While banks generally don’t expect the economy to pull out of its slump anytime soon, Bank of America executives already see a light at the end of the covid-19 tunnel.

On a call with analysts, Bank of America Chief Executive Officer Brian Moynihan said the bank could now see hopeful signs of a rebound among its customers:

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“As states began to reopen in the past couple months, we saw an improvement in spending levels as customers became more active buying fuel and spending on home projects and eating out.”

Indeed, a recovery is in the offing, says Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank:

“We’re in the latter stages of the bottoming-out process—signs 4 and 5 are the ones we still need to see improvement on.”

The 5 signs Bank of America is watching

Before markets can recover from the massive downturn created by the coronavirus, they need to “find a bottom,” Hyzy says.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThat process is already well underway, he adds, with significant progress being made on three of five fronts. “We’re in the latter stages of the bottoming-out process—signs 4 and 5 are the ones we still need to see improvement on.”

Below, Hyzy offers a progress report on the signs the CIO is watching that may indicate the markets may be reaching their bottom and could turn the corner towards recovery.

Sign #1: Capital flows more freely

Amid a wave of panic selling by investors in March, the Federal Reserve (Fed) promised to buy unlimited amounts of government debt and lend money to local governments and businesses to help keep capital markets from drying up.

Such policies appear to be working, Hyzy says. “Capital is flowing more freely, and fixed income markets are acting in a more stable manner, even as we speak.”

✔ Status: Underway

Sign #2: Stock-bond relationship normalises

In normal market conditions, bond prices tend to rise as stock prices fall, and vice versa, so having both in a portfolio helps mitigate risk.

In March, bonds and stocks dropped in tandem as investors sold them in search of cash.

With stimulus helping to stabilise bond markets, the inverse relationship between stocks and bonds is returning—a key sign of market stability, Hyzy says.

✔ Status: Underway

Sign #3: Volatility eases

“Market volatility went above 80 in mid-March, the highest on record,” Hyzy says—as measured by the Chicago Board Options Exchange (CBOE) Volatility Index (VIX).

The March 16 closing of 82.69 was higher even than the 80.86 level in November 2008, at the onset of the financial crisis.1 “Currently, the VIX has fallen below 50,” Hyzy notes.

“More importantly, it has fallen on days when markets are down.”

✔ Status: Underway

Sign #4: U.S. dollar weakens

Amid a global scramble for less risky currencies, the dollar has shot up in value during the current virus crisis.

“This can hurt the economies and finances of emerging market countries, given their high exposure to U.S. debt, and delay the eventual recovery overseas,” Hyzy says.

“Though there are signs the dollar may be cresting, we need to see some consistent weakening.”

✔ Status: Needs improvement

Sign #5: Bad news is taken in stride

One crucial sign of stability is when markets have already factored in the effects of the coronavirus on the economy and can absorb daily developments without panicking, Hyzy believes.

“We’ve seen this sporadically, but it needs to be more consistent.”

✔ Status: Needs improvement

“No rosy path ahead,” warns Michael Corbat, Citigroup’s CEO

Bank of America’s optimistic take on the economic prospect is hardly the norm among major US banks.

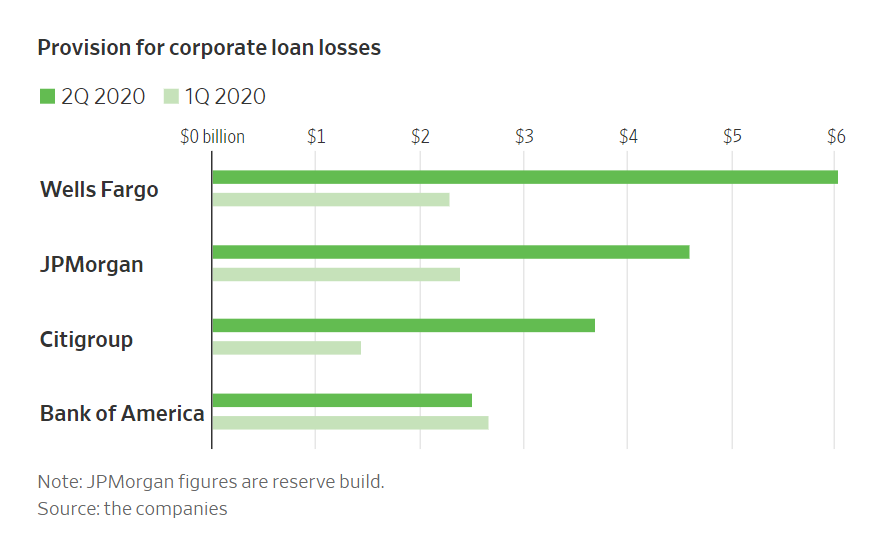

In their earnings reports last week, JPMorgan Chase, Citigroup, and Wells Fargo indicated that they expect the current recession to be worse than they had initially anticipated.

To be sure, even Bank of America expects deep unemployment and a years-long rebound from the current period of contraction. The bank said it processed some 1.8m payment deferrals on consumer debt so far this year, mostly in its credit-card accounts.

Bank of America—whose second-quarter profit fell 52%—has set aside $5.12bn in the second quarter to cover losses on its consumer and commercial loans.

JPMorgan, Citigroup and Wells Fargo set aside between $7.9bn and $10.47bn each.

In the current situation, says Michael Corbat, Citigroup’s CEO, nobody should feel “like the worst is absolutely behind us and that it’s a rosy path ahead.”