Inflation remains a challenge for most consumers and less than half of bank customers are currently categorised as financially healthy. So, personalised financial advice has emerged as the key to a meaningful bank customer experience.

This fact is underscored by the JD Power 2024 US Retail Banking Advice Satisfaction Study. The report reveals that financial advice resonates more than ever with retail bank customers. But only 42% of them indicate recalling that their bank provides guidance. Of those who do receive guidance, more than three-quarters (76%) act on it.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Customers who act on the financial advice and guidance provided by their bank are getting not only help on how to save time or money. But also, these services result in increased satisfaction and strong engagement and brand advocacy,” said Jennifer White, senior director for banking and payments intelligence at JD Power.

“As banks get increasingly savvy about how to personalise content by leveraging AI and training their staffs on how best to connect with customers, both recall and usage of financial advice is increasing, which is a very positive step forward for the industry.”

JD Power 2024 US Retail Banking Advice Satisfaction Study – key takeaways

- Recall of financial advice among younger customers far exceeds the industry average: Overall, 42% of retail bank customers recall receiving financial advice from their bank. Among customers under the age of 40, the average recall rate for financial advice jumps to 60%.

- Majority of bank customers act on advice: A vast majority (76%) of customers who receive financial advice take action. Most frequent actions taken in response to advice include updating account settings (25%), shifting money between accounts (22%) and downloading the bank’s mobile app (22%).

- Big bump in satisfaction when customers take action: Overall satisfaction with retail banking advice increases 163 points (on a 1,000-point scale) when customers act based on specific advice provided by their bank.

- Many banks still miss the mark on consistent personalisation: One key variable with a significant effect on satisfaction is “received personalised banking advice/guidance.” When this criterion is met, overall satisfaction increases 195 points and banks are moderately successful at achieving this goal with 63% receiving personalised content.

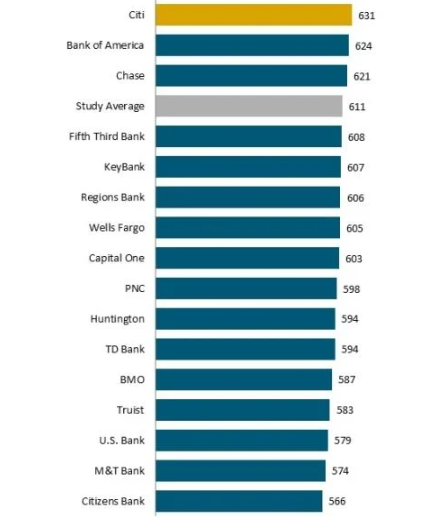

Study Ranking

Citi ranks highest in customer satisfaction with retail banking advice with a score of 631. Bank of America (624) ranks second and Chase (621) ranks third.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData