Bank of America’s YouTube ad campaigns from the last six months (October 2024 to March 2025), strategically allocated resources to enhance financial literacy, digital banking experiences, and entrepreneurial growth. By leveraging educational platforms, streamlined mobile applications, and bespoke business solutions, Bank of America’s approach reflects an intent to function as a significant contributor to financial empowerment across a diverse customer base, according to Global Ads Platform of GlobalData, publishers of RBI.

Sagar Kishor, Ads Analyst at GlobalData, said: “Bank of America’s advertising demonstrates a deliberate effort to balance transactional efficiency with knowledge dissemination, showcasing efficient digital services (mobile transfers, online banking) alongside educational initiatives like “Better Money Habits.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The campaigns feature direct, functional demonstrations of these digital tools with platforms designed to increase financial literacy. This dual approach, using both practical instruction and educational content, aims for the bank to be seen as a source of immediate solutions and sustained financial growth.”

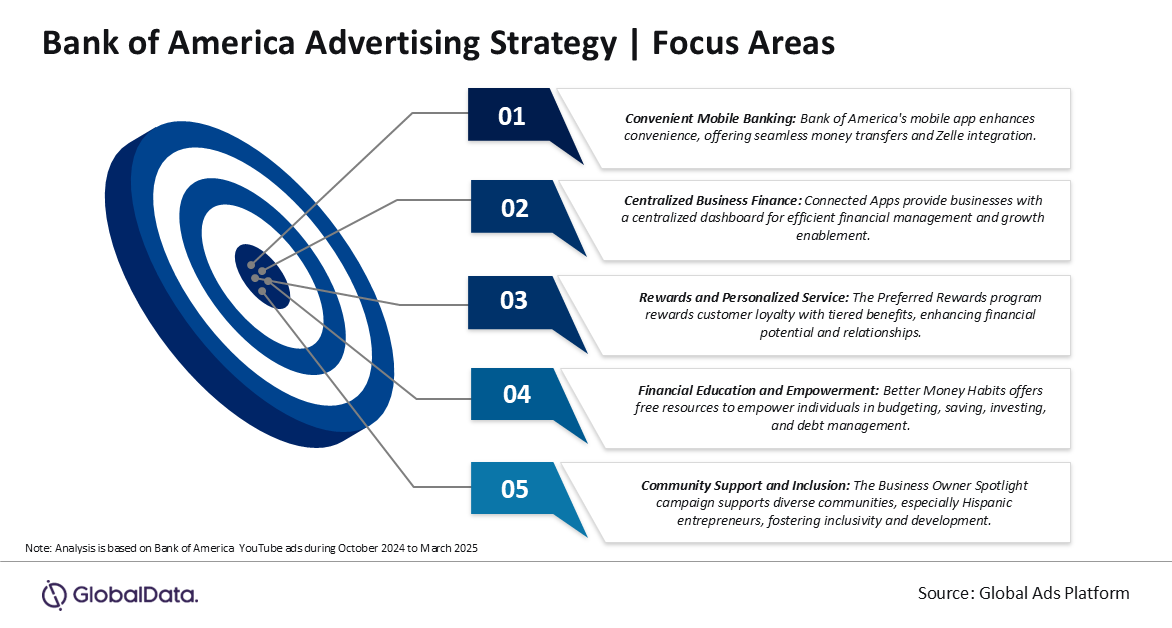

GlobalData’s Global Ads Platform reveals the key focus areas of Bank of America’s advertisements below:

Convenient mobile banking

Bank of America’s mobile banking emphasises convenience and ease of use through its app, offering features like quick money transfers between accounts and integrated services like Zelle for peer-to-peer payments. These features target existing customers, tech-savvy individuals, and busy professionals, highlighting the app’s user-friendliness, efficiency, and seamless integration for managing finances on the go and facilitating quick, free transactions with contacts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCentralised business finance

Bank of America’s Connected Apps offer a centralised online dashboard for businesses to manage finances, track key metrics, and integrate third-party services. Targeting small business owners and financial decision-makers, the ads highlight efficiency, growth enablement, and enhanced financial control through this streamlined platform.

Rewards and personalised service

The Preferred Rewards programme is showcased as a tiered benefits system for existing customers, offering enhanced rewards, relationship bonuses, and personalised service. The advertisements highlight the programme’s ability to maximise financial potential and reward customer loyalty, designed for current clients, affluent individuals, and those pursuing financial advancement.

Financial education and empowerment

Bank of America’s Better Money Habits platform is promoted as a free resource, empowering individuals to take control of their finances through knowledge and personalised guidance on budgeting, saving, investing, and managing debt. The ads highlight empowerment, support, and opportunity, aimed at those seeking to improve their economic independence.

Community support and inclusion

The ‘Business Owner Spotlight’ campaign showcases Bank of America’s backing of diverse communities, particularly Hispanic entrepreneurs. This initiative illustrates the bank’s dedication to inclusivity and community development, highlighting the bank’s provision of support for underrepresented business owners.