UK current account switching for the third quarter of 2024 has dropped for the third quarter in a row. Moreover, total switches in Q3 drop to the lowest quarterly total since the third quarter of 2022 (Q3: 2022 222,108).

Specifically, for the period between July and September 2024, there were 247,229 current account switches using the Pay.UK seven day switching service. This is down by 28% from the year ago quarter.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

For the first three quarters of 2024, there have been 881,306 switches. This represents a fall of almost 14% from the first three quarters of 2023 (1,023,464).

Moreover, the fourth quarter of 2023 represented a bumper quarter when 433,701 switches took place. This resulted in 1,457,165 switches in calendar year 2023.

So unless the fourth quarter of 2024 is along similar lines, the total figure for calendar year 2024 will be down markedly compared with last year.

Santander and NatWest the big winners

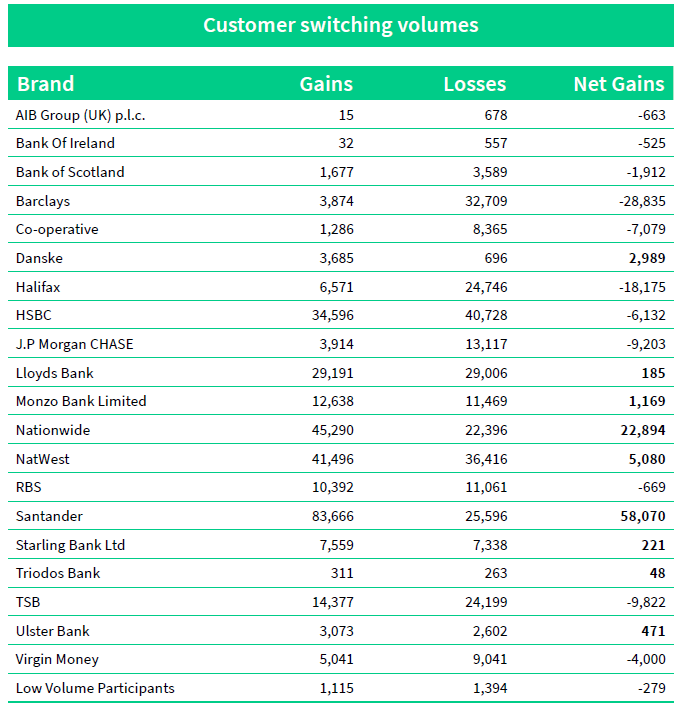

End user data is always released three months in arrears so the brand-by-brand comparisons released today covered the period from April to June 2024. Santander had the highest net switching gains with 58,070 over the period, followed by Nationwide (22,894), NatWest (5,080) and Danske (2,989).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs ever, the world class nature of the switching service is not in doubt. During Q3 2024, awareness of the service remained high at 77%, while 92% of consumers were satisfied with their switch.

Online or mobile banking (45%) was top reason people preferred their new account, followed by interest earned (37%). Customer service was third most important reason, rising to 34%, up from 29% in Q2 2024. A similar rise was seen for the fourth most important reason, location of branches, which was cited by 27% of respondents, up from 24% in Q2 2024, suggesting both factors are of rising importance for switching consumers.

Increasingly competitive market

John Dentry, Product Owner at Pay.UK, owner and operator of the Current Account Switch Service, said:

“The Service sits in the centre of an increasingly competitive and dynamic banking market. Banks and building societies are actively developing, and announcing, new innovative incentives, often packaging multiple offers together to sweeten the deal. We are also seeing a stream of new products and perks to help entice consumers, and with this backdrop, consumers should keep their eye on their provider and the wider market to ensure they’re with the bank that best suits their needs.”

“Quick, hassle-free switching plays a crucial role in ensuring that customers can easily find a current account that works best for their individual needs. Whether for personal banking or small businesses, the ability to switch accounts in a seamless, free, and efficient way is vital. This ensures everyone has the freedom to choose a provider that offers the best fit, no matter what services or features they’re looking for. The Service remains committed to working with partners and consumers to maintain this high level of support.”