The Monzo unicorn valuation is awaiting confirmation after the challenger bank reached the million-customer milestone over the weekend.

Only weeks before it had been revealed that the challenger is set to join the league of the UK unicorns.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On its blog, Monzo boasted that 20,000 new customers are signing up every week. The digital-only bank is busy sending out more than 3,000 new bright coral cards each day.

Monzo growing rapidly

Monzo faces tough competition from the likes of Revolut but that hasn’t stopped it driving forward with its goals. It now claims that Monzo accounts for 15% of new current account openings across the UK.

Since the bank ended its beta prepaid programme in April, its customer base has surged by 75%. It shows no signs of slowing down. Monzo has stopped its waiting list so anyone wanting to join up can do so immediately.

The bank is now processing £1bn ($1.3bn) in payments every month, with customers spending more than £4bn with their Monzo cards to date.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTom Blomfield, CEO of Monzo said: “Our community of customers now extends across

the UK, and I’m so grateful that more than a million people are helping us build a better

bank. But our mission is to make money work for everyone, so this is only just the start!

“We’re working hard to earn our customers’ trust by building a product that solves people’s problems, giving them brilliant customer service, and being totally transparent every step of the way. This milestone shows that there’s real, mainstream appetite for a bank that’s doing things differently.”

Monzo noted that, on average every customer has around 16 contacts within the app to send and receive money transfers. The app is designed to make every day payments simple, secure and fun. Friends and family can split bills while they are out for dinner or directly pay the contacts they have within the app.

According to the blog, customers send more than £800,000 to their contacts on Monzo each day. The challenger has gained a strong reputation for customer service. The blog stated that it has a Net Promoter Score (NPS) of +80.

Monzo unicorn valuation sits at more than $1bn. The valuation is expected to be confirmed after it completes its latest round of fundraising.

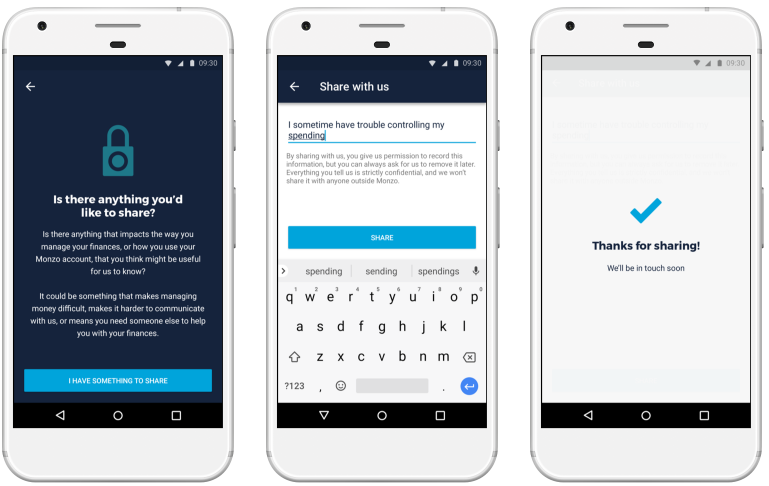

Share with us

On 25 September Monzo announced the release of a ‘Share with us’ tool to encourage customers to ask for help regarding their financial welfare.

On the blog it stated:

“If there’s anything that affects the way you deal with your money or the relationship you have with your bank, it might be worth telling us. We can use that knowledge to support you in a way that suits your needs – whether that’s letting you opt out of lending if you’ve struggled to manage debt in the past, or giving you a different way to verify your identity if you find it tricky to take selfie videos.”

There is a specialist team that will be available for extra support. The team will help a customer through the app until the issue is resolved.

The Monzo unicorn valuation is a clear sign that this challenger will continue to drive forward, creating new products and expand its services to millions more customers.