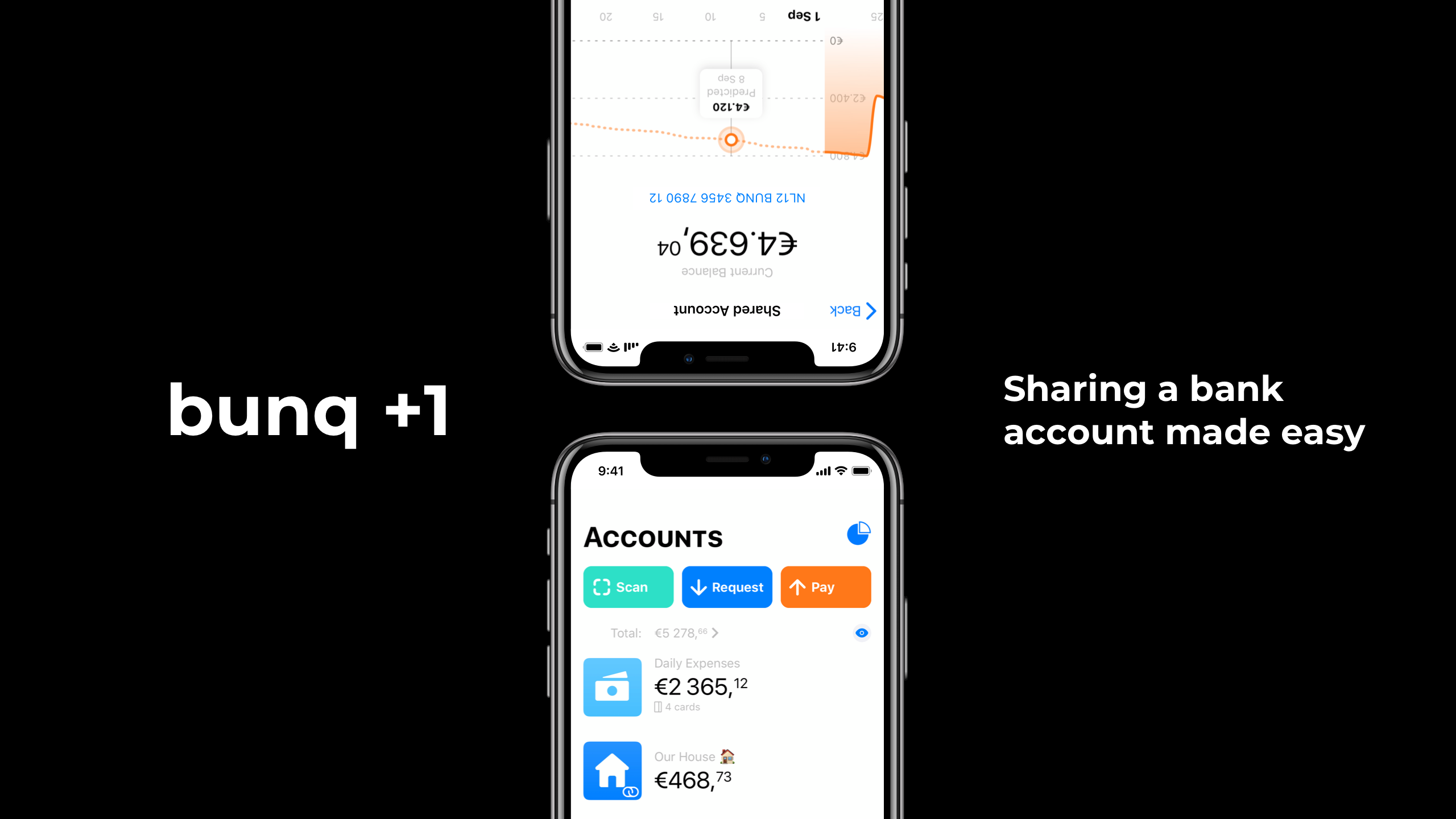

Dutch challenger bank bunq has launched bunq+1 joint accounts, enabling premium and business users to share accounts.

Users can create a bunq+1 account for anyone they wish, including partners and children. In addition, businesses are able to create bank accounts for employees, helping to track expenses.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Ali Niknam, bunq CEO and founder, said: “At we are inspired by our users to create new features that makes life easier. By listening to their feedback we have developed this elegant solution that makes shared finances easy for children, (co-)workers and partners all in one go.”

Through bunq+1, customers can deposit money, and make and view transactions. They will also receive their own card.

Furthermore, parents can create a bank account for their child. The child is then equipped with their own card, however, their parents have the ability to keep a view of their spending in real-time.

bunq+1 will also provide assistance to children and help them learn how to handle money.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEntering the UK market

Last October, the Dutch challenger expanded its footprint by launching its services in the UK. The move followed launches in Germany, Austria, Italy, Spain, France, Ireland and Belgium.

bunq offers customers in the UK several services. bunq Premium is a mobile experience with up to 25 fully functional Euro bank accounts as well as Maestro and Mastercard debit and credit cards. Users choose where their funds are stored and how they are used.

Consumers can also utilise a bunq Travel Card, which calculates the true exchange rate on purchases in foreign currencies.

Speaking to RBI in October, Niknam said: “The UK has always been on our wish list to launch. In fact, it would have been the first country we launched in if it hadn’t been for Brexit. I actually was physically in the UK on the night the vote took place; I was preparing the launch there. Then, for me, the unexpected outcome came into existence and then I went home the next day.

“I’m really happy that we have finally been able to soft launch our product in the UK.”