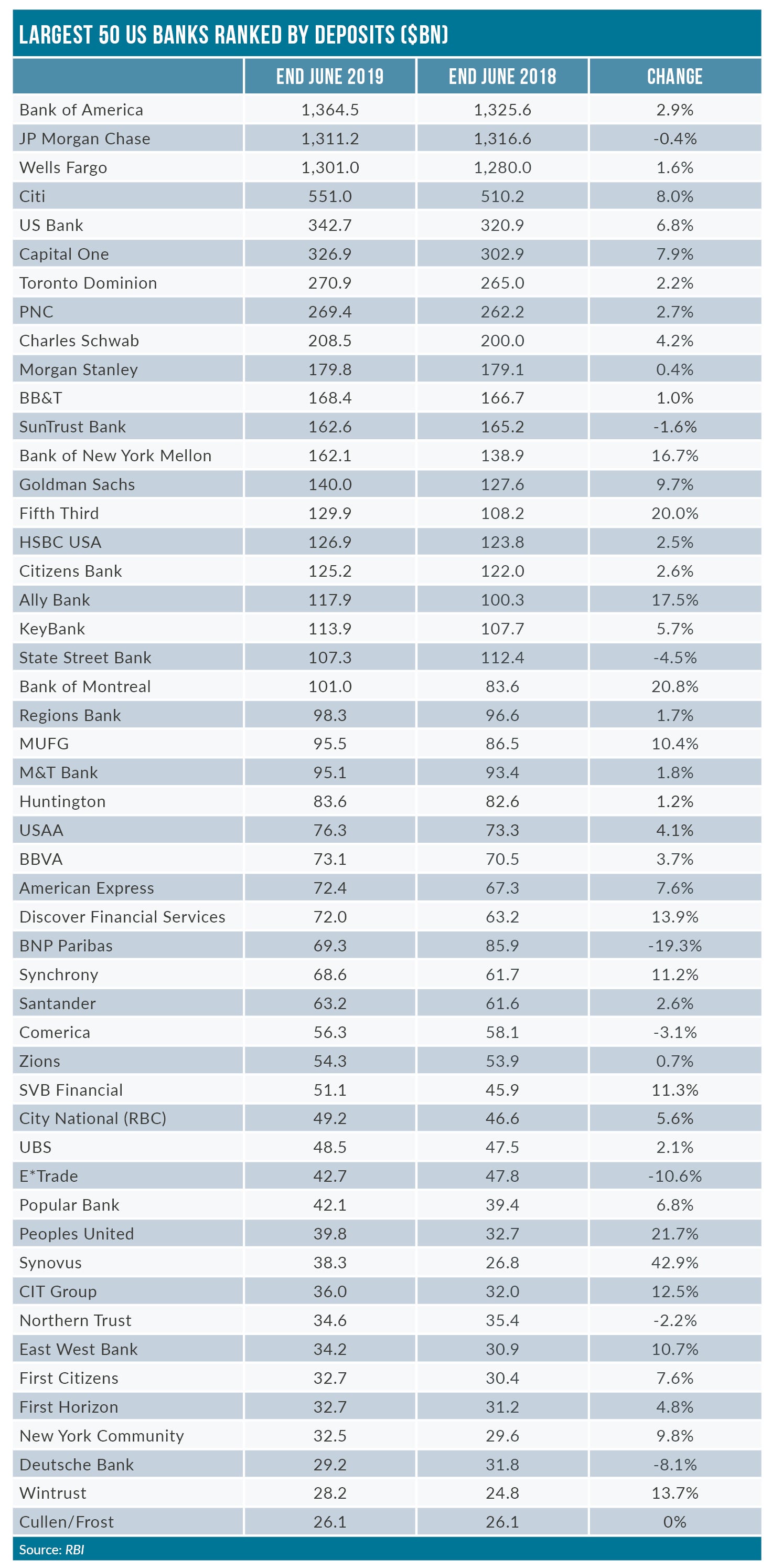

Bank of America remains the largest US bank by deposits just ahead of Chase.

According to the annual Summary of Deposits from the FDIC total deposits grew by 2.9% at Bank of America to $1.36trn at end June 2019.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

By contrast, deposits dip by 0.4% year-on-year at JP Morgan Chase to $1.31trn.

For over 20 years Bank of America ranked the largest US bank as measured by deposits. That is until Chase usurped Bank of America in the FDIC rankings in 2017. Chase ranked top for only one year with Bank of America back on top in the June 2018 ranking.

Deposits at the Big Four – Bank of America, Chase, Wells Fargo, and Citi – grew by a combined 2.2%. These four banks hold around 38.2% of all US deposits.

Meantime, the top 50 banks combined hold $9.16trn of deposits. This amounts to around 77% of total US commercial bank deposits of $11.85trn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt the end of June 2019, 21 US financial institutions had deposits of more than $100bn. This represents an increase from 19 at the end of June 2018. As recently as 2014 only 14 US banks had deposits of more than $100bn. In June 2009, the corresponding figure was only eight banks.

Largest US banks by deposits: Goldman Sachs on the rise

Goldman Sachs continues to rise up the deposits rankings as it expands beyond its traditional areas of business.

At the end of June 2009, Goldman Sachs ranked as the 29th largest US bank by deposits.

In the intervening ten years, Goldman Sachs deposits have quadrupled from $35bn to $140bn. It now ranks as the 13th largest US bank by deposits.

In the 12 months to end June 2019, Goldman Sachs are up by another 10%.

The past 12 months represent another triumph for digital only player Ally Bank.

Ally is now the 17th largest US bank by deposits up from the 42nd largest in June 2009.

Deposits rise by 17.5% year-over-year for the Detroit headquartered digital bank to $117.9bn.

Ally has acquired around 2 million customers since rebranding from General Motors Acceptance Corporation following the financial crisis.

Largest US banks by deposits: Canadian growth

The past 12 months witnesses strong deposit growth in the US for the major Canadian lenders.

In particular, deposits grow by 20.8% y-o-y at Bank of Montreal to $101bn. BMO is now the 21st largest US based bank by deposits.

Meantime, Toronto Dominion remains the largest international bank in the US deposits. TD ranks as the 7th largest US bank by deposits, up from 13th a decade ago.

RBC ranks 40th with deposits growth of 5.6% in the past year via its City National franchise.

City National assets are up by 53% since its November 2015 acquisition by RBC. At the same time, City National deposits are up by almost 50% to $49.2bn.

MUFG Union Bank deposits growth, major marketing campaign

Other notable international banks such as MUFG post strong deposit growth.

Union Bank total deposits rise by 10.4% to $95.5bn for the year to end June 2019.

And now it is ramping up its marketing to build on its rise in market share in its local markets.

In particular, Union Bank kicked off a new integrated marketing campaign anchored by the tagline ‘Your Details Matter’ on 9 September.

The campaign runs until the end of the first quarter of 2020. The Union Bank ‘Your Details Matter’ campaign showcases a variety of financial journeys that Union Bank helps clients with. From starting out to owning a business, buying a home or managing wealth, the campaign focuses on the emotions of life moments that intersect with significant financial decisions.

The multifaceted advertising campaign includes TV and radio commercials, billboards, social media and digital ads throughout the San Diego market. At the same time, Union Bank has also launched a completely re-imagined website that provides more ways for people to connect with bank experts.

In addition, Union Bank is introducing a new visual identity across the company, taking a phased approach beginning with marketing collateral and client communications at Union Bank branches in San Diego.

Fifth Third deposits rise by 20%

Among the local regional retail banks, Fifth Third continues to rise up the rankings.

A decade ago, Fifth Third ranked as the 25th largest US bank by deposits. Boosted by its M&A activity, Fifth Third now ranks 14th with deposits rising by 20% last year to $129.9bn.

And it is M&A activity -the disposal of First Hawaiian – that results in deposits falling by 19% at BNP Paribas.