The COVID-19 pandemic not only disrupted banking operations, but also brought a fundamental shift in consumer behaviour towards contactless and digital interactions in banking which traditionally relied on physical branches for business. As banks turn cautious towards disbursements amid bleak economic conditions, loan book growth and asset quality are becoming causes of concern, while increasing digitalisation is calling for higher investments in cyber security and fraud detection.

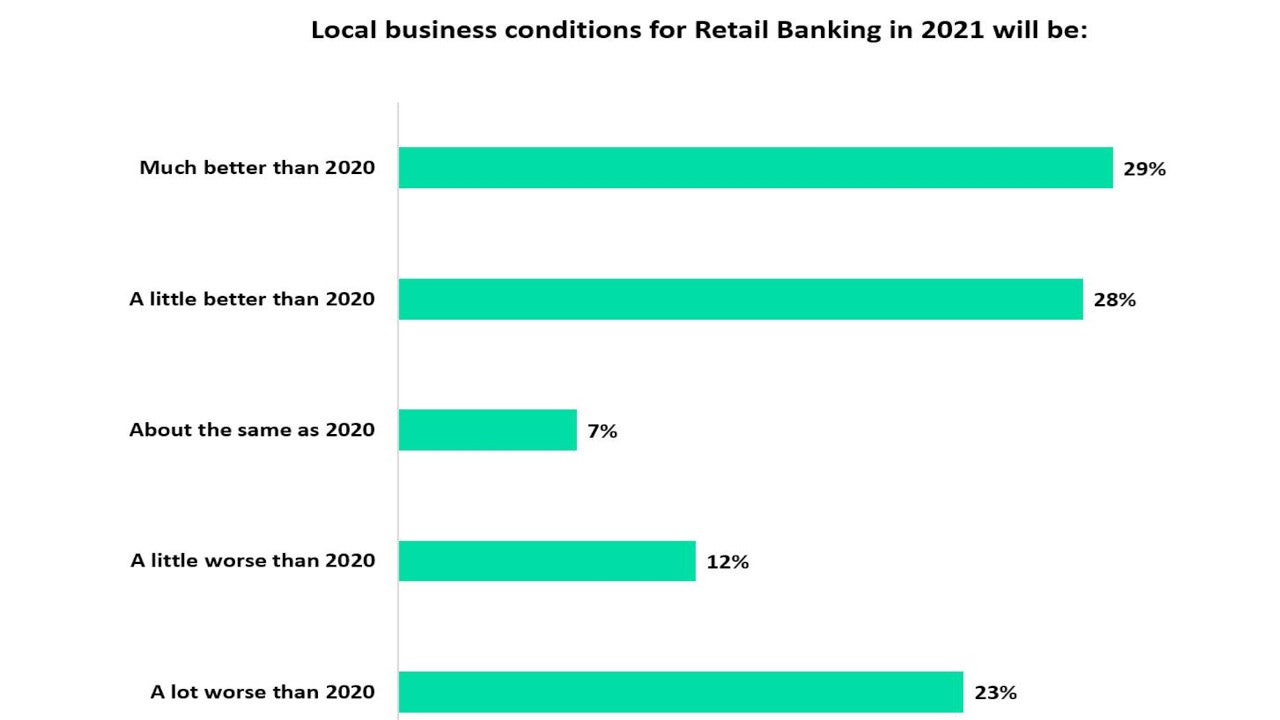

Verdict has conducted a poll to assess the improvement in local business conditions for retail banking in 2021 compared to 2020, amid COVID-19. Analysis of the poll results shows that a majority 57% of the respondents expect better business conditions compared to 2020, including 29% who expect a high improvement and 28% who expect a slight improvement.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On the contrary, 36% of the respondents expect the conditions to worsen in 2021, including 24% who expect the conditions to be a lot worse than 2020 and 12% who expect them to be slightly worse.

The remaining 7% of the respondents expect no change in local business conditions for retail banking in 2021.

The analysis is based on 82 responses received from the readers of Retail Banker International, a Verdict network site, between 22 January and 02 June 2021.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataChallenges facing retail banking

Banks have been forced to shut many of their branches to comply with local regulations during the pandemic. Lockdown restrictions resulted in the temporary closure of approximately 8,500 bank branches in the UK alone, with customers having to rely on online banking to transact. The World Economic Forum (WEF) predicts that 50% of goods consumption could shift to online in several developed markets by 2030, which is set to accelerate digitalisation in banking.

Large-scale loan losses, decline in consumer finance loans and other lending activities, and non-performing assets are some of the immediate challenges facing retail banks. In India, for example, retail gross non-performing assets (GNPAs) are expected to rise to 11% in fiscal year 2021-22 (FY21) due to the second wave of coronavirus, compared to 7% in FY20, according to credit rating agency CRISIL.

On the other hand, digital transformation is calling for higher investments in cybersecurity and fraud detection, as well as staff training. Losses incurred due to fraudulent transactions reached £479m ($663.37m) in 2020, an increase of 5% from the previous year, according to UK Finance, a trade association for the banking and finance industry in the UK.

COVID-19 has resulted in banks accelerating their digitalisation efforts since last year, a trend that is expected to continue in 2021 although the current year is not expected to cause a similar level of disruption as 2020.