Digital banking provider Meniga has closed a €8.5m ($9.4m) investment led by Groupe BPCE, Grupo Crédito Agricola and UnCredit.

Meniga plans to use the funding for continued investment in its R&D activities, as well as for strengthening the sale & service teams. Other participants in the round included current instiutional investors Velocity Capital, Industrifonden and FrumtakVentures.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Georg Ludviksson, Meniga CEO and Co-founder, said: “We are very pleased to welcome Groupe BPCE and Crédito Agrícola to our growing group of strategic investors. Partnering closely with our customers is a key part of our strategy to be the preferred digital innovation partner to our clients.

An equity relationship is an excellent way to strengthen such partnerships.We appreciate the continued vote of confidence and growing business we have with our impressive global client base.”

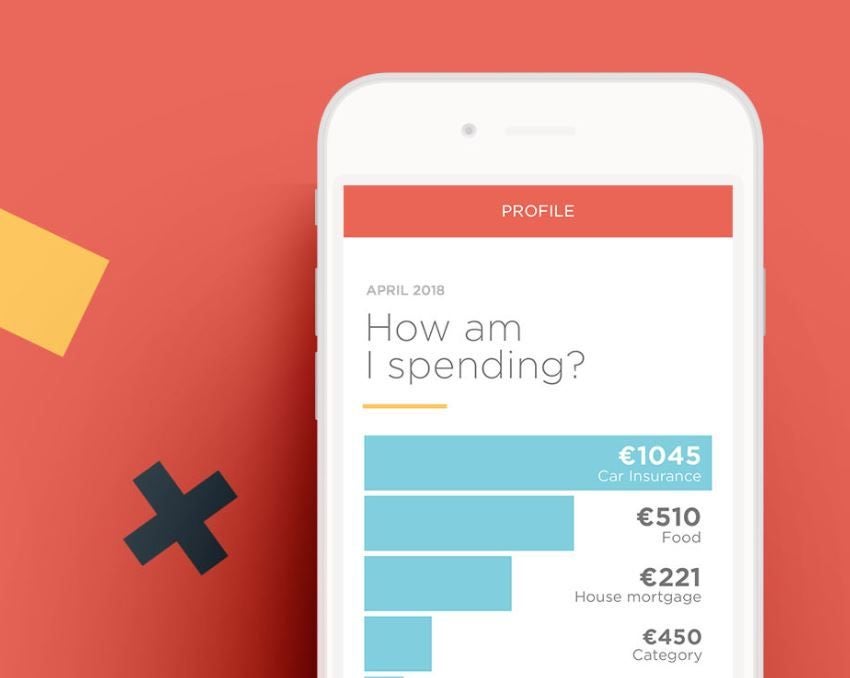

Meniga, founded in 2009, aims to help banks and fintechs use personal finance data to innovate online and mobile channels. Its product offering includes, data aggregation, personal and business finance management, cashback rewards and transaction-based carbon insights.

Previous partnerships

Groupe BPCE first partnered with the fintech in 2018 and is now joining the group of strategic investors.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataYves Tyrode, Chief Digital & Data Officer at Groupe BPCE, said: “Our partnership with Meniga has been extremely positive to date. Together, we have laid the groundwork for continued digital innovation at Groupe BPCE to better serve our customers. We look forward to continue transforming our digital customer experience and contribute to building the future of digital banking together with Meniga.”

In addition, Crédito Agrícola recently launched its new banking app moey! powered by Meniga.

Licinio Pina, CEO of Crédito Agrícola, said: “Meniga played an instrumental role in the creation of moey! and we are excited to continue the journey of embracing Open Banking together with Meniga. We are very pleased to join the esteemed group of strategic investors in the company.”

Back in February, Meniga secured its FCA licence and is now registered as an Account Information Service Provider (AISP).

As a result, Meniga now plans to expand its UK product offering beyond financial services.