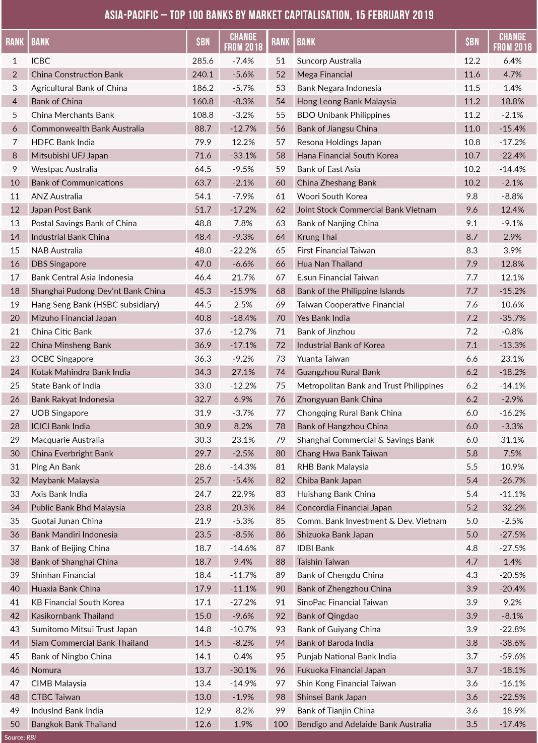

China, inevitably dominates any ranking of the largest 100 Asia Pac banks by market cap. Six of the top 10 by this metric and more than 30 of the top 100 are in China. But a challenging 2018 for Japanese lenders results in a number of the country’s banks exiting the top 100.

The largest 100 Asia Pac banks by market cap share price performance in the past year is decidedly mixed.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The big six large commercial banks in China continue to post rising net profits and encouraging falls in non-performing loans.

Net interest margins inched up at the six: ICBC, China Construction Bank, Agricultural Bank of China, Bank of China, Bank of Communications and Postal Savings Bank (PSB).

And the last-named boasts the strongest performing share price of any major Chinese lender since the start of 2018.

PSB along with regional lender Ping An Bank, has been among the most enthusiastic China lenders targeting credit card growth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLargest 100 Asia Pac banks: China credit card debt soars

Chinese banks issued around 650 million credit cards as of the third quarter of 2018. This represents a rise of more than one-third in the past three years.

Balances outstanding on Chinese credit cards have soared by 120% in the past three years to almost $1trn.

And now researchers at Citi forecast that China’s largest card issuers will be keen to rein in card balances.

Non-performing loans at the major Chinese lenders continued to inch down in 2018.

According to research from PwC, non–performing loan ratios for the largest 15 Chinese banks in H118 fell to 1.53%. That represents a four basis point fall from the year ago period.

On the other hand, total written-off provisions across the largest fifteen banks have increased year on year. And analysts caution that Chinese lenders need to be wary of potential red flags. As well as rising credit card balances, these include real estate loans and local government debt.

Largest 100 Asia Pac banks: Japan woes

If China is relatively stable, share price performance of Japan’s lenders is anything but. Since the start of 2018, Japan’s lenders share prices represent a car crash with double digit falls. Even the country’s largest bank, Mitsubishi UFJ’s share price is down by a third.

Capital adequacy ratios are declining across the sector and the market is pricing in risks from a forecast slowing economy.

But it is the regional banks that are most adversely affected by negative interest rates and a shrinking population.

In addition, Japan’s regional lenders have been hammered by shedding foreign debt that has declined in value. The aim is understandable: to avoid mega future paper losses.

The combination of rising yields on US Treasurys and the steeper costs of procuring the dollar worsened the cost-benefit ratio of holding US debt.

The market has been merciless with Shizuoka Bank down by 27% in the past year. Mebuki no longer ranks in the largest 100 Asia Pac banks by market cap and is down by almost 40%.

And then there is the Suruga Bank saga. Suruga’s shares have been hammered following a probe that reported compliance failures, undue pressure on staff and weak corporate governance.

The Shizuoka-based bank made its name by targeting the sub-prime lending sector. Until last year, it boasted sector beating net interest margins more than double its rivals.

Since the start of January 2018, shares at Suruga are down by 77% and it no longer ranks in the largest 100 Asia Pac banks by market cap.

Largest 100 Asia Pac banks by market cap: Australian losses

To the surprise of nobody, the past year has been unkind to share price performance at Australia’s big four banks.

Australia’s big four constitute seven of the country’s largest seven companies by market cap, worth more than $250bn combined.

The market is pricing in forecast slower loan growth and rising bad debts as well as increased competition.

Not to mention punishing the Australian banks for the humiliating Royal Commission. The investigation found evidence of banks’ taking fees without providing advice, mistreating superannuation customers and unfairly failing to pay out insurance claims.

And now three of the big four lenders are shrinking with ANZ, CBA and NAB selling or planning to shed their wealth management divisions.

Largest 100 Asia Pac banks by market cap: 2018 highlights

Double digit share prices in the past year are rare across the region but bucking the trend includes Kotak Mahindra.

Kotak has been among the strongest performing Indian banking share for the past 12 months driven by strong loan growth.

Kotak’s net profits rose by 23% for the quarter ending 31 December with savings deposits up by more than one-third.

Other highlights? As RBI March goes to press, DBS kicks off the reporting season with a record annual profit.

South East Asia’s largest lender reports fiscal 2018 profits up a whopping 28% to a record S$5.63bn.

Notably, DBS’s return on equity of 12.1% is near its historical high in 2007 prior to the global banking crisis.

The DBS results set a positive marker for the reporting season and all eyes now turn to results from its smaller rivals.