The impact of the COVID-19 pandemic on the financial services sector has been mixed but the future remains uncertain due to the after-affects.

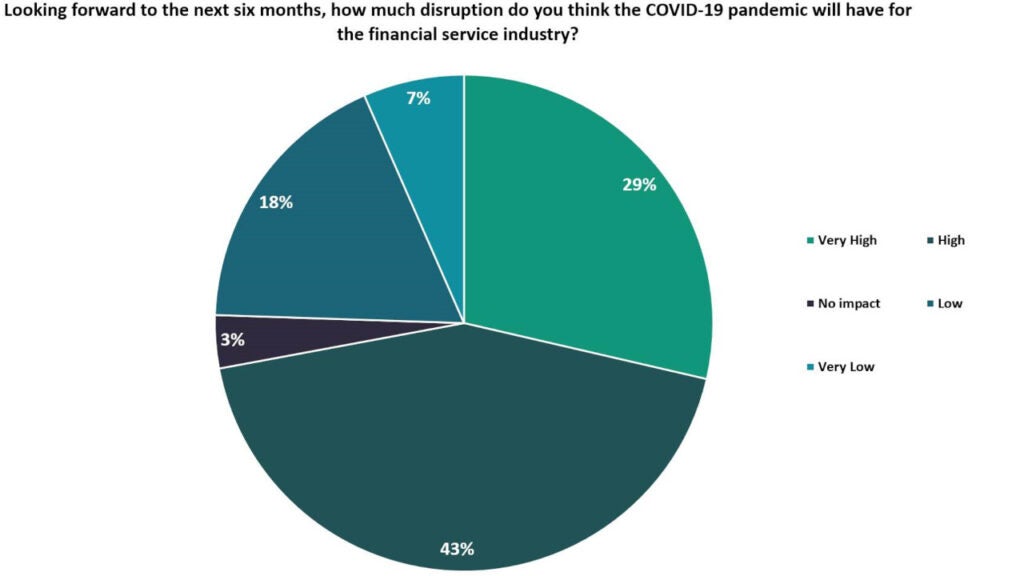

Verdict has conducted a poll to assess the extent of disruption that COVID-19 will have on the financial services industry in the next six months.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The financial services industry is expected to be highly disrupted in the next six months as opined by a majority 72% of the respondents. While 43% of the respondents foresee a high disruption, 29% opined that the impact would be very high.

The financial services industry is expected to be highly disrupted in the next six months as opined by a majority 72% of the respondents. While 43% of the respondents foresee a high disruption, 29% opined that the impact would be very high.

Further, 18% of the respondents voted that the impact of the pandemic would be low, followed by 7% who opined that the impact would be very low on the financial services industry.

Comparatively, just 3% of the respondents opined that the pandemic would have no impact on the Industry in coming six months.

The analysis is based on 290 responses received from the readers of Verdict network sites Retail Banker International, Cards International, Electronic Payments International, and Private Banker International to a poll fielded between 03 August 2020 and 13 January 2021.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe future of the financial services industry

The switch for financial services industry towards remote operations and the challenge to re-organise their business model was not easy amid the pandemic. The industry had to adopt digitisation, virtualisation of the workforce, and improve safety and surveillance apart from other structural changes.

The industry was further affected by macro trends, which primarily comprised low interest rates, asset impairments, surge in non-bank alternatives, rise in unilateralism, near-shoring, and diversification of offshore locations.

A major impact is expected to come from second-order effects such as deteriorating credit quality of customers and low interest rate environment, which are expected to be felt for the next several years, according to PricewaterhouseCoopers.