Canadians are feeling more optimistic and upbeat about their financial prospects and the economy at large. Specifically, consumers’ confidence level inches up to 5.78 (on a 10-point scale) from 5.68 a year ago, reports JD Power. Consumers’ outlook on the economy is even more bullish, up to 5.02 from 4.84 in 2023.

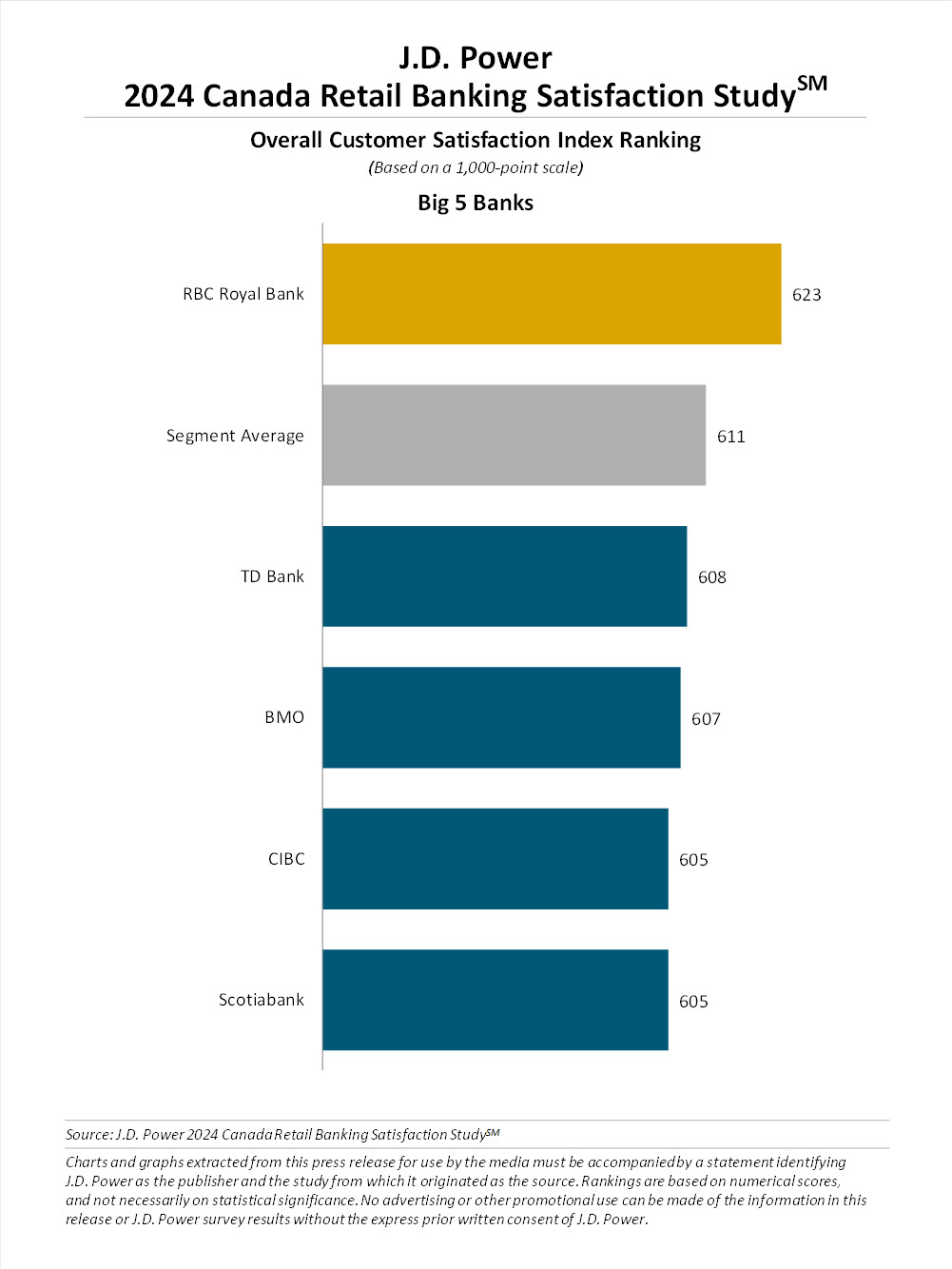

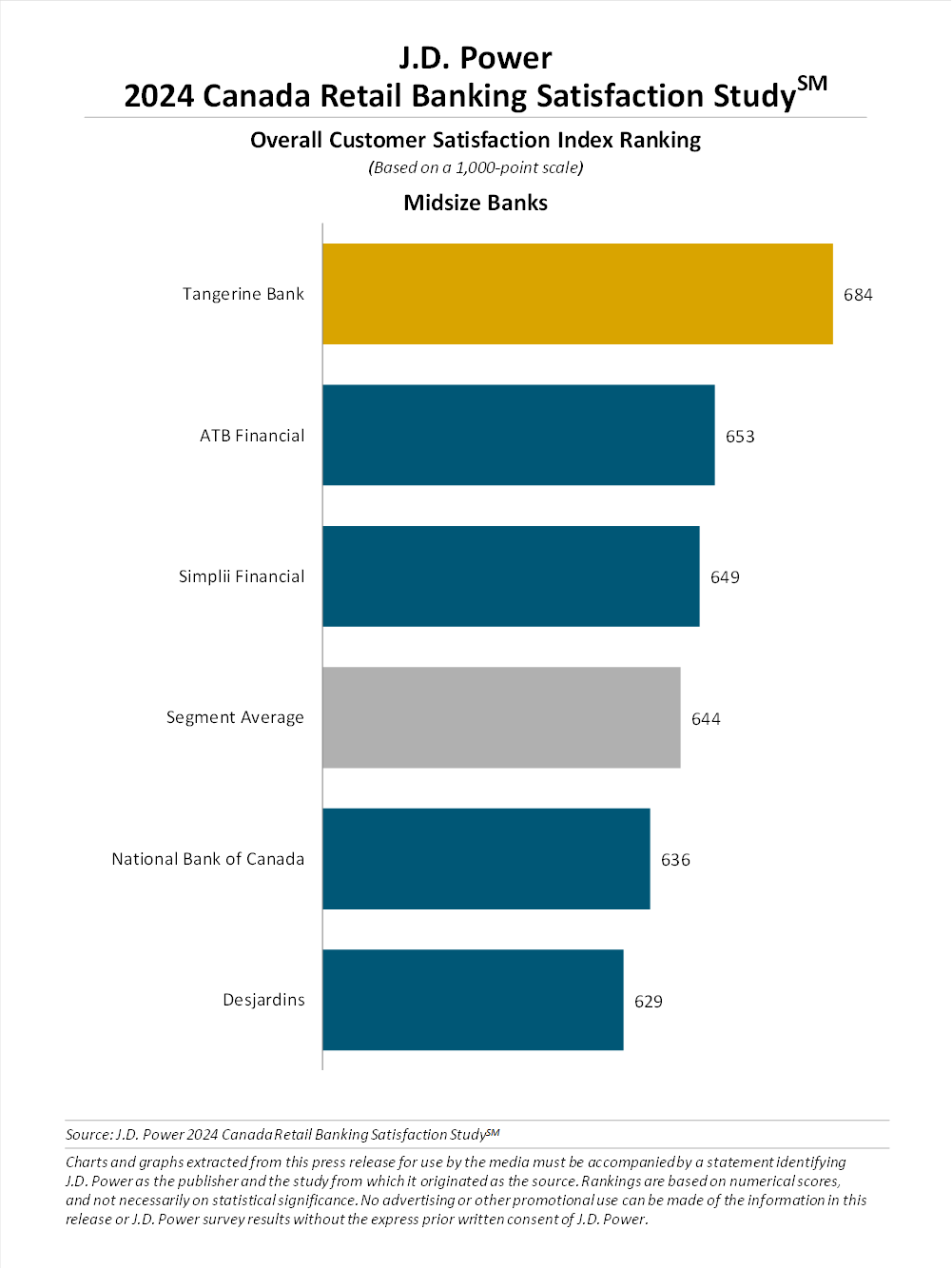

At the same time, Canadians’ satisfaction with their banks is on the rise. The 2024 JD Power Canada Retail Banking Satisfaction Study reveals that customer satisfaction with Canada’s Big 5 banks improves by 8 points to 611 (on a 1,000-point scale) this year. Similarly, Canada’s mid-size banks experience a 7-point increase.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“The improvement in customer satisfaction is great news for the Canadian banking industry. But it’s important that the industry focuses on leveraging the momentum,” says Jennifer White, senior director of banking and payments intelligence at JD Power.

“With 63% of customers also having deposit relationships with at least one other financial institution, the risk of losing deposits to a competitive institution still lingers. Banks need to find ways to elevate their client relationships from transaction-based to more meaningful value-add offerings that build trust and enable seamless services.”

JD Power 2024 Canada Retail Banking Satisfaction Study key findings

- Key Satisfaction Driver: Trust is the most influential element of customer satisfaction. Every small occurrence that dents it, opens the door a bit wider for customers to switch banks. The study shows that the top three actions that damage trust are unexpected fees (54%); blaming the customer for an error (32%); and bad banking practices reported in the media (27%).

- Branch experience lagging. Although banks and customers are adopting online and mobile banking at a rapid pace, 49% of bank customers opt to use both digital and branch services. With such a significant proportion of customers visiting the branch, only 10% receive all four service-related best practices at the branch: greeting by name; offering to assist with other financial issues and needs; mentioning other ways the bank can help; and genuinely thanking them for their business. The study finds that delivery of branch service best practices can lift customer satisfaction by 109 points.

- Fees and poor service facilitate attrition. Among customers who intend to switch banks, the top two reasons are charged too many/high fees (32%) and poor service experience (30%). Customers also cited promotional offers from other banks (27%) as a leading driver of customer attrition, meaning that, despite customers’ potentially high overall satisfaction, they are often keeping an eye on alternative banks.

RBC, Tangerine top study rankings

Royal Bank of Canada (RBC) ranks highest among the Big 5 banks with a score of 623, some way clear of the others. TD (608) edges BMO (607) for second spot with CIBC and Scotiabank tied with scores of 605.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTangerine Bank ranks highest among mid-size banks for a 13th consecutive year, with a score of 684. ATB Financial (653) ranks second and Simplii Financial (649) ranks third.

The Canada Retail Banking Satisfaction Study is now in its 19th year. It measures customer satisfaction with Canada’s large and mid-size banks. The study measures satisfaction across seven factors. In order of importance these comprise: trust; people; account offerings; allowing customers to bank how and when they want; saving time and money; digital channels; and resolving problems or complaints.