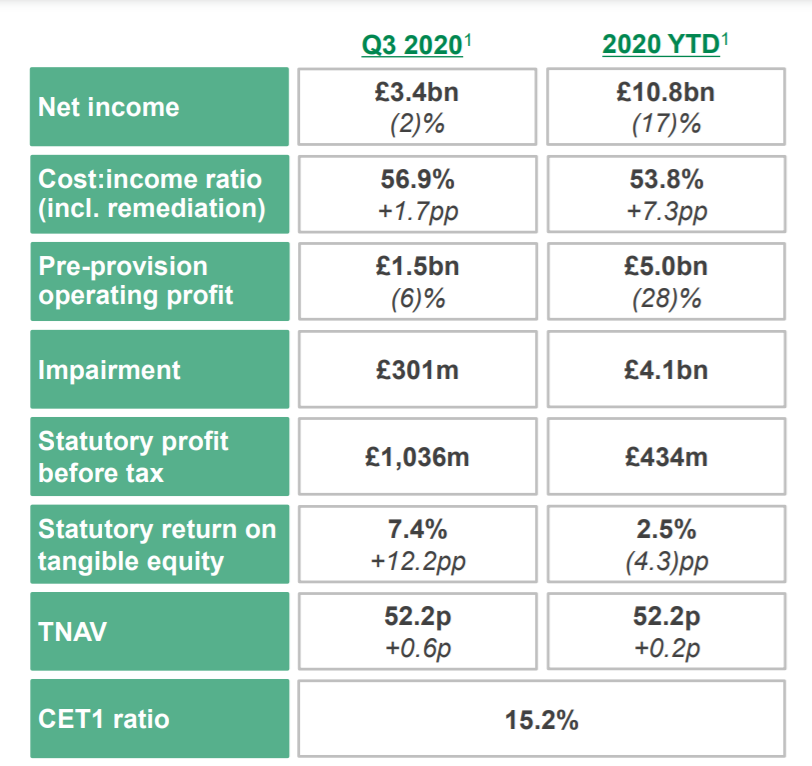

Lloyds Bank has announced a pre-tax profit of £1bn ($1.3bn) in the third quarter on income of £3.4bn, recovering from a larger-than-expected loss provisions to cover loans going bad in the first half of the year due to the Covid-19 pandemic.

The profit beats analysts’ expectations (an average of £588m) and is likely to give investors a more optimistic view of the bank’s near-term prospects.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Although our performance has clearly been impacted by the pandemic and the associated challenging economic environment, I am pleased that we are now seeing an encouraging business recovery and, with impairments significantly lower, a return to profitability in the third quarter,” CEO António Horta-Osório said in a statement.

Resilient business model with return to profitability in Q3

1 – Q3 2020 variance quoted against Q2 2020; 2020 YTD variance quoted against the first 9 months of 2019.

Source: Lloyds Bank

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTwo major reasons account for Lloyds’ return to profit:

An upsurge in mortgage activity

Britain’s biggest domestic lender benefited from a jump in its mortgage business, receiving the highest number of mortgage applications since 2008.

This translated into £3bn net growth in mortgages in Q3 with £3.5bn increase in open mortgage book. Lloyds has 22% market share of approvals and a strong mortgage pipeline (mortgage loans that are already locked-in).

Boosting mortgage activity is the stamp duty holiday (running from 8th July 2020 to 31st March 2021) designed to support the housing sector through the crisis.

The stamp duty land tax is a tax paid by someone who purchases a property or piece of land in England or Northern Ireland – Scotland and Wales have their own systems.

Fewer loan defaults than predicted

Another positive development for the bank is that the loan defaults that had been expected from the economic crisis did not materialise as badly as feared. As a result, full-year provisions for bad loans are now expected to be at the lower end of previous guidance.

The bank took £301m of impairments related to bad loans during the quarter – significantly below the second quarter and in line with pre-crisis levels.

Lloyds said loss provisions for the full-year were now likely to be “at the low end” of the £4.5bn to £5.5bn range provided earlier this year.

Not out of the woods yet, despite a better outlook

Horta-Osório said the UK economy had performed much better than Lloyds had expected in the third quarter.

However, in his presentation to analysts and investors, the wrote: “significant uncertainties remain and will persist while [the] pandemic continues.”

The bank did not mention the resumption of dividend payments.