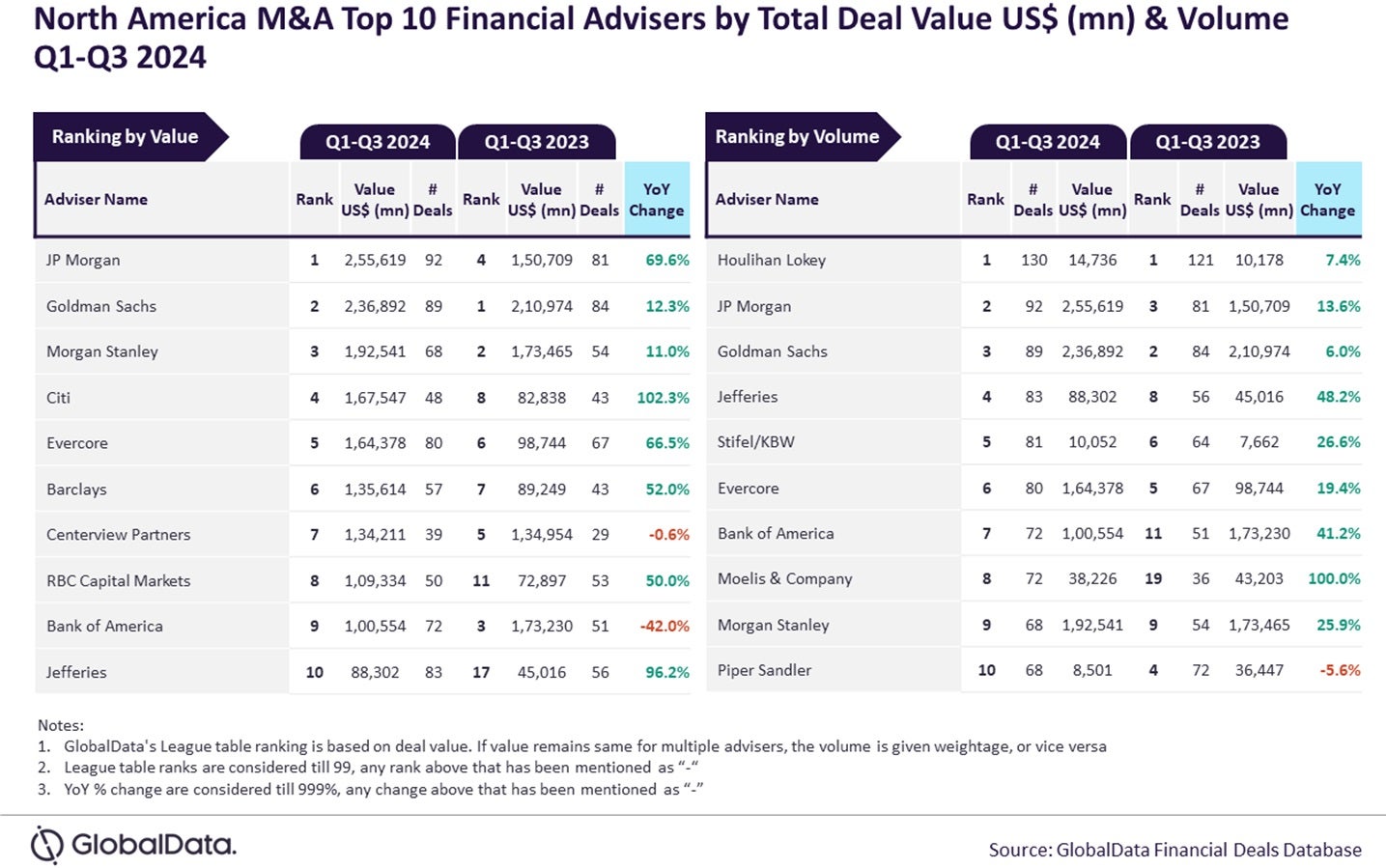

JP Morgan and Houlihan Lokey have topped the mergers and acquisitions (M&A) rankings for financial advisers in North America for the first three quarters of 2024, according to the latest financial advisers league table by GlobalData.

According to GlobalData’s Deals Database, which assesses financial advisers based on the M&A deals they have facilitated, JP Morgan topped the charts in deal value, while Houlihan Lokey led in deal volume.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

JP Morgan advised on deals worth $255.6bn, securing the top position by value. Houlihan Lokey, on the other hand, advised on 130 deals, making it the most prolific adviser by volume during this period.

Goldman Sachs was the runner-up in deal value, advising on transactions totalling $236.9bn. Morgan Stanley followed with $192.5bn, Citi with $167.5bn, and Evercore with $164.4bn in advised deal value.

GlobalData lead analyst Aurojyoti Bose said: “Houlihan Lokey was the top adviser by volume during Q1-Q3 2023 and managed to retain the top position by this metric during Q1-Q3 2024 as well. It is noteworthy that Houlihan Lokey was the only adviser to hit the triple-digit deal volume during Q1-Q3 2024.

“Meanwhile, JP Morgan registered a significant rise in the total value of deals advised and resultantly its ranking by value jumped from fourth position during Q1-Q3 2023 to the top position during Q1-Q3 2024.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“JP Morgan advised on 52 deals, each valued ≥ $1 billion, that also included seven mega deals valued ≥ $10 billion. This helped JP Morgan register a massive jump in terms of value. Apart from leading by value, it also held the second position by volume during Q1-Q3 2024.”

In terms of deal volume, JP Morgan also held a strong position, coming in second with 92 deals.

Goldman Sachs was close behind with 89 deals, Jefferies with 83, and Stifel/KBW with 81 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks deal submissions from leading advisers.

…………..

PR/image