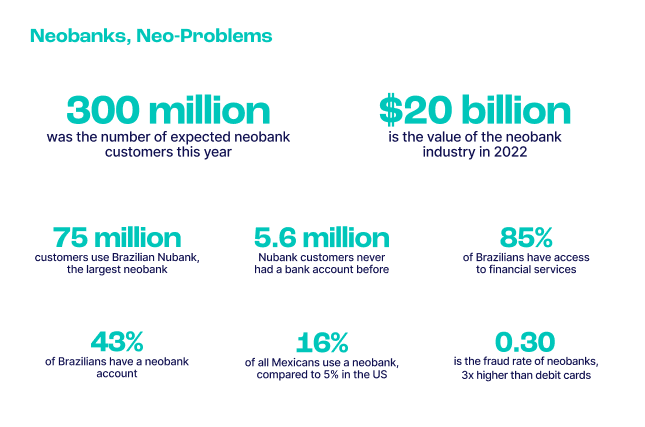

Online fraud and financial crime prevention platform, SEON breaks down the biggest banking fraud trends affecting the market. SEON’s ‘Global Banking Fraud Index 2023’ notes that the value of the global neobank market rose nearly $20bn over 2022.

Around 36% of all financial institutions experienced card fraud in 2022 reports SEON. This represents a 26% increase on the year prior.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

US lenders report that 75% of all fraud losses are related to consumer phishing. Other financial services report those cases at 66%. Fraudsters are finding new digital lockpicks to crack electronic locks they face when accessing, buying, and exchanging money online.

SEON’s report includes insights into fraud trends and neobank adoption rates around the rest of the world.

The number of monthly fraud attacks on banks earning over $10m in annual revenue has shown a consistent increase year-on-year. Likewise, the report highlights that 84% of companies with revenues of $1bn or more have had more than 100 payment accounts targeted by fraud in the past year. Despite this, only 65% of companies experienced fraud in 2023, which is the lowest rate since 2014.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Banking industry moving in the right direction

Tamas Kadar, CEO and co-founder of SEON said: “It’s been an interesting year for the banking sector. Despite a few bumps in the road there’s clear evidence the industry is moving in the right direction. However, to ensure this momentum can be sustained, those working within traditional banks, as well as neobanks must be highly vigilant around the growing risks associated with fraud.

“If this doesn’t happen, institutions risk monetary and reputational damage because of fraud. This is an ever-present threat. 71% of financial institutions report a security breach from Business Email Compromise last year alone. Thankfully, as well as compiling an index of today’s fraud pain points, companies like SEON are also on hand to provide businesses in the banking and neo-banking sectors with new tools to fight back against the fraudsters.”

The SEON ‘Global Banking Fraud Index’ is available to download on its company website.