UK current account switching for the second quarter of 2024 has dropped for the third quarter in a row. Moreover, total switches in Q2 drop to the lowest total for seven quarters. There were 313,293 switches in Q2, the lowest since the third quarter of 2022.

On the other hand, for the 12-month period to end June, the switch service facilitated 1,411,553 switches. That is up from 1,277,484 for the year ago period, an increase of 10.4%. The running 12-month total is boosted by record high quarterly switches in Q4 2023, when there were 433,701 switches.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

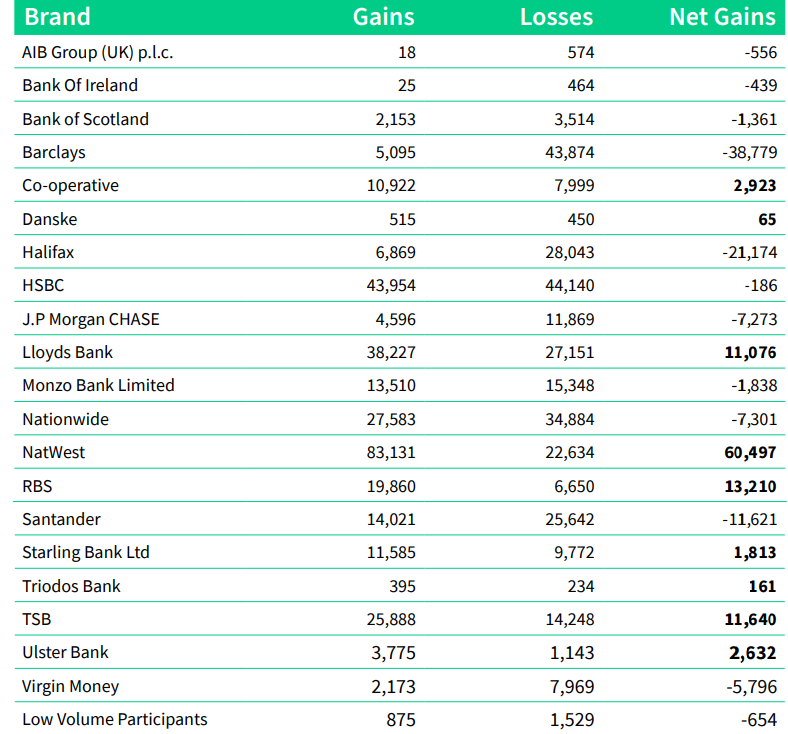

End user switching data by brand is published three months in arrears. So, the figures revealing brand-by-brand net gains and losses relate to the first quarter of 2024.

The power of account switching incentives

In Q1 2024, NatWest had the highest net switching gains with 60,497, followed by RBS (13,210), TSB (11,640) and Lloyds (11,076).

The net gains for NatWest and sister brand RBS are boosted by account switching incentives. The significance of the offer of account switching offers is highlighted also within Lloyds Banking Group brands. The main Lloyds brand offered incentives to switch in Q1 and posts a five-figure net in net switches. Meantime, sister brands Bank of Scotland and Halifax had no such incentives and post net losses of 1,361 and 21,174 respectively.

The biggest net loser in the latest statistics, is Barclays, down by 38,879 in the first quarter, when it ran no switch offer. This compares with the fourth quarter of 2023, when it ran a £175 offer to switch. In Q4, 2023, Barclays posted net gains of over 12,000 switches. Meantime, Barclays has renewed its £175 offer and will no doubt return to post net gains when the figures for the current quarter are released.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Total switches approach 11 million since 7-day launch

The services has now enabled 10.9 million current account switches since it launched in September 2013. Small business and charity accounts have also increased, albeit from a low base, up by 7% on the same quarter last year (5,814).

During Q2 2024, 79% of people were aware of the Service and 91% were satisfied with their switch, rising from 78% and 90% in Q1 2024 respectively. In addition, 99.7% of switches were completed within seven working days, up from 98.7% in Q1 2024.

Online or mobile banking (43%) remained the top reason people preferred their new account, as has consistently been the case for over 12 months. Following this, interest earned (37%) was the second most important reason, with customer service (29%) and location of branches (24%) close behind.

John Dentry, Product Owner at Pay.UK, owner and operator of the Current Account Switch Service, said: “The continued upward trend in current account switching underscores the importance that consumers and businesses place on finding the right banking partner. This quarter’s switching data reflects not only a robust and competitive market but also the trust and confidence that end users have in the Current Account Switch Service.

“As the UK economy shows signs of recovery, it’s encouraging to see that the Service remains a critical tool for those looking to switch their current account. Whether for individuals or small businesses, the ability to switch accounts through a process that is quick, free and easy ensures that everyone can find a current account that best serves their needs, whatever they may be.”