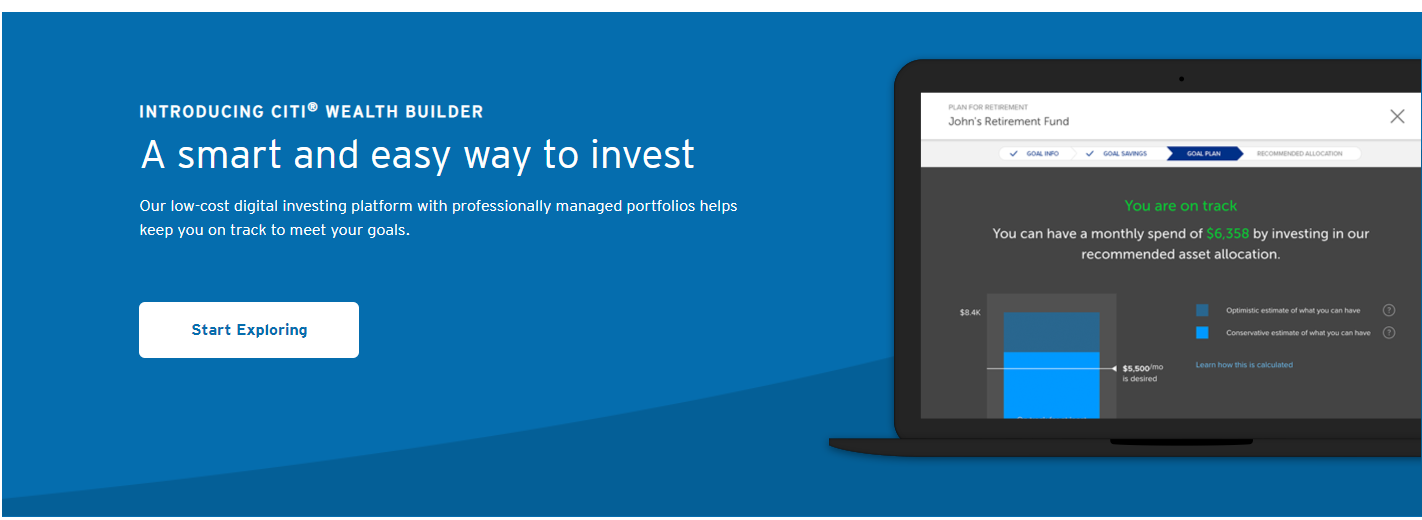

Citi is rolling out Citi Wealth Builder a cut price digital investment platform incorporating professionally managed portfolios.

Moreover, Citi Wealth Builder clients can open an account with an initial investment of only $1,500.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Furthermore, Citi Wealth Builder levies no advisory fees for Citi Priority and Citigold clients. Additional accounts apply an advisory fee of 0.55%.

Citi Wealth Builder matches customers to one of six portfolios based on their risk profile. In particular, Citi assess customer responses to questions ranging from their level of comfort with market volatility to their retirement goals and how much they’ve saved to date. Customers can adjust their investment levels with a real-time view of how those changes may affect their goals.

Once the account is opened, Citi Wealth Builder monitors and automatically re-balances diversified ETF portfolios managed by investment experts. Customers may follow their accounts online or in the Citi Mobile App, with live support available 24/7.

Citi Wealth Builder: powered by Jemstep

Citi Wealth Builder follows on from a number of Citi enhanced client initiatives. For example Citi launched commission-free trading for ETFs and new-issue U.S. Treasury purchases for Citigold clients. Similarly, Citi has launched Citi Wealth Advisor. This provides Citigold clients with a dedicated relationship team to create personalised financial road-maps designed to grow their wealth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Citi Wealth Builder makes it easy for clients to start investing so they can reach the next level of their financial journey,” says John Cummings, Head of Citi US Consumer Wealth Management. “It’s part of Citi’s holistic approach to banking and wealth management. In just a few minutes, customers can start building a solid foundation for years to come.”

Simon Roy, President, CEO Jemstep adds: “Jemstep is proud to partner with Citi to provide personalised, goal-based wealth advice. We have worked closely with Citi to configure the Jemstep digital advice platform. This provides a compelling client experience supporting Citi’s unique value proposition, omni-channel delivery capabilities and robust operational and compliance requirements.”