Banks and financial services providers were forced to adopt online and digital operations as the COVID-19 pandemic posed several challenges.

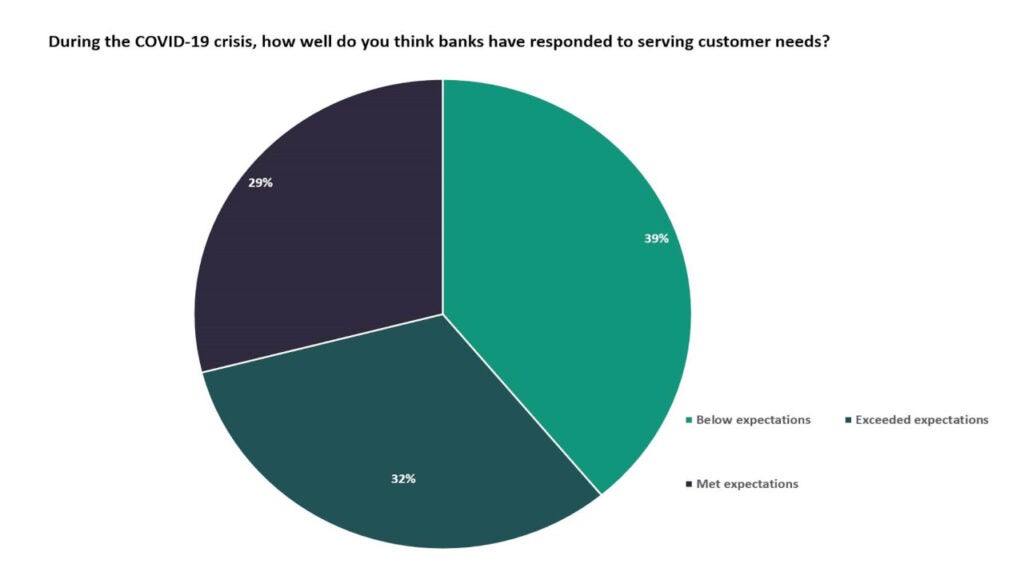

Verdict has conducted a poll to assess how well banks have responded to serving customer needs during the pandemic.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Analysis of the poll results shows that banks have failed to meet the customer expectations during the crisis, as opined by a majority 39% of the respondents.

Analysis of the poll results shows that banks have failed to meet the customer expectations during the crisis, as opined by a majority 39% of the respondents.

Further, 29% of the respondents felt that banks just managed to meet customer expectations, while 32% of the respondents opined that banks exceeded their expectations during the pandemic.

The analysis is based on 182 responses received for the poll fielded on Verdict network sites Retail Banker International, Cards International, Electronic Payments International, and Private Banker International between 31 July 2020 and 13 January 2021.

COVID-19 changed the way banks and customers interact

The financial services and banking sector grappled with multiple challenges owing to lockdown measures implemented to curb the spread of coronavirus. The sector witnessed a surge in digital banking services. Many banks, however, struggled to respond to the increased calls from various customer demographics owing to lack of resources and credit-worthiness among other factors.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBanks were forced to reassess their investments in digital infrastructure for remote working operations as well as for building safe and interactive platform for contact-less operations with fewer or no bugs. Another major challenge faced by both commercial and retail banks included debt collection, which was dealt with in the short-term by waiving fees and allowing customers to skip payments.

The industry needs to upgrade its digital offerings as well as automate its processes to address the challenges posed by the pandemic. The sector should also focus on the needs of businesses impacted most by the pandemic and help them recover through financial support, according to Accenture.