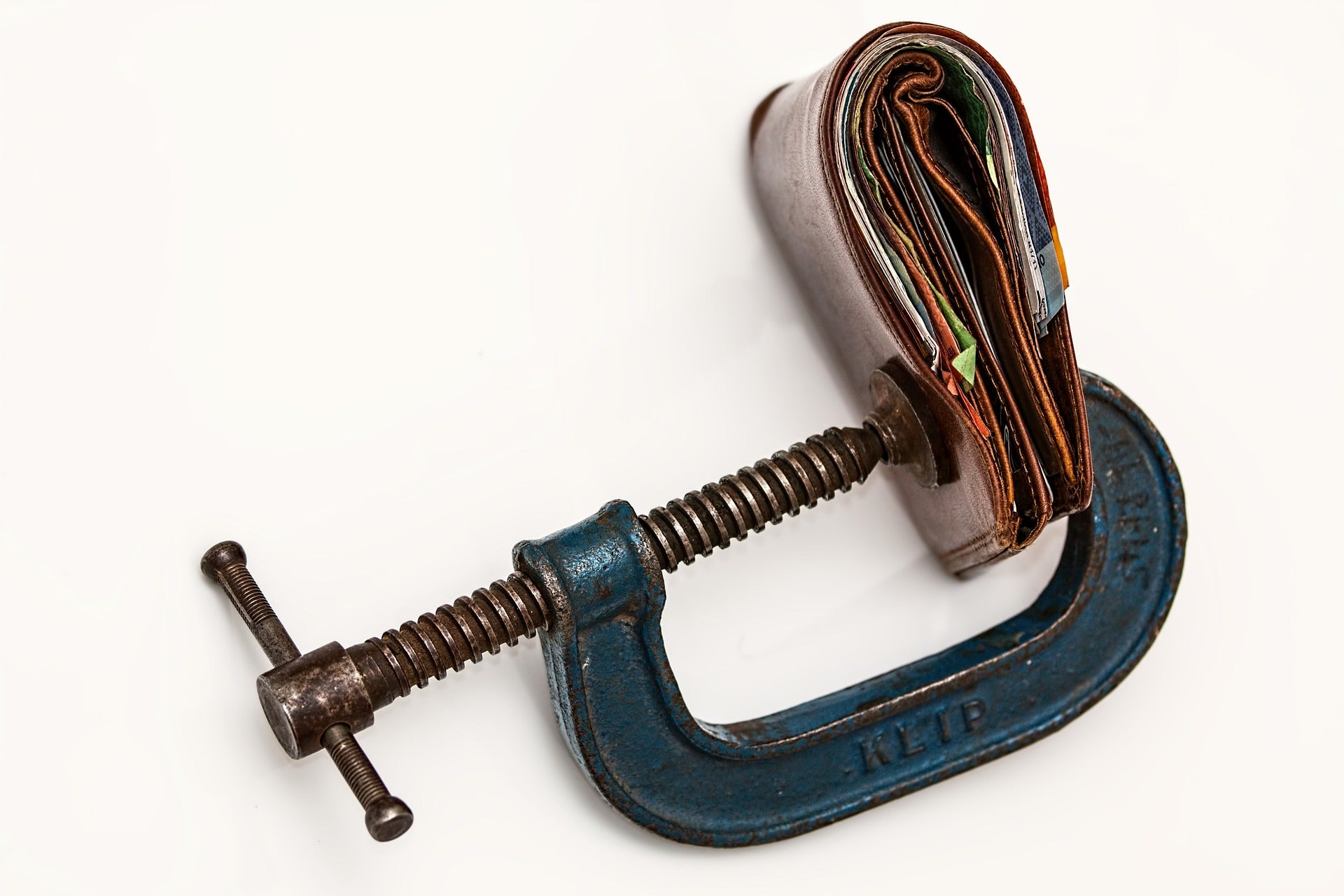

Swedish central bank has called on banks to cut back on large dividend payments and share buybacks as high inflation poses risk to financial stability.

In a report on financial stability, the Riksbank said that among others, the Russian invasion of Ukraine is one of the reasons for the rise in inflation, which is deteriorating growth prospects.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

According to the central bank, the biggest risks the banks faced were their exposure to highly indebted commercial property companies and the high level of indebtedness among households.

“The economic development entails an increased risk for major credit losses among major Swedish banks. Since the risks have now increased, the Riksbank considers that the banks should be restrictive with regard to large dividend payments and share buybacks,” the banking regulator said.

As per Reuters’ report, rising interest rates have added to Swedish banks’ income from lending to businesses and households.

Even as major banks, such as Swedbank, Nordea, Handelsbanken and SEB, have reported profits in recent quarters, economists expect the growth to drop significantly in 2023, the news agency said.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn its report, the Swedish central bank said between 2012 and 2021, Swedish property companies increased their borrowing from just over SEK1.3 trillion ($119.44bn) to SEK2.3 trillion, which today corresponds to 42% of the country’s GDP.

Property companies make up about 43% of banks’ loans and a credit crunch could force them to reduce investment, affecting construction and economic growth.

“In the worst case, higher borrowing costs could lead to property companies defaulting on their payments,” the Riksbank warned in its report. The central bank has also warned about the increasing risk of cyber threats and emphasised the need to ‘strengthen the ability to prevent, detect and manage cyber risks’.