Over two-in-five microbusiness owners take home less than £10,000 a year. The stat is one key takeaway from research released by Zempler Bank into the challenges facing the UK’s 5.3 million microbusinesses. It says the opportunity to be one’s own boss remains highly attractive, but entrepreneurship isn’t without its challenges.

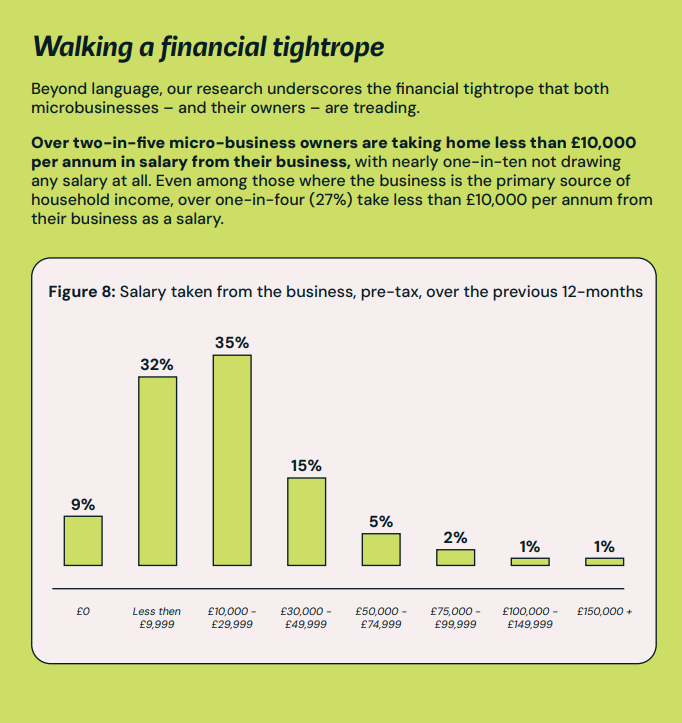

When asked how much they take in salary from their business after tax, over two-in-five (41%) microbusiness owners say they are taking home less than £10,000 in salary per year, with nearly one-in-ten (9%) not drawing any salary at all. This number is significantly higher among female business owners with almost half (49%) taking home less than £10,000, compared to almost one-third (32%) of men.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Managing cashflow a major issue for 1-in-4

The research shows that going out alone isn’t always immediately lucrative and points to possible reasons why. Over four-in-ten (41%) say that finding customers is a major challenge. Some 28% identify recent inflationary pressures of the growing cost of materials and supplies. One in four respondents highlight managing cashflow as a major issue.

There is a silver lining says Zempler Bank. As businesses begin to establish themselves, these numbers improve considerably. The research shows over three-quarters (77%) of business owners paid a salary of less than £10,000 in the first year – of which 28% paid themselves no salary at all. This falls to 46% in years one to three and continues to decline thereafter.

The research also highlights a weakness in broader business resilience too. Over one third of businesses (35%) say they have under £1,000 in cash savings. 12% said they had nothing. This reflects Zempler’s earlier research highlighting 75% of business are funded by personal savings or from friends and family.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMicrobusinesses call for government support

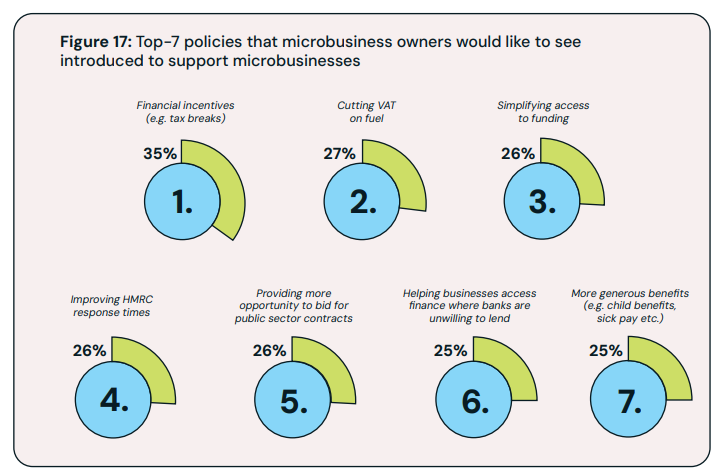

Businesses have highlighted which policies they’d like to see from the new Government to support them and encourage more businesses.

- Tax breaks to encourage people to start their own business (35%)

- Cutting VAT on fuel (27%)

- Simplifying access to funding (26%)

- Improving HMRC’s response time (26%)

- Increasing the opportunity for SMEs to compete for public sector contracts (26%)

Among female-led businesses and sole traders, there was a greater desire for policies providing more generous benefits such as sick pay, pensions tax relief and child benefits. Women-led businesses also said there is a need to improve access to finance where banks are unwilling to led. A higher percentage of male-led businesses supported cutting VAT on fuel.

Rich Wagner, CEO, Zempler Bank, said: “Most entrepreneurs know and accept that starting a new business is not easy, but this research reveals just how tough those early days can be. It’s another reminder of just how resilient and determined these business owners are and it’s great to see that the majority of founders have no regrets about striking out on their own. These companies need all the support they can get whether that’s access to lending and other crucial services or tax incentives that can ease the burden of those difficult first few years in business.”

Wagner launched the company as Cashplus with an e-money licence in 2005. It secured a banking licence from the PRA in 2021 and rebranded as Zempler Bank on 9 July this year.