Digital lender Nubank’s ascent to Brazil’s number one bank provider by dethroning Banco do Brasil, the country’s oldest bank founded in 1808, signifies a paradigm shift in the banking industry. By prioritising digital-first strategies and financial inclusion, the neobank has reshaped consumer expectations, exposing legacy banks’ challenges in user experience and innovation, and setting a new benchmark for the future of financial services, says GlobalData, publishers of RBI.

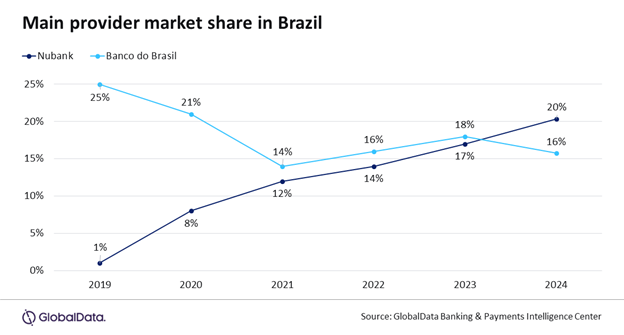

GlobalData’s Global Primary Banking Relationship Analytics 2024 shows that with 100 million customers and a 20% market share in November 2024 the challenger became the main bank provider in Brazil.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Blandina Hanna Szalay, Banking & Payments Analyst at GlobalData, comments: “Nubank is the first digital bank globally to achieve this status, underscoring the transformative power of fintech in reshaping traditional banking hierarchies.”

Over half of Brazilian adults are now Nubank customers

A fifth of all adults, approximately 20 million people, consider this digital-only provider their primary banking relationship.

This number exceeds the total customer bases of most challenger banks worldwide. Nubank’s rapid growth has been propelled by its strong appeal among Gen Z and Brazil’s lower mass market, boasting market shares of 35% and 25% within these groups, respectively.

Szalay continues: “By focusing on financially underserved communities, Nubank has demonstrated that inclusion and innovation can drive both social impact and business success.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThese achievements, however, do not only speak to the success of an inclusive neobank, they also demonstrate legacy banks’ ongoing struggles with user experience.

According to GlobalData’s Annual Financial Services Consumer Survey 2024, 35% of recent bank switchers in Brazil did so to receive a better digital banking experience, making this by far the most cited reason. This figure rises to 47% among those switching to Nubank. This emphasises the urgency for traditional banks to modernise their offerings or risk further erosion of their market share.

Szalay concludes: “Ultimately, while digital user experience remains a key battleground, the race will also hinge on building and sustaining customer trust. As more players vie to become central to consumers’ financial lives, trust will likely prove as pivotal as technology in determining long-term success.”