Goldman Sachs is developing its digital consumer business division Marcus by launching new products and partnerships and offering digital solutions for consumers to better spend, borrow, invest and save.

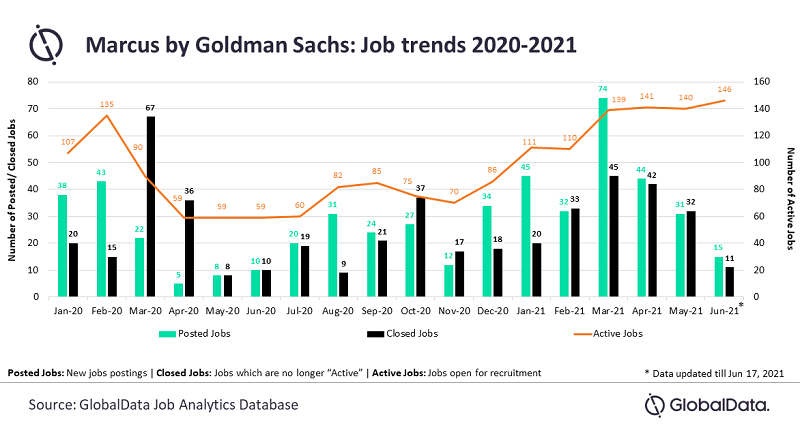

Job postings by the division grew in Q1 2021 with 151 jobs as against 103 jobs in Q1 2020.The job postings have been increasing since December 2020, finds GlobalData, a leading data and analytics company.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData Business Fundamentals analyst Ajay Thalluri said: “Goldman Sachs is hiring across operational roles including consumer engineering, fraud operations, payments platform, marketing, and digital collections. The company is also developing a new automated consumer investment platform for users in the UK. It is focusing on new merchant partnerships to grow its point-of-sale business, Marcus Pay.

Goldman Sachs is also poaching senior management talent from other companies to give a fillip to Marcus. For example, its consumer banking division is seeing new hires including the appointment of Peeyush Nahar, who was previously with Uber Technologies, as the global head of the consumer business in May 2021.”

Its ‘UX Lead – Vice President’ job posting suggests that the firm intends to develop its Marcus digital storefront team in order to create web and mobile experiences.

Important job postings this year include a ‘Head of Marketing and Comms Product – Vice President,’ for developing Marcus Cards businesses and a ‘Product Management – Vice President’ to develop new products for retail deposits.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe firm is also appointing fraud operations management specialists for loss prevention and recovery strategies. For instance, ‘Fraud Servicing – Vice President’ looks at fraud operations infrastructure, managing a team of 500 people.

Furthermore, new product development for consumer fraud management division is targeted through ‘Fraud Risk Capability and New Product Development – Vice President’.

Thalluri added: “Marcus will be used to assist consumers with financial products and analysis tools. It is expanding in markets, such as the UK, and has a significant number of patents in the fintech space, suggesting new product development and increased hiring. According to GlobalData’s Patents Database, Goldman Sachs has filed close to 200 patents in the fintech space since 2016.”