Danish neobank Lunar has launched Lunar Youth, a new banking app designed for kids and teens aged seven to 17.

This initiative is part of Lunar’s strategy to become a full-service bank in the Nordics, offering a “seamless” financial experience for families and catering to the financial needs of a new generation.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Lunar Youth is linked to parents’ accounts, allowing young users to explore digital money management while parents maintain oversight.

The app aims to help children and teens build real-life financial habits.

Lunar said it has gained traction among younger, digital-savvy users, reaching nearly one million users across the Nordics.

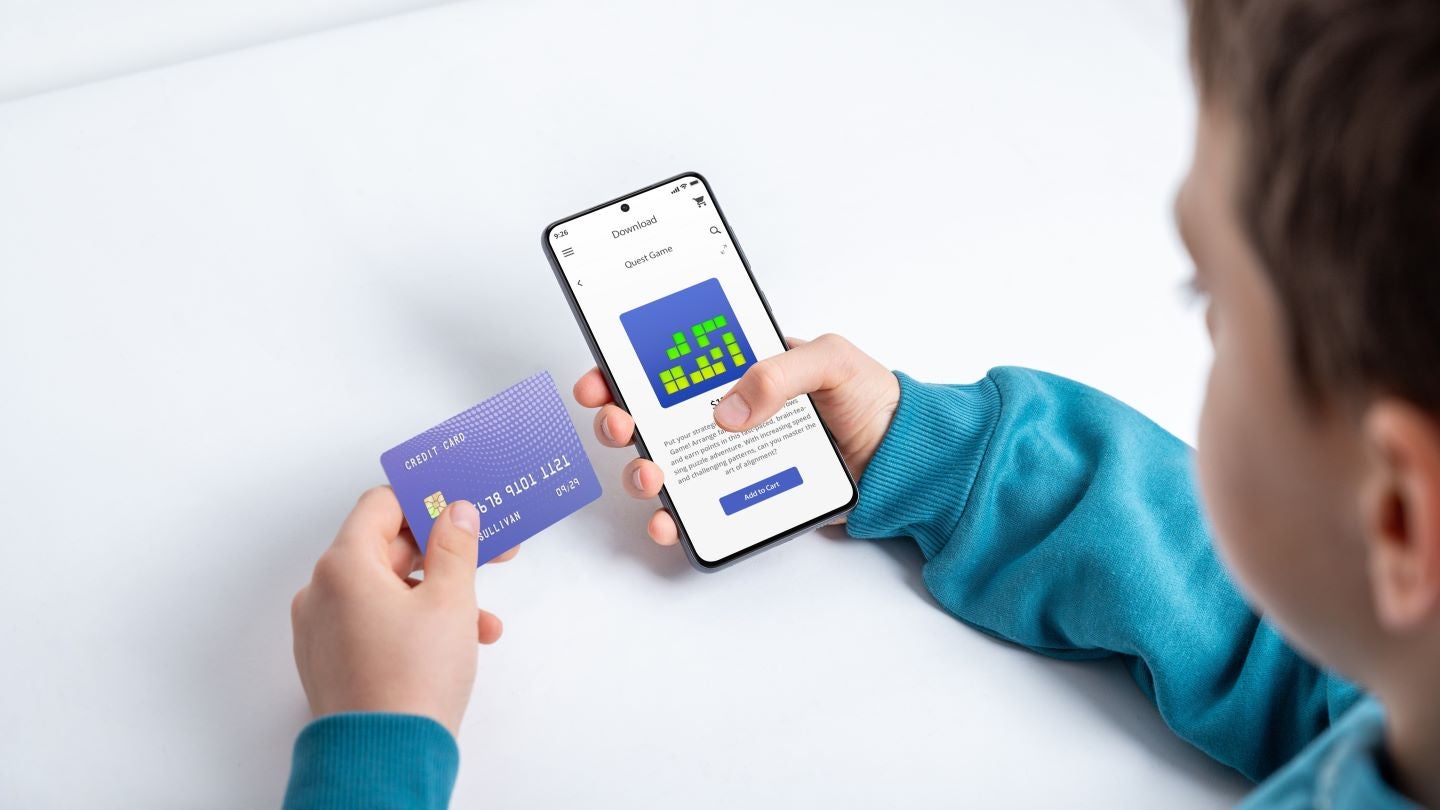

Lunar founder and CEO Ken Villum Klausen said: “Kids today grow up in a world where money is mostly digital—whether it is tap-to-pay, in-app purchases, or subscriptions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Lunar Youth is a natural next step in our journey towards becoming the go-to digital bank for all life stages. It is about giving kids and teens a safe, fun, and practical way to engage with money—together with their parents.”

The app prioritises safety, offering parental controls such as spending limits, transaction monitoring, and category restrictions on crypto, gambling, and adult content.

Online purchases require parental approval, and users can set their own PIN codes for both cards and app logins.

Lunar Youth also provides a personalised experience with customisable card designs and app themes.

For users over 13, it supports Apple Pay and Google Pay, alongside digital tools such as spending overviews, real-time insights, and categorisation.

A budgeting tool is expected to launch by the end of March.

The app debuted this week in Denmark, Sweden, and Norway.

It is available as part of the Lunar Plus plan and the Unlimited plan.

Lunar has been expanding its footprint, raising €24.1m ($26.29m) in 2024 to support its full-scale launch in Sweden. In 2023, the Danish digital bank secured €35m in funding.