’ artwork displayed across nearly 1,000 financial centres.

Bank of America opened 58 new centres in 2022. It now plans to open more than 55 new locations in 2023 across 34 markets. In the previous 10 years, the bank expanded its financial centre network into nine cities. Branch openings included Colorado, Minnesota, Indiana, Pennsylvania, Utah, Ohio and Kentucky.

“Our financial center strategy is designed to serve our clients when, where and how they choose to manage their financial lives,” said Aron Levine, President of Preferred Banking at Bank of America. “Although more clients are using our digital banking capabilities, many still visit our centres for in-person conversations about some of their more complex financial needs. Our redesigned centres make it easy for them to meet with professionals for tailored solutions and advice on their life priorities and financial goals.”