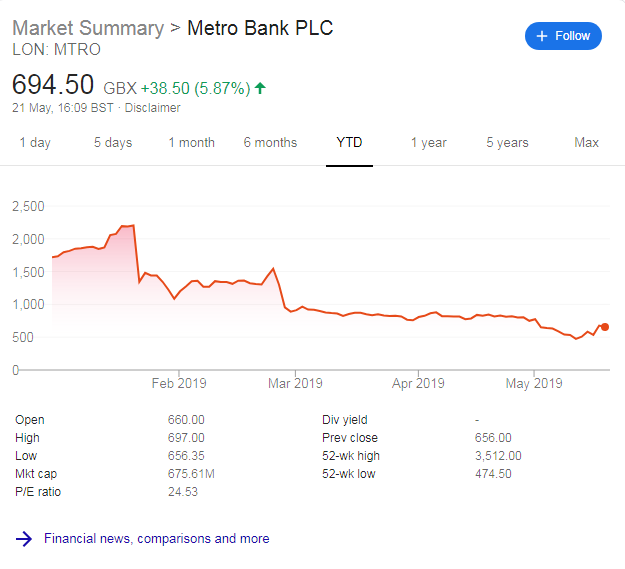

The Metro Bank share price is at last settling down after a turbulent four months.

Metro Bank has raised £375m from shareholders amid high demand. Initially it had planned to raise £350m. Indeed, there were orders for the new stock of more than double the amount raised.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

For fans of colourful founder Vernon Hill such as this writer, it has been a painful period to cover Metro.

The trouble all started back on 23 January. An accounting error and profits warning resulted in a drop in the Metro Bank share price from £22.00 to £13.40.

A drop in one day of 40%.

Press comment was scathing. I lost count of the number of hostile articles in the tabloid and broadsheet press, including the FT.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMetro Bank’s risk-weighted assets increased to £8.9bn, about £900m ahead of analyst forecasts.

Well capitalised, exemplary credit history, profitable and liquid

As respected banking analyst Ian Gordon of Investec wrote the other day:

“Metro Bank is well capitalised. It has an exemplary credit history, is moderately profitable and is extremely liquid.”

The bank was at pains to report it had not encountered any deterioration in the performance of its loans.

Underlying profit before tax for fiscal 2018 duly came in up more than 130% up on the prior year.

It reported profits of £50m instead of the £59m forecast by analysts.

As I have argued many times, Metro Bank has grown deposits at an exceptional pace. Since its launch, it has grown deposits to £15bn.

So funding has not been an issue.

Perhaps it is terribly old-fashioned to argue that deposits growth is crucial.

So take the average cost of customer deposits.

By that metric, as Metro matured, its average funding costs have declined, falling below the UK base rate in 2018.

It was however a shock to report that Metro Bank suffered modest deposit/outflows in late January/February.

I have often compared and contrasted the fortunes of Metro Bank and Monzo.

Both are UK banking success stories since their respective launches. Metro and Monzo customer numbers are comparable.

Both banks enjoy phenomenally high levels of customer advocacy and class leading net promoter scores.

Only one of the two banks is however reporting revenue and only one has a £15bn lending book.

RBI Award for Best Branch Strategy

It will be interesting to see the latest financials from Monzo-its last published results cover the period to end February 2018.

As reported in this issue, Metro is a deserved winner at RBI’s annual global banking awards for best branch strategy.

It achieved a notably double success in February. It ranked top in the Competition and Market Authority’s service quality survey among retail current account holders for overall service and services in branches.

Notwithstanding the hugely positive coverage resulting from its CMA double poll success, the Metro Bank shares price continued to tumble.

No matter that Metro Bank was awarded £120m on 22 February – the largest share – of the capability and innovation fund. This is the £775m scheme funded by RBS dating back to its 2008 government bailout.

The Metro Bank share price again fell by 40%, in the last week of February, from £15.40 to £9.55.

Now some of the press comment bordered on the silly. And became markedly personal with one headline writer tastelessly opting for ‘Over the Hill’

Metro Bank share price: partial recovery towards £7

By 13 May, the Metro Bank share price hit a new low of £4.75. The IPO price by the by was £20, so pretty dismal.

Now, having raised the fresh capital, the share price as RBI goes to press is touching £7.

As Ian Gordon fairly notes, Metro does continue to “face real challenges around profitability and returns.”

The bank’s targets of low double digit return on equity by 2023 may be out of reach.

Metro will have lessons to learn from this very painful four month period. There will be a small number of hostile shareholders at the upcoming AGM. Some will vote against the chairman and some of his board colleagues.

The bank was arguably too slow to raise the fresh capital. It will also need to show suitable remorse when the FCA and PRA end their respective enquiries into the accounting blunder.

I hope that there remains no question of the chair resigning at this stage. He has earned the right to leave at a time of his choosing, perhaps next year when it ends its existing relationship with architects InterArch.

I dare say that Legal and General and Royal London Asset Management will do their worse at the AGM. I also do not doubt they will be in a minority.

Meantime, at current valuations, Monzo is worth more than three times the value of Metro Bank. And if you agree with those respective valuations, we will just need to agree to disagree.