Women in finance, gender equality, and how it is being encouraged within the industry has caused much-heated debates across the sector.

It’s very clear that there are not enough women in finance, but what is actually being done to change that? It’s a massive problem and one that history will not look kindly on.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The ‘alpha male’ culture still dominates the financial industry. It’s important to note that it isn’t just traditional banks that are guilty of this; the problem has spread to the more modern digital banks, tech companies and fintechs.

Gender equality banking

In June 2018, the Treasury Committee, led by Conservative MP Nicky Morgan, released a report calling for the need for reforms to entice more women to get involved in banking.

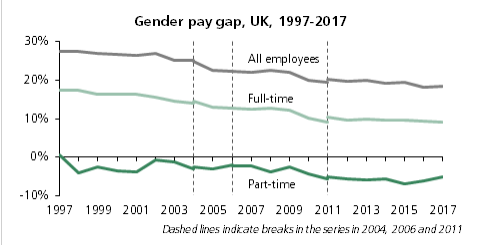

The gender pay gap report revealed that men are employed on an hourly rate averaging 35% more than what women had been receiving. When it came to bonuses, it was appallingly worse with men averaging 52% more.

So what can the government do to improve the opportunities for women in finance? Well, the report stated that it’s all about shaking up the culture. A lot of women have stated that the culture of the financial sector is what puts them off getting involved.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFirstly, the report calls for finance firms across the UK to publish strategies for putting an end to the gender pay gap. Secondly, all firms need to look closely at the recruitment and promotion policies to get rid of any bias within the system.

Source: Treasury Committee UK Parliament

Whether banks and financial institutions take this up with committed transparency is yet to be seen.

Anne Boden: Leading by example

Anne Boden is the founder and CEO of Starling Bank, a digital-only bank that has been a driving force of change in the banking industry.

Boden has an impressive and extensive financial background. However, in the thirty years that Boden has been in banking, she has faced considerable bias. Gender equality and banking do not necessarily go hand-in-hand.

Speaking to RBI about how to get more women in finance, Boden noted:

“We need to talk about it. It needs to be written about – that women are not being promoted through the organisations. The important thing to tackle is that the standards women are held to are higher than the standards men are held to. Women have to be perfect, and very often women are called too soft or too hard.

“I think it’s a question of being resilient. Be prepared to work hard and realise that it will be harder for you as a woman, but that shouldn’t put you off. Women will get there in the end.”

Boden believes that the financial crisis was caused because the people within the system were thinking the same.

However, finance is not just about making money, it’s about innovating and creating. For that, you need all types of brilliant people contributing different ideas. A much greater push is needed to get more women in finance, or the industry faces the possibility of history repeating itself.