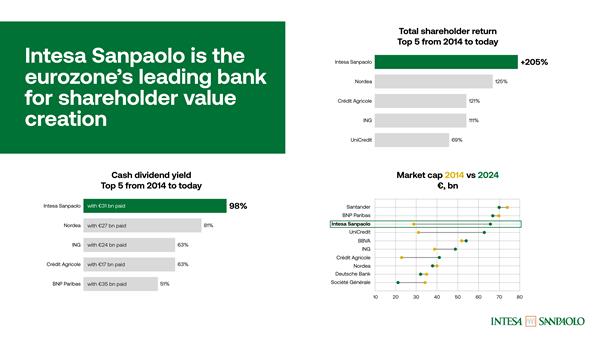

Intesa SanPaolo has distributed its interim dividend to shareholders and in the process, claims the honour of being the leading bank in the eurozone for total shareholder return in the past decade.

Specifically, Intesa Sanpaolo reports an increase of 205% in combined growth in share value and dividend distributions since 1 January 2014.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Over the past 10 years, Intesa Sanpaolo has

- achieved a 107% increase in stock market value, with a €37bn rise in market capitalization since January 2014;

- distributed €31bn in dividends to its shareholders, resulting in a cumulative dividend yield of 98%, including the interim dividend paid on 20 November.

In comparison with the other leading eurozone banks in terms of market-capitalisation, Santander (which raised €15 bn through capital increases) distributed €23bn in dividends, while BNP Paribas distributed €35bn, with a cumulative dividend yield of 51%.

FY 2024 revised net profit target of c€9bn

Earlier this month, the bank’s CEO Carlo Messina reaffirmed its full fiscal year guidance of a net profit exceeding €8.5bn and set a revised target for 2025 set of around €9bn.

“Our bank has high potential to organically increase profitability,” said Messina, highlighting that Intesa Sanpaolo is well-equipped to face the current economic environment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMessina added: “Intesa Sanpaolo has developed a unique model in Europe with the consolidated leadership of its Divisions serving families and businesses, a significant Wealth Management, Protection, and Advisory component, efficient management of international operations, technologically advanced digital offerings, a ‘Zero NPL’ bank status, and a high-profile ESG rating at an international level.”

The Intesa Sanpaolo share price is currently up by 38% for the year-to-date.