From competitive overdraft rates to travel discounts and gift vouchers, the major UK banks have a range of incentives designed to tempt school leavers to open student current accounts. But as campus-based branches become increasingly rare, the marketing battleground is increasingly fought on social media, so what are best student bank account incentives?

Students remain an attractive segment for UK banks – they all want to win school leavers’ custom. Students are seen as the high earners and most profitable customers of the future, and accordingly banks are out to snap up new accounts using an array of tempting initial offers.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Choosing a student account is one of the most important financial decisions a school leaver will make. For many students this will be the first time they open a bank account, and with so many offers advertised, deciding which bank to go with can be a gruelling process. For most students, the ability to bag as large an interest free overdraft as possible will be the main financial benefit.

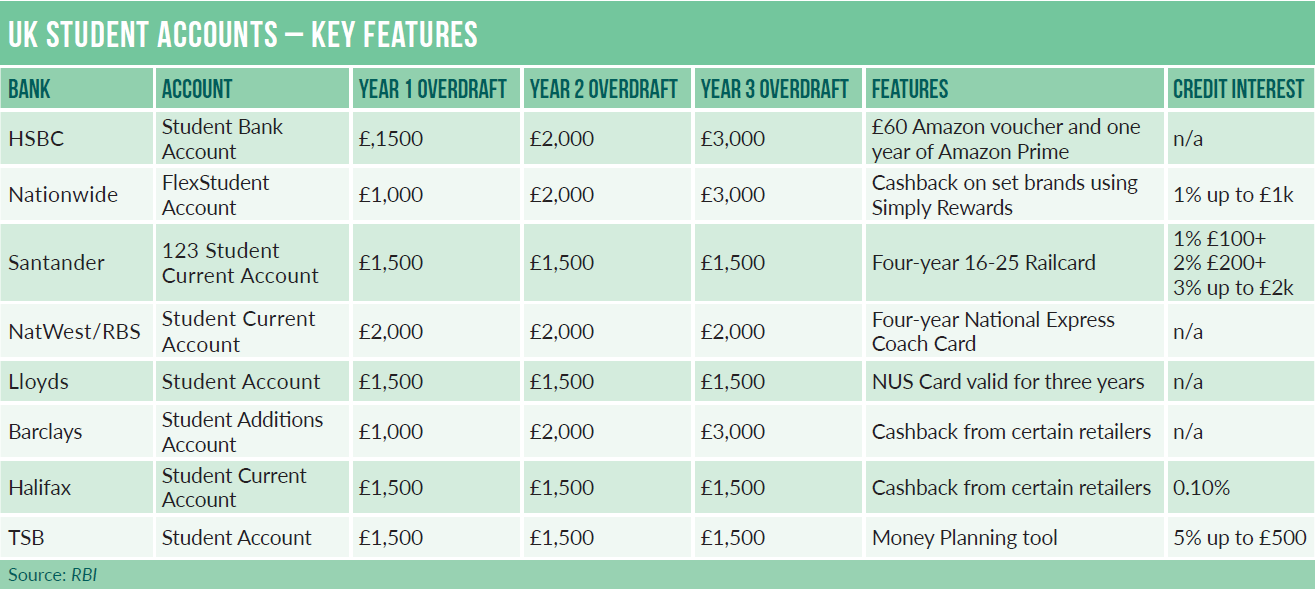

Each bank surveyed by RBI varies its overdraft limits, fees and changes to that overdraft when the account becomes a graduate account. Eventually students will have to pay back the overdraft, and if they are not careful during university there can be high costs.

Nationwide’s Flex Account has one of the larger overdraft amounts on the market. Its interest-free overdraft starts at £1,000 ($1,317) in the first year of study, rising to a maximum of £3,000. To open this account, students an initial credit of £500 and continue paying that per term to use the Flex Account overdraft.

Daniel King, Nationwide’s head of current accounts, tells RBI: “For most students, it will be the first time they manage finances themselves, and we want to make a safe environment for them to establish that.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAlthough it remains interest-free once a student has completed their studies, it switches over to a graduate account with some changes to the overdraft and repayment scheme. Assuming at the end of the course a student has the maximum overdraft of £3,000, in the first year after graduation, Nationwide will lower the overdraft limit by £500 to £2,500, then £750 in the second year and a further £750 in the third year after graduating. King says Nationwide does this gradually to give “graduating students a soft landing into the adult environment” and that it “modelled the account carefully, researching the likelihood of graduate employment, the likely amount of their first salary” to support each individual to the best of their ability.

Bank student overdrafts compared

HSBC also offers a competitive overdraft with £500-1,000 in the first year with no overdraft fee. This amount again increases per year to £2,000 in year two and £3,000 in year three. However HSBC does not guarantee the maximum amount; the amount a student receives will be judged on their credit score account activity. HSBC also accepts level 4+ Apprentices to the student account with the same benefits.

Nathan Donald, senior product manager at HSBC, stresses the importance of student customers, both new and existing. He tells RBI: “They are absolutely key to our future customer growth and part of our retail banking strategy now, seeing both the internal support and external traction, and coverage to improve off the back of that.

“With new customers we’ve tended to focus on UK domestic students. Every year HSBC usually has a campaign, and in the last two years the focus has been more on social media and digital because the insight we have tells us they are the channels students interact with the most.”

NatWest offers a slightly lower overdraft to students. In the first term of their course, students can receive up to £500 interest-free, potentially rising to £2,000 for the remainder of the degree. However, as with HSBC the amount given will depend on the individuals’ credit score. To use the overdraft year on year, students must pay in £750 per term.

Lloyds and Santander both have the same overdraft amounts offered as part of their student accounts. The two banks offer up to £1,500 from year one to year three, and if students continue their studies they can apply for an increase depending on their credit score; if the credit score is healthy then Santander can offer up to £1,500.

Lloyds Bank student overdraft

Lloyds’ overdraft scheme differs marginally during the first year. For the first six months, students have access to an overdraft of £500 from the point of opening the account, which can increase gradually to £1,500 if all the bank’s various current account requirements are met.

Lloyds is making some changes to its overdraft and fee systems. From 2 November 2017, there will be daily overdraft fees if students exceed the agreed fee-free limit. For every £7 spent over the arranged overdraft amount, Lloyds will charge £0.01 the same day. The bank believes the new change will be more manageable than implementing monthly bulk charges, and help students keep track of how much they are spending on their overdraft.

Travel discounts

One of most practical and money-saving incentives offered is the 16-25 Railcard provided by Santander, that will last four years. Whether students are travelling across the country or taking a quick visit home, they can enjoy a third off all standard anytime, off-peak and first class advanced tickets. A 16-25 Railcard costs £30 a year, so in total this giveaway is worth £120.

NatWest has a similar travel discount: a four-year National Express coach card. Normally a coach card costs £27 for three years or £10 a year. The card gives students a third off standard adult coach fares across the UK. It also includes 10% off travel fares to certain events and festivals in the UK, and 10% off coach fares across Europe when booking through Eurolines. To receive the coach card, students must sign up to NatWest’s online banking services.

Santander offers access to 1-2-3 World offers, including special deals on other Santander products, but in terms of incentives, NatWest and Santander’s most enticing features are the travel cards with long-lasting benefits.

Best student bank account incentives

Travel discounts are not the only products on offer for students. There is an abundance of instant freebies that are advertised to students that will be available to them upon opening a student account.

HSBC offers students and level 4+ apprentices beginning their first year of study a £60 Amazon voucher, plus a one-year Amazon Prime membership, provided applications to the student account are submitted before the end of October 2017. The incentive also offers students free one-day delivery on certain items, as well as discounts on TV streaming.

Lloyds will provide students with a free NUS card that is valid for three years and offers over 200 student discounts on the high street, including 25% off ticket prices at Odeon cinemas, up to 10% off at Apple, 40% off at Pizza Express, 20% off National Express and 10% discount at the Co-op. The NUS card normally costs £12 per year, so students save a total of £36 for access to numerous discounts if they choose to bank with Lloyds.

Nationwide’s guarantee that, as long as a student does not have any credit problems, they will be offered the maximum overdraft is its most eye-catching feature, but added freebies are also available on the account. Using debit or credit cards, students can receive cashback on certain brands using the Simply Rewards programme.

Bank account incentives for international students

International students applying for an account come under different schemes depending on which bank they decide to go with.

NatWest will allow international students to apply for its Student Account, with one key difference being that they cannot apply for the overdraft normally offered. They can access other benefits, however, such as the free National Express Young Persons Coach card.

Both HSBC and Nationwide offer current accounts to international students, allowing purchases made outside the UK, and online or mobile banking. They will not offer an overdraft, however.

HSBC’s Nathan Donald states: “With international students we have a slightly different approach. They can have a standard basic account that gives the access to saving products. For those who do want to stay in the UK we don’t give them lending straight away, but allow them a period of time to start building a credit footprint in the country and then move them to a standard current account where they can have access to lending if they so choose.”

Gone are the days when the major UK banks operated campus-based branches: The marketing focus is increasingly online, especially via social media channels.

What has not changed, however, is the banks’ belief that the right combination of student-friendly products and services can grab customers who will prove to be profitable for many years to come.