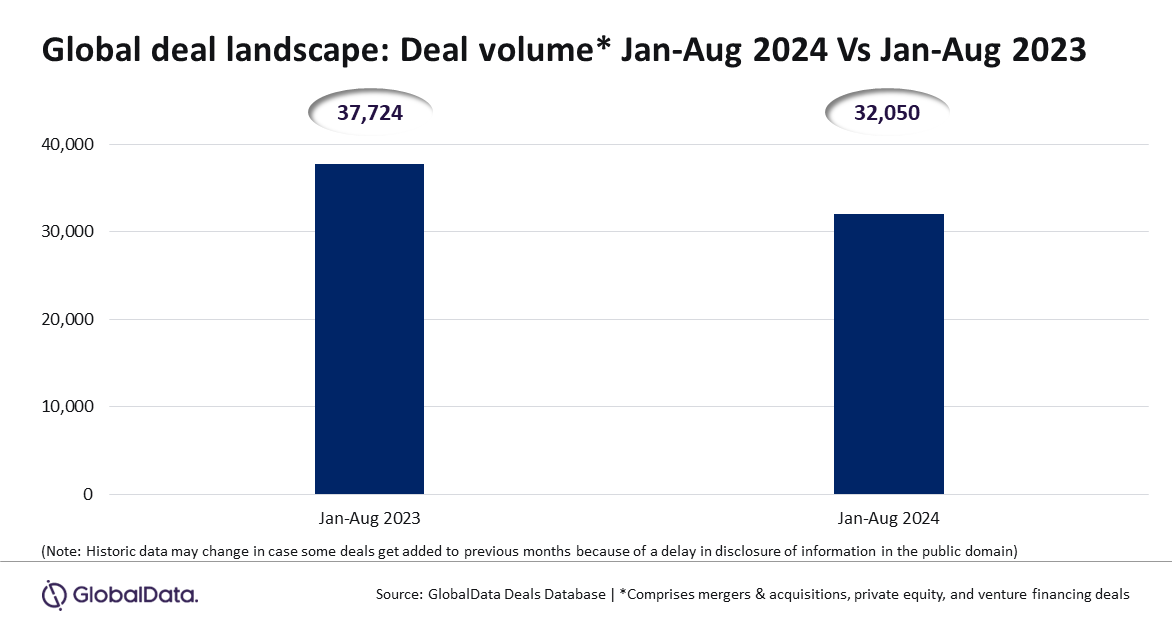

A total of 32,050 deals (mergers & acquisitions (M&A), private equity and venture financing) were announced globally during January-August 2024. This represents a 15% year-on-year (y-o-y) decline in deal volume compared to the 37,724 deals announced during the first eight months of 2023, according to GlobalData, publishers of RBI.

GlobalData Deals Database

An analysis of GlobalData’s Deals Database revealed that all the deal types under coverage witnessed decline in volume during January-August 2024 compared to January-August 2023.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

M&A deals volume registered a YoY decline of 9.5% during January-August 2024 while the number of private equity deals and venture financing deals y-o-y fell by 13.4% and 23.9%, respectively.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “Amidst the challenging market conditions, deal activity across all the regions as well as most of the markets within these regions has taken a hit. Factors such as macroeconomic challenges and geopolitical issues are likely influencing the deal-making activity. It will be important for deal makers to navigate this complex environment with strategic foresight and adaptability.”

North America registered a 18.9% y-o-y decline in deal volume, while Europe, Asia-Pacific, Middle East and Africa, and South and Central America experienced respective deals volume y-o-y fall by 16.2%, 8.1%, 10.4%, and 27.3%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIndia and Japan buck the trend

Similarly, the US, the UK, China, Canada, Germany, France, Italy, and the Netherlands witnessed y-o-y decline in deal volume by 18.3%, 9.1%, 22.4%, 24.4%, 19.4%, 34%, 14.4%, and 18.4%, respectively. Meanwhile, India and Japan were the notable exceptions to register improvement in deal activity during the review period.

Bose concluded: “While the significant decline in global deal activity reflects current market challenges, it also presents a unique opportunity for strategic consolidation and long-term value creation. The dip in deal volume, particularly in major regions, may open doors for savvy investors and companies to acquire undervalued assets and strengthen their positions for the eventual market rebound.”