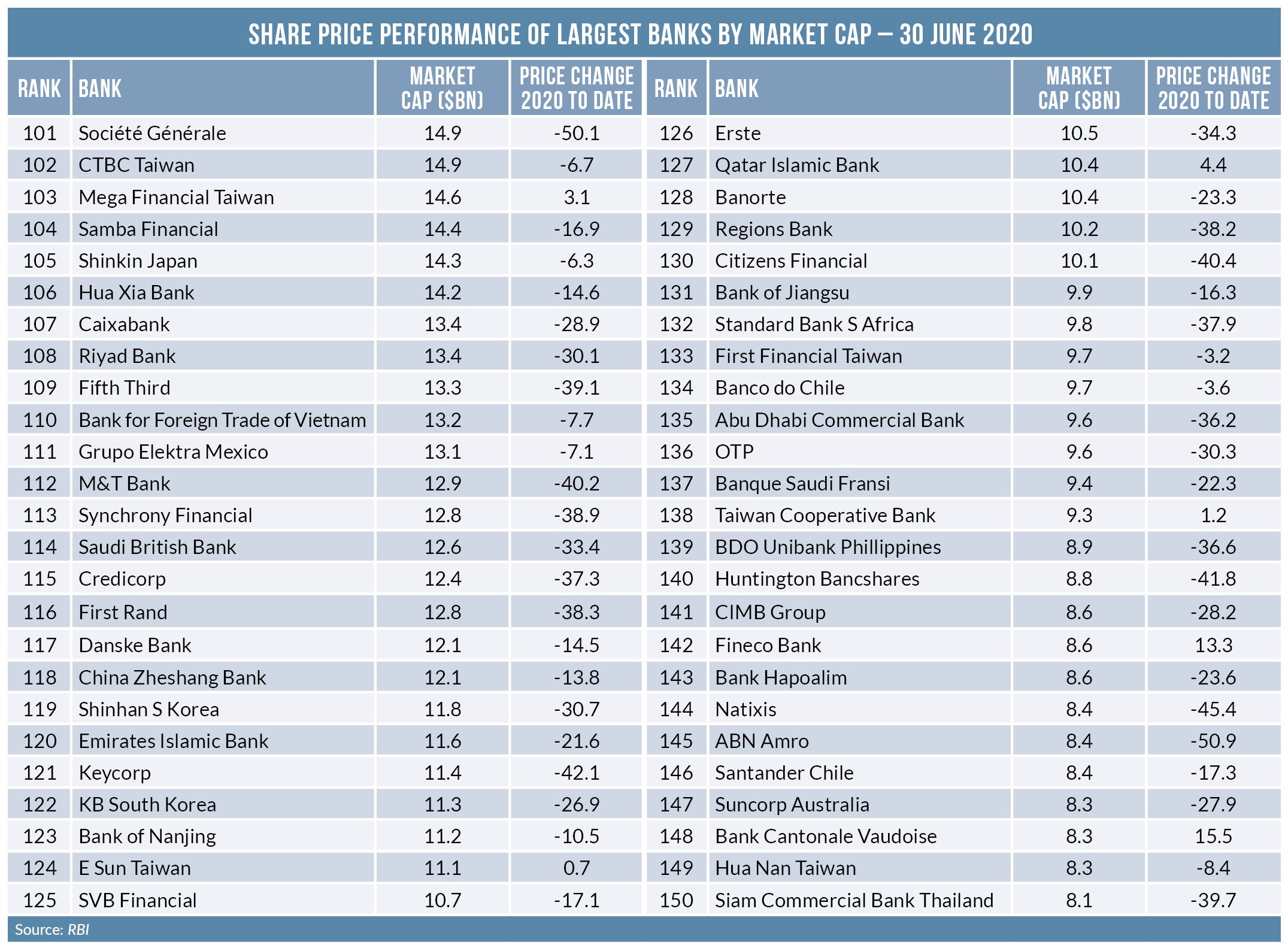

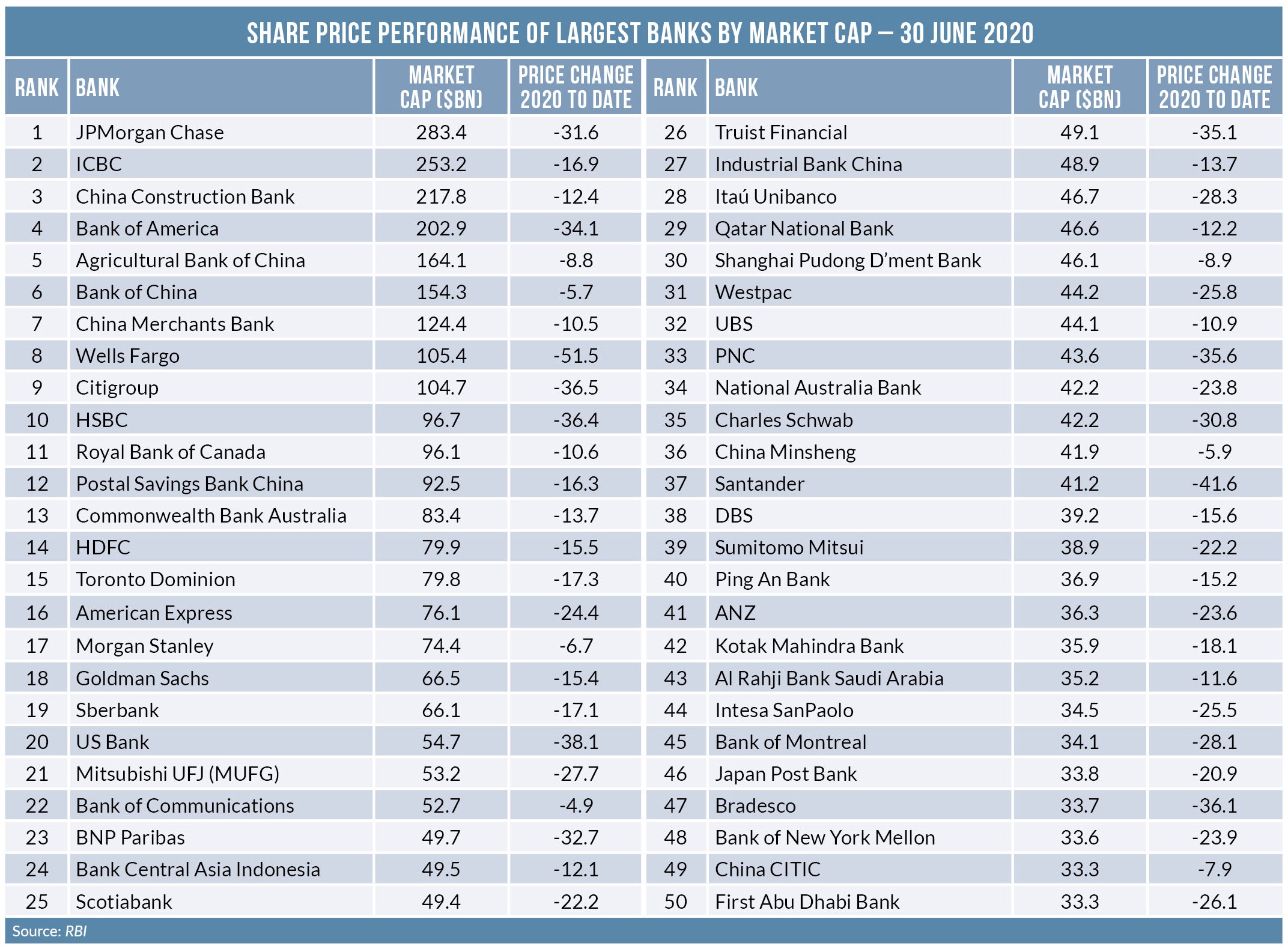

Covid-19 is hammering bank share prices with a mere eight banks out of the world’s largest 150 quoted banks posting a rise in their share price in the period from 1 January to 30 June. As Douglas Blakey reports, Deutsche Bank is, somewhat surprisingly given its recent history, among the banks in positive territory

Looking at H120 bank share prices, let us deal first with the banks showing share price gains as it is a short list to discuss.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Shares in Turkish lender Finansbank, acquired by Qatar National Bank from National Bank of Greece in 2015 and subsequently re-branded as QNB Finansbank, are ahead by 24.3% for the year to date.

Online trading and banking platform FinecoBank is also enjoying a strong first half. Shares in the Italian firm, spun out of UniCredit, are up by 13.3% in the first half. The share price at three Taiwanese lenders, Mega Financial, E Sun and Taiwan Cooperative are also in positive territory as is the case at Swiss-based Bank Cantonale Vaudoise and at Qatar Islamic Bank.

H120 bank share prices: IDBI Bank: +37% YTD

The strongest performing bank of note in the first half is India’s IDBI Bank. For the period 1 January to 30 June, IDBI’s share price is ahead by 37%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIDBI ranks just outside the top 150 with a market cap of $7.1bn but its share price hit a 52-week high in June. The share price rise coincided with news that the bank was to sell more than one half of its stake in insurer IDBI Federal Life.

Of the world’s major banks, the most notable share price gain is Deutsche Bank, reversing years of decline. Deutsche Bank has tumbled down all rankings of the world’s major banks by market cap since the financial crisis. The Deutsche Bank market cap peaked in 2007 at over $75.4bn. In the first quarter this year, it slid to little more than $12bn. Since then, the Deutsche Bank share price has risen by more than 60% to just over $20bn as its restructuring plan shows sign of progress.

As to whether Deutsche Bank can maintain this progress is a regular topic of discussion among analysts with a near consensus that the bank will not hit its 2022 revenue or profit targets.

Fiscal year 2020 is likely to be the sixth year in a row that Deutsche reports a loss, with estimates of the loss ranging from around €1.5bn to €2.0bn.

But for once, as Deutsche wins plaudits for its strategy of more cost-cutting, job-cuts and scaling back investment banking, its share price is not among the list of biggest losers-talking of which.

H1 2020 biggest losers

Wells Fargo wins the unwanted prize as the biggest loser for the year to date among the world’s major retail banks, down by 51.5%. But it is a close-run thing with Société Générale, down by 50.1% and now, surely temporarily, not even ranking in the top 100 banks by market cap.

In the UK, Lloyds and RBS are down by 51.4% and 49.1% respectively, in both cases their share price no doubt hammered in part by the Bank of England’s dividend policy.