Covid is making the majority of Canadians more comfortable conducting financial transactions online. But while Covid is accelerating the move to virtual sales, the branch is far from dead. Moreover, most consumers still want human interaction for certain transactions.

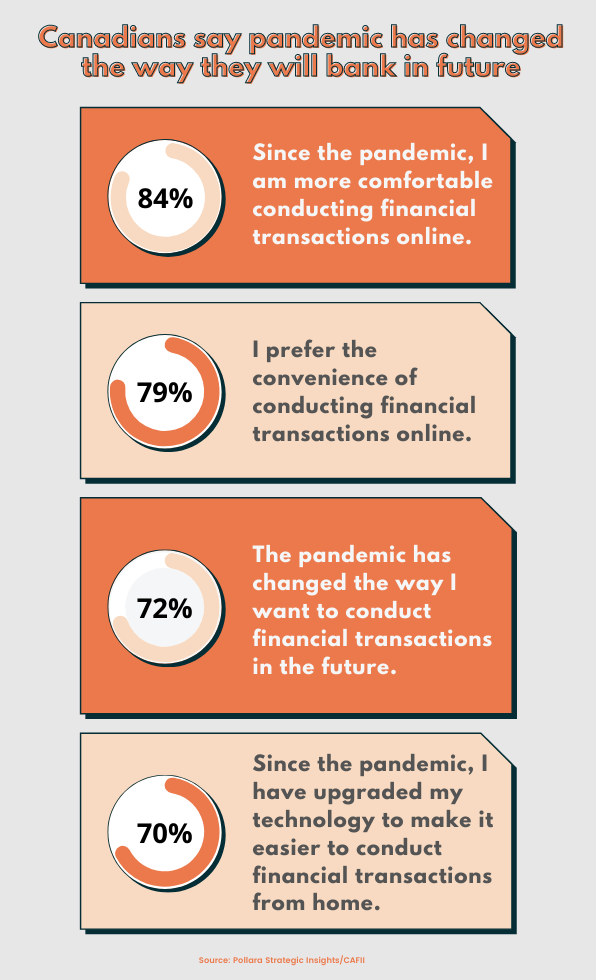

Specifically, 84% of Canadian consumers with Credit Protection Insurance say Covid has made them more comfortable conducting financial transactions online.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Moreover, 72% say it has changed the way they want to conduct these transactions in future. And 70% say they have upgraded their technology to make it easier to conduct financial transactions from home.

Pre-Covid, Canadians were most likely to arrange a loan or buy insurance in person at a branch. Some 48% of people surveyed with Credit Protection Insurance (CPI) say that’s where they did these transactions.

Once the pandemic is over, only 36% of respondents say they will return to a branch for these types of transactions. In other words, a 12-percentage point decline since 2018.

Trend towards virtual sales accelerates

It is also evidence that the trend towards virtual sales and service channels continues to build momentum with Canadians.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThose are some of key findings of a new Pollara Strategic Insights survey. The survey commissioned by the Canadian Association of Financial Institutions in Insurance (CAFII).

CPI is used to pay off or pay down a mortgage or HELOC. It makes debt payments in the event of covered occurrences such as death, disability, critical illness, or job loss.

Consumers still value branches and human interaction

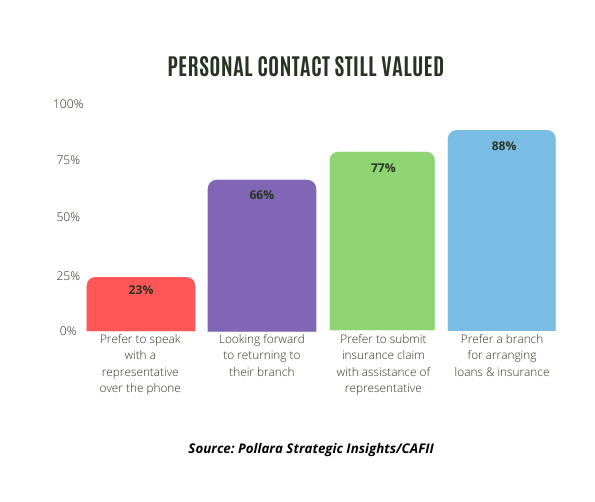

Consumers still put a high value on branches. Some 66% of respondents say they are looking forward to going back to theirs at some point in the future. Canadians also want the opportunity to deal with financial representatives. 88% of respondents say they would prefer this method especially for arranging loans and insurance.

At the same time, nearly half of respondents (47%) say they would prefer another channel to speak with a representative. Examples include by phone (23%), have a person visit their home (13%), or speak with someone by video conferencing (11%).

The same sentiment applies to making an insurance claim. 77% of respondents say they would prefer to submit a claim on their CPI with the assistance of a representative. This compares to 22% who would choose self-service as their preferred option. However, of those 77% who prefer human contact to make a claim, only 33% say they prefer it to be at a branch as opposed to other channels such as phone, home visit, video conferencing or email.

Financial institutions need to make online easier to use

Respondents also say it is important for financial institutions to make consumers comfortable with online transactions. Those include:

- make it easy for customers to connect with a person to get answers to their questions in real time (93%);

- ensure plain language information is available online (92%);

- ensure security and protection of personal information (92%);

- provide immediate online confirmation of the transaction (91%);

- provide online tools and diagrams to illustrate product and price information (89%);

- have all personal information shared only through a secure online portal (89%);

- and provide customers the ability to deal with one representative throughout the process (88%).

Covid accelerates Canadian digital drive-highlights importance of insurance

Covid not merely accelerates the Canadian digital drive. It is also raising the prominence of insurance as an option for Canadians. Some 65% say they are more likely to obtain CPI for a mortgage or HELOC than before the pandemic. Life is the most popular type of insurance for mortgages and HELOCs. 77% of respondents say they had purchased it during the pandemic for a mortgage and 71% for a HELOC. This is down slightly from 2018. However, the percentage of consumers covered for disability, critical illness and job loss are all up versus 2018. Two-fifths have taken the latter option this year, an increase of 17% since 2018.

In terms of CPI customer satisfaction, 96% of respondents say they are somewhat/very satisfied. This represents a nine-point increase over 2018. Similarly, respondents report an increased level of confidence in and knowledge of their CPI coverage.

Consumers are adapting well: Keith Martin, CAFII

“The pandemic has and will continue to change the way that people conduct financial transactions in Canada. We are pleased to see consumers are adapting well to their new reality. And our industry’s customer satisfaction levels have been up to the challenge,” says Keith Martin, Co-Executive Director of the Canadian Association of Financial Institutions in Insurance (CAFII).

The Canadian Association of Financial Institutions in Insurance is a not-for-profit industry Association. It is dedicated to the development of an open and flexible insurance marketplace. CAFII believes that consumers are best served when they have meaningful choice in the purchase of insurance products and services. CAFII’s 14 members include the insurance arms of Canada’s major financial institutions. These include BMO Insurance; CIBC Insurance; Desjardins Insurance; National Bank Insurance; RBC Insurance; ScotiaLife Financial; and TD Life Insurance.