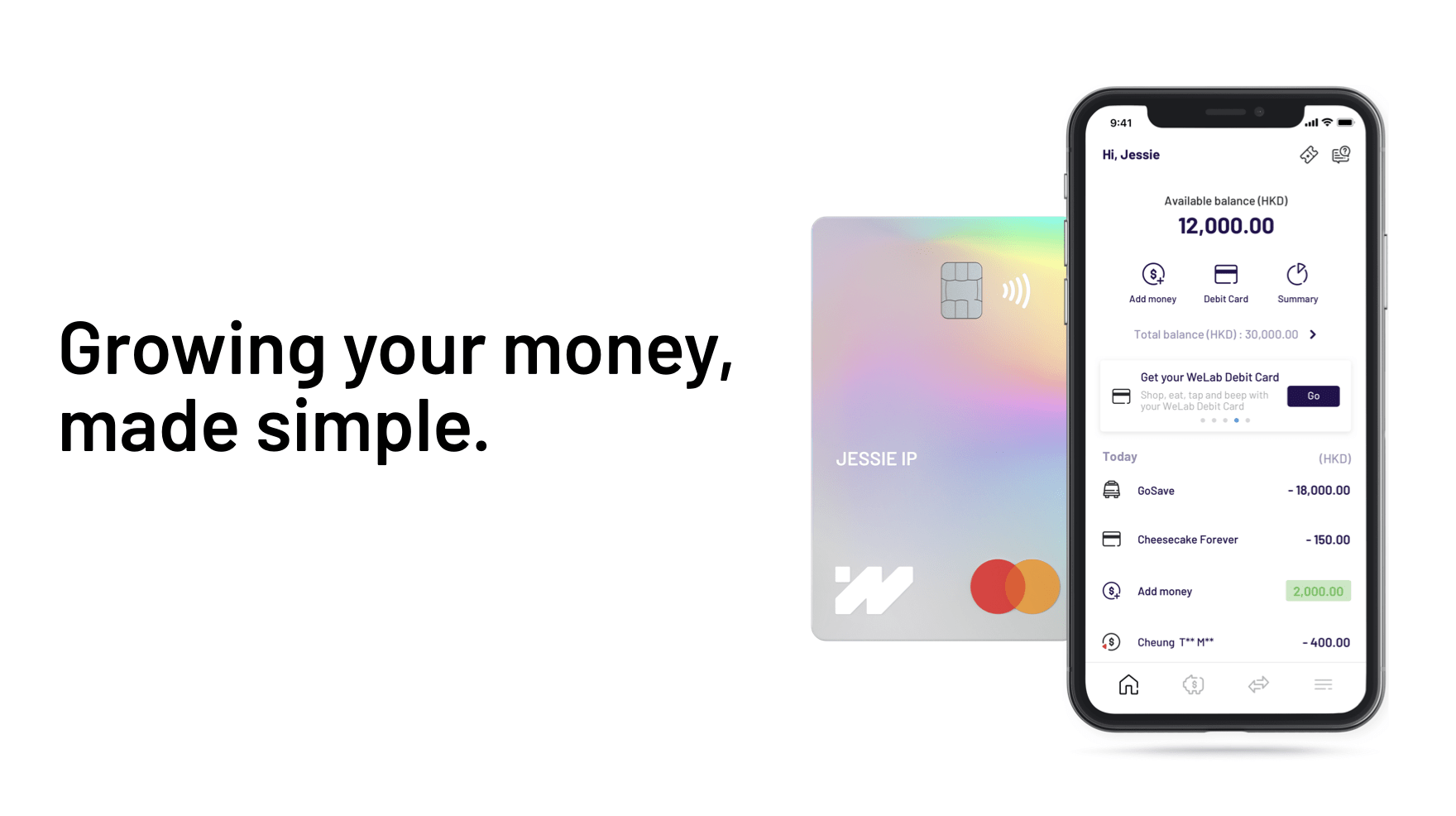

Hong Kong’s first challenger WeLab bank has today gone live with Temenos to provide mobile phone-based digital banking services for its customers.

WeLab Bank is now powered by Temenos Transact for core banking and Temenos Analytics for financial crime mitigation.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In addition, the bank was implemented on Amazon Web Services and Google Cloud, making it the first multi-cloud digital bank in Hong Kong.

Adrian Tse, WeLab Bank CEO, said: “WeLab Bank was born from an initiative to reimagine the banking experience for the 7.5 million people of Hong Kong. From the start, we knew this vision needed the most advanced cloud native technology and a partner that shared our vision for digital transformation.

“With Temenos we have efficiently built WeLab Bank from scratch, free from any legacies, with innovative features that proactively help customers to take control of their money and their financial journey.”

The challenger launched in August 2020 and reported 10,000 account openings in its first 10 days of launch.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTemenos technology

Through Temenos’ technology, WeLab Bank aims to scale its business efficiently, and reduce its operating costs.

Max Chuard, Temenos CEO, said: “Congratulations to WeLab Bank on the launch of their trailblazing new digital bank. Building and launching a licenced bank in such a rapid time frame is a fantastic achievement. We are proud to have supported them in becoming the first multi-cloud digital bank in Hong Kong.

“Temenos cloud-native, cloud-agnostic strategy means we can satisfy the needs of the most innovative and ambitious neobanks like WeLab Bank to run on multiple cloud providers. We know this is just the beginning for WeLab and we are excited to be part of their story as they revolutionise banking for people in Hong Kong.”

Currently, customers can open a WeLab Bank account with $0 monthy fees and access services, including deposits, an instant virtual debit card, and real-time payments, via their mobiles.