OCBC Q220 net profit falls 40% year-over-year to S$730m ($533m) from S$1.22bn in the year ago quarter missing analyst forecasts.

For the first half of the current fiscal, OCBC net profit is down by 42% y-o-y to S$1.43bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Specifically, the OCBC Q220 earnings are impacted by a rise in provisions for loan losses. In addition, the bank is hit by a reduction in lending income as a result of the Covid pandemic.

For example, OCBC provisions for credit losses rise from S$111m a year ago to S$750m.

On the other hand, operating profit before allowance rises by 4%. This is driven by increased associates’ contributions and a reduction in operating expenses.

In the second quarter, net interest falls by 7% as asset growth is more than offset by margin compression. But non-interest income is ahead by 11% on increased trading and insurance income.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTotal customer loans rise by 2% y-o-y to S$268bn while total customer deposits rise by 4% to S$310bn.

OCBC Q220: less positive metrics

Margin pressure results in OCBC’s net interest margin falling by 10 basis points y-o-y to 1.58%.

Meantime, the bank’s first half cost-income ratio inches up by 90 basis points to 43.3%.

At the same time, the bank’s non-performing loans rises from 1.5% a year ago to 1.6%.

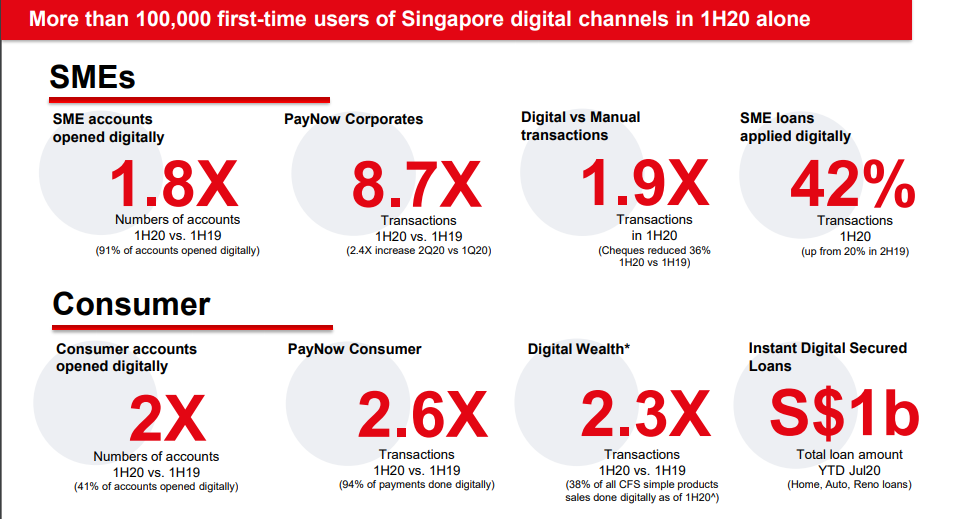

Positive metrics include a number of digital highlights. OCBC reports more than 100,000 first time digital banking users in the first half of 2020. Other OCBC digital highlights include a Singapore first enabling the use of SingPass to access digital banking services. OCBC is also the first bank in Southeast Asia to allow instant encashment of cheques. And OCBC is the first bank to partner and integrate with Google Pay to enable peer-to-peer payments.

OCBC declares a dividend of 15.9 cents per share for the first half. In the year ago period, the bank paid a dividend of 25 cents per share.