Retail central bank digital currency (CBDC) development projects continue to face significant hurdles before achieving large-scale implementation. Key challenges include ensuring system interoperability with existing payment methods and currencies worldwide, addressing privacy concerns in advanced economies, and overcoming infrastructure limitations in emerging economies, according to GlobalData, publishers of RBI.

GlobalData’s latest report, “The State of Central Bank Digital Currencies in 2025 and Beyond,” highlights that retail CBDCs fail to address real consumer needs or pain points meaningfully. Furthermore, they offer no clear tangible benefits that would drive user adoption.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Lack of compelling incentives for consumers to switch payment methods

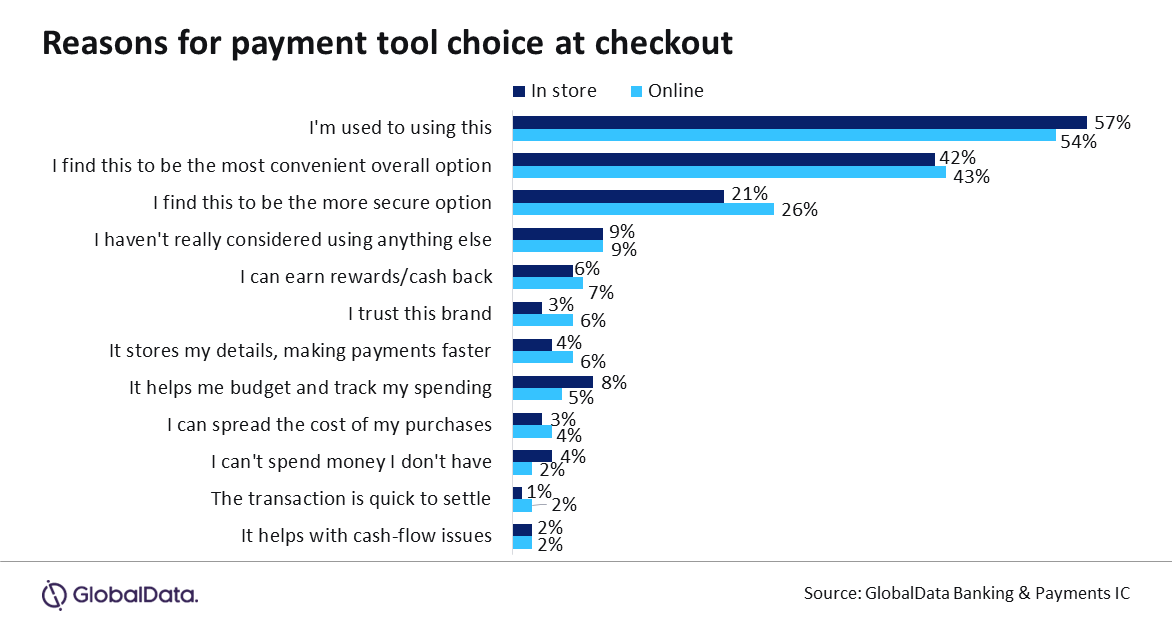

Blandina Szalay, Banking and Payments Analyst at GlobalData, said: “The very limited uptake of CBDC in countries where it fully launched – in the Bahamas, Jamaica, the Eastern Caribbean Currency Union, and Nigeria – can be attributed to the lack of compelling incentives for consumers to switch to CBDCs from the payment methods they are already used to.”

With habit and convenience being the dominant factors influencing payment tool choices globally for both in-person and online payments, central banks will require either robust incentive schemes or mandates to achieve a widespread adoption of their digital currencies. In countries already operating CBDCs, consumers have expressed that using CBDCs and their associated wallets has introduced additional friction to existing payment processes without offering sufficient benefits. Critics from other CBDC-piloting countries echo these sentiments.

Szalay added: “Achieving critical mass in CBDC adoption, however, will be necessary to reap any advantages initially proposed by central banks. These could include driving domestic payment system innovation, improving cross-border payment efficiencies, fostering financial inclusion, and newfound financial and monetary stability in emerging economies by formalising their economies via CBDC.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBank of England launches digital pound lab

Most recently, the Bank of England (BoE) unveiled its digital pound lab, a testing sandbox aimed at addressing key challenges such as interoperability, or absence of clear use cases and lack of viable business models. These issues are set to be tackled throughout 2025, before the decision on a wider launch is made.

Szalay concluded: “As national governments keep allocating resources towards their ongoing CBDC projects, they should also consider the level of their citizens’ openness and willingness to use the central bank’s digital currency in their everyday lives. Should incentives prove insufficient, and governments have to turn to mandates, it will only reinforce critics’ concerns that CBDCs are a tool for asserting domestic and international control.”