UK challenger Metro Bank has raised £375m ($478m) in funding from shareholders to ease concerns over its future.

The bank was aiming for £350m and has exceeded its target. Shares were priced at 500p, a 36p discount to its closing share price on Thursday 16 May.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

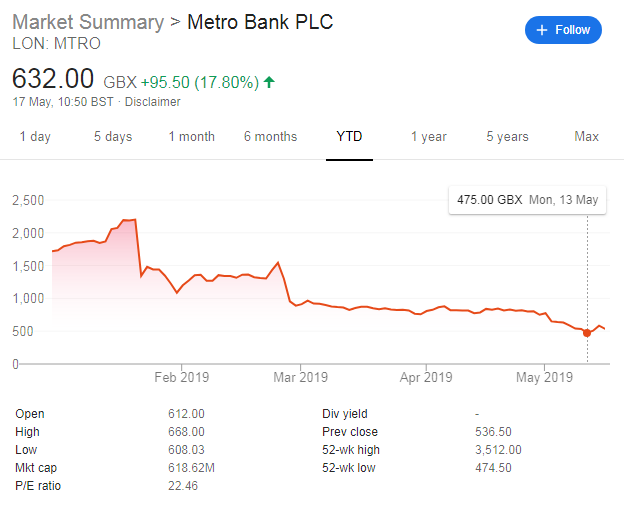

Metro Bank shares have been on a rough road in 2019. Starting the year valued at 1,718p, it dropped to a low of 475p earlier this month. It has now risen again to 637p.

In a statement, the Bank of England said: “The Prudential Regulation Authority welcomes the steps taken today by Metro Bank. Metro Bank is profitable and continues to have adequate capital and liquidity to serve its current customer base. It has raised additional capital in order to fund future growth.”

Metro Bank was also the victim of a hoax prior to this new funding. Rumours were spread on WhatsApp regarding the bank’s financial stability. This led to some customers queuing to withdraw money and items from safety deposit boxes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCurrently, Metro Bank has 66 branches, or stores, in the UK, mainly focused around London. It remains committed to expanding its stores network. It says that it will expand to new strong SME markets in the North with 30 new stores by 2023.

Furthermore, there are a further seven branches in advanced planning stages or under construction.

In better news for the challenger, Metro Bank, Starling and ClearBank were the first round winners of the RBS Banking Competition giveaway. In February, BCR awarded Metro Bank £120m, Starling £100m and ClearBank £60m.

In addition, Metro Bank, first direct and Nationwide top the second Competition and Markets Authority (CMA) survey ranking UK banking service quality – and to the surprise of few in the industry, RBS again ranks bottom.

Since August 2018, UK banks are required to publish information on how likely people would be to recommend their bank – including its online and mobile banking, branch and overdraft services – to friends and relatives.

The results show the proportion of customers for each brand ‘extremely likely’ or ‘very likely’ to recommend each service. For overall banking service quality, Metro is top with a score of 83% just ahead of first direct on 82%.